Term Structure of Interest Rates Chapter Seven

advertisement

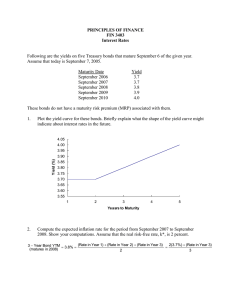

Term Structure of Interest Rates Chapter Seven Problem Set 1. You observe that one year Government of Canada bonds are currently yielding 4.5%. Two year Government of Canada bonds are yielding 5.25%. What is the market predicting for the yield on one year bonds, one year from today? (6%) 2. The spot yield on two year bonds is 5.25%. The spot yield on 5 year bonds is 6.50%. What is the market predicting for the yield on 3 year bonds, two years from today? (7.34%) 3. You are an investor seeking to maximize your investment returns. You have observed the information shown in Question 2. Your personal belief is that the three year rate, two years from today, will be 6.50%. Should you invest in one five year bond or a series of two short bonds? Why? (5 years) 2 4. Using the information in Question 3, calculate the dollar difference in the two scenarios, assuming you have $100,000 to invest for a five year period. (2 short bonds - $133,811.37; 1 long bond $137,008.67) 5. The term structure of interest rates is sloping downward (referred to as an inverted yield curve). What is the market predicting for future short interest rates? What theory do we use to support this? (Down – Unbiased expectations theory) 6. The nominal interest rate is currently 6%. If the market is expecting inflation of 4%, what is the real interest rate (use both an approximation and the exact method for calculating the real rate). (Approximation – 2%; Exact – 1.92%) 7. You want to purchase a ten year, $100,000 Government of Canada bond carrying a 6% coupon, paid semi-annually. If your required yield is 5%, how much would you pay for the bond? ($107,794.58) 3 8. You are planning for retirement. One component of your retirement planning strategy is to purchase strip bonds that mature each year during retirement. If you want one $100,000 bond to mature each year during retirement, what would you have to pay today, assuming you can purchase a strip bond with a YTM of 6% that matures exactly 30 years from now? ($17,411.01) 9. A six year, $1,000 face value bond with a 4% coupon is currently selling in the market for $942. What is the YTM for this bond? (5.15%) 10. Decompose the YTM for the bond in Question 9 into its two components of coupon (current) yield and the capital gain or loss. (Coupon yield – 4.2463%; Capital gain – 0.9018%) 4