Exam1CheatSheet

advertisement

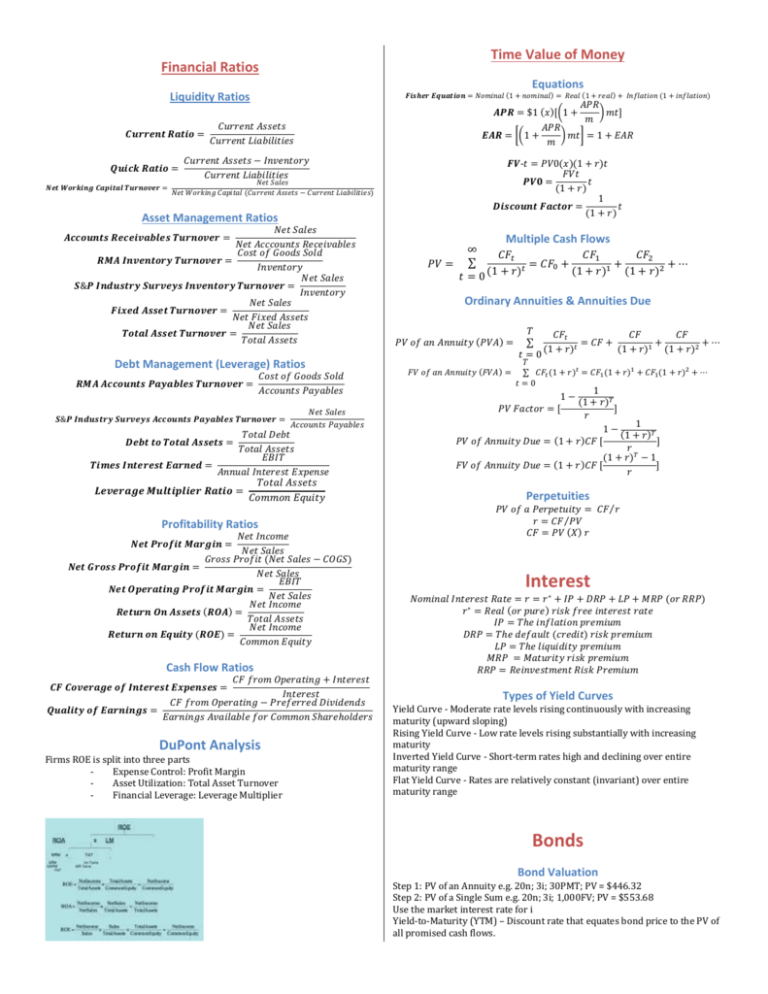

Time Value of Money Financial Ratios Equations Liquidity Ratios 𝑭𝒊𝒔𝒉𝒆𝒓 𝑬𝒒𝒖𝒂𝒕𝒊𝒐𝒏 = 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 (1 + 𝑛𝑜𝑚𝑖𝑛𝑎𝑙) = 𝑅𝑒𝑎𝑙 (1 + 𝑟𝑒𝑎𝑙) + 𝐼𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 (1 + 𝑖𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛) 𝑨𝑷𝑹 = $1 (𝑥)[(1 + 𝑪𝒖𝒓𝒓𝒆𝒏𝒕 𝑹𝒂𝒕𝒊𝒐 = 𝑸𝒖𝒊𝒄𝒌 𝑹𝒂𝒕𝒊𝒐 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑵𝒆𝒕 𝑾𝒐𝒓𝒌𝒊𝒏𝒈 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝑁𝑒𝑡 𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 (𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠) Asset Management Ratios 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑁𝑒𝑡 𝐴𝑐𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑 𝑹𝑴𝑨 𝑰𝒏𝒗𝒆𝒏𝒕𝒐𝒓𝒚 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑺&𝑷 𝑰𝒏𝒅𝒖𝒔𝒕𝒓𝒚 𝑺𝒖𝒓𝒗𝒆𝒚𝒔 𝑰𝒏𝒗𝒆𝒏𝒕𝒐𝒓𝒚 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑭𝒊𝒙𝒆𝒅 𝑨𝒔𝒔𝒆𝒕 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝑁𝑒𝑡 𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑻𝒐𝒕𝒂𝒍 𝑨𝒔𝒔𝒆𝒕 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝑨𝒄𝒄𝒐𝒖𝒏𝒕𝒔 𝑹𝒆𝒄𝒆𝒊𝒗𝒂𝒃𝒍𝒆𝒔 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = Debt Management (Leverage) Ratios 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑 𝑹𝑴𝑨 𝑨𝒄𝒄𝒐𝒖𝒏𝒕𝒔 𝑷𝒂𝒚𝒂𝒃𝒍𝒆𝒔 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑃𝑎𝑦𝑎𝑏𝑙𝑒𝑠 𝑺&𝑷 𝑰𝒏𝒅𝒖𝒔𝒕𝒓𝒚 𝑺𝒖𝒓𝒗𝒆𝒚𝒔 𝑨𝒄𝒄𝒐𝒖𝒏𝒕𝒔 𝑷𝒂𝒚𝒂𝒃𝒍𝒆𝒔 𝑻𝒖𝒓𝒏𝒐𝒗𝒆𝒓 = 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑃𝑎𝑦𝑎𝑏𝑙𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐸𝐵𝐼𝑇 𝑻𝒊𝒎𝒆𝒔 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝑬𝒂𝒓𝒏𝒆𝒅 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 𝑫𝒆𝒃𝒕 𝒕𝒐 𝑻𝒐𝒕𝒂𝒍 𝑨𝒔𝒔𝒆𝒕𝒔 = 𝑳𝒆𝒗𝒆𝒓𝒂𝒈𝒆 𝑴𝒖𝒍𝒕𝒊𝒑𝒍𝒊𝒆𝒓 𝑹𝒂𝒕𝒊𝒐 = 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑜𝑚𝑚𝑜𝑛 𝐸𝑞𝑢𝑖𝑡𝑦 Profitability Ratios 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡 (𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 − 𝐶𝑂𝐺𝑆) 𝑵𝒆𝒕 𝑮𝒓𝒐𝒔𝒔 𝑷𝒓𝒐𝒇𝒊𝒕 𝑴𝒂𝒓𝒈𝒊𝒏 = 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐸𝐵𝐼𝑇 𝑵𝒆𝒕 𝑶𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝑷𝒓𝒐𝒇𝒊𝒕 𝑴𝒂𝒓𝒈𝒊𝒏 = 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑹𝒆𝒕𝒖𝒓𝒏 𝑶𝒏 𝑨𝒔𝒔𝒆𝒕𝒔 (𝑹𝑶𝑨) = 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑹𝒆𝒕𝒖𝒓𝒏 𝒐𝒏 𝑬𝒒𝒖𝒊𝒕𝒚 (𝑹𝑶𝑬) = 𝐶𝑜𝑚𝑚𝑜𝑛 𝐸𝑞𝑢𝑖𝑡𝑦 𝑬𝑨𝑹 = [(1 + 𝐴𝑃𝑅 ) 𝑚𝑡] 𝑚 𝐴𝑃𝑅 ) 𝑚𝑡] = 1 + 𝐸𝐴𝑅 𝑚 𝑭𝑽-𝑡 = 𝑃𝑉0(𝑥)(1 + 𝑟)𝑡 𝐹𝑉𝑡 𝑷𝑽𝟎 = 𝑡 (1 + 𝑟) 1 𝑫𝒊𝒔𝒄𝒐𝒖𝒏𝒕 𝑭𝒂𝒄𝒕𝒐𝒓 = 𝑡 (1 + 𝑟) Multiple Cash Flows ∞ 𝐶𝐹𝑡 𝐶𝐹1 𝐶𝐹2 𝑃𝑉 = ∑ 𝑡 = 𝐶𝐹0 + (1 + 𝑟)1 + (1 + 𝑟)2 + ⋯ (1 + 𝑟) 𝑡=0 Ordinary Annuities & Annuities Due 𝑃𝑉 𝑜𝑓 𝑎𝑛 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 (𝑃𝑉𝐴) = 𝐹𝑉 𝑜𝑓 𝑎𝑛 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 (𝐹𝑉𝐴) = 𝑇 𝐶𝐹𝑡 𝐶𝐹 𝐶𝐹 = 𝐶𝐹 + + +⋯ ∑ (1 + 𝑟)𝑡 (1 + 𝑟)1 (1 + 𝑟)2 𝑡=0 𝑇 ∑ 𝐶𝐹𝑡 (1 + 𝑟)𝑡 = 𝐶𝐹1 (1 + 𝑟)1 + 𝐶𝐹1(1 + 𝑟)2 + ⋯ 𝑡=0 1 1− (1 + 𝑟)𝑇 𝑃𝑉 𝐹𝑎𝑐𝑡𝑜𝑟 = [ ] 𝑟 1 1− (1 + 𝑟)𝑇 𝑃𝑉 𝑜𝑓 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 𝐷𝑢𝑒 = (1 + 𝑟)𝐶𝐹 [ ] 𝑟 (1 + 𝑟)𝑇 − 1 𝐹𝑉 𝑜𝑓 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 𝐷𝑢𝑒 = (1 + 𝑟)𝐶𝐹 [ ] 𝑟 Perpetuities 𝑃𝑉 𝑜𝑓 𝑎 𝑃𝑒𝑟𝑝𝑒𝑡𝑢𝑖𝑡𝑦 = 𝐶𝐹 ⁄𝑟 𝑟 = 𝐶𝐹 ⁄𝑃𝑉 𝐶𝐹 = 𝑃𝑉 (𝑋) 𝑟 𝑵𝒆𝒕 𝑷𝒓𝒐𝒇𝒊𝒕 𝑴𝒂𝒓𝒈𝒊𝒏 = Cash Flow Ratios 𝐶𝐹 𝑓𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 + 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐶𝐹 𝑓𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑸𝒖𝒂𝒍𝒊𝒕𝒚 𝒐𝒇 𝑬𝒂𝒓𝒏𝒊𝒏𝒈𝒔 = 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝐴𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 𝑪𝑭 𝑪𝒐𝒗𝒆𝒓𝒂𝒈𝒆 𝒐𝒇 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝑬𝒙𝒑𝒆𝒏𝒔𝒆𝒔 = DuPont Analysis Firms ROE is split into three parts Expense Control: Profit Margin Asset Utilization: Total Asset Turnover Financial Leverage: Leverage Multiplier Interest 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑅𝑎𝑡𝑒 = 𝑟 = 𝑟 ∗ + 𝐼𝑃 + 𝐷𝑅𝑃 + 𝐿𝑃 + 𝑀𝑅𝑃 (𝑜𝑟 𝑅𝑅𝑃) 𝑟 ∗ = 𝑅𝑒𝑎𝑙 (𝑜𝑟 𝑝𝑢𝑟𝑒) 𝑟𝑖𝑠𝑘 𝑓𝑟𝑒𝑒 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒 𝐼𝑃 = 𝑇ℎ𝑒 𝑖𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝐷𝑅𝑃 = 𝑇ℎ𝑒 𝑑𝑒𝑓𝑎𝑢𝑙𝑡 (𝑐𝑟𝑒𝑑𝑖𝑡) 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝐿𝑃 = 𝑇ℎ𝑒 𝑙𝑖𝑞𝑢𝑖𝑑𝑖𝑡𝑦 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝑀𝑅𝑃 = 𝑀𝑎𝑡𝑢𝑟𝑖𝑡𝑦 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝑅𝑅𝑃 = 𝑅𝑒𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑅𝑖𝑠𝑘 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 Types of Yield Curves Yield Curve - Moderate rate levels rising continuously with increasing maturity (upward sloping) Rising Yield Curve - Low rate levels rising substantially with increasing maturity Inverted Yield Curve - Short-term rates high and declining over entire maturity range Flat Yield Curve - Rates are relatively constant (invariant) over entire maturity range Bonds Bond Valuation Step 1: PV of an Annuity e.g. 20n; 3i; 30PMT; PV = $446.32 Step 2: PV of a Single Sum e.g. 20n; 3i; 1,000FV; PV = $553.68 Use the market interest rate for i Yield-to-Maturity (YTM) – Discount rate that equates bond price to the PV of all promised cash flows. APR = Bond equivalent yield. E.g. semi-annual is 2*r, not EAR which would be [1+r/2)]2-1 $𝐴𝑛𝑛𝑢𝑎𝑙 𝐶𝑜𝑢𝑝𝑜𝑛 𝑃𝑎𝑦𝑚𝑒𝑛𝑡 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑌𝑖𝑒𝑙𝑑 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑃𝑟𝑖𝑐𝑒 Interest Rate Risk (or price risk) – Risk associated with price fluctuations caused by interest rate changes Reinvestment Rate Risk – Risk associated with the rate at which coupons are reinvested Default Risk (or credit risk) – Risk associated with issuer’s ability to make payments as specified. Stocks 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝐴𝑚𝑜𝑢𝑛𝑡 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑆𝑡𝑜𝑐𝑘 𝑃𝑟𝑖𝑐𝑒 𝑃𝑉0 = + +⋯ (1 + 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑅𝑎𝑡𝑒)1 (1 + 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑅𝑎𝑡𝑒)1 𝐷1 = 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑌𝑖𝑒𝑙𝑑 𝑃0 G = Expected growth rate 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑒𝑑 𝐿𝑜𝑎𝑛 𝐴𝑚𝑜𝑢𝑛𝑡 = 𝐶 (𝑥) 𝐷1 +𝑔 𝑃0 1 𝑛] ) 1+𝑟 𝑟 [(1 − ( LT bonds are subject to greater interest rate risk. ST bonds are subject to greater reinvestment risk Both LT and ST bonds are subject to reinvestment risk on coupons Present Value & Future Value 𝐹𝑉 = $1 (𝑥)(1 + 𝑟)𝑡 $1 𝑃𝑉 = (1 + 𝑟)𝑡 1 (1 − [ ) (1 + 𝑟)𝑡 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 𝑃𝑉 = 𝑐 (𝑥) 𝑟 𝑃𝑉 𝑜𝑓 𝑎 𝑃𝑒𝑟𝑝𝑒𝑡𝑢𝑖𝑡𝑦 = 𝐶 ⁄𝑟 (1 + 𝑔) (1 − [ ]𝑡 (1 + 𝑟) 𝐺𝑟𝑜𝑤𝑖𝑛𝑔 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 𝑃𝑉 = 𝐶 (𝑥) (𝑟 − 𝑔) 1 𝐶 (𝑥) 𝐺𝑟𝑜𝑤𝑖𝑛𝑔 𝑃𝑒𝑟𝑝𝑒𝑡𝑢𝑖𝑡𝑦 𝑃𝑉 = 𝐶 = (𝑟 − 𝑔) (𝑟 − 𝑔) 𝑄𝑢𝑜𝑡𝑒𝑑 𝑅𝑎𝑡𝑒 𝐸𝐴𝑅 = [1 + ( )] 𝑚 − 1 𝑚 𝐿𝑜𝑎𝑛 𝐴𝑚𝑜𝑢𝑛𝑡 𝑃𝑢𝑟𝑒 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝐿𝑜𝑎𝑛 𝑃𝑉 = (1 + 𝑖)𝑛 1 [(1 − ( )] (1 + 𝑖)𝑛 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑒𝑑 𝐿𝑜𝑎𝑛 𝐴𝑚𝑜𝑢𝑛𝑡 = 𝐶 (𝑥) 𝑖 𝐵𝑜𝑛𝑑𝑠 𝐴𝑛𝑛𝑢𝑎𝑙 𝐶𝑜𝑢𝑝𝑜𝑛𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑌𝑖𝑒𝑙𝑑 = 𝑃𝑟𝑖𝑐𝑒 [1 − 𝐵𝑜𝑛𝑑 𝑉𝑎𝑙𝑢𝑒 = 𝐶 (𝑥) Cash Flows from Financing Activities Cash flows from a company's activities relating to the receipt and repayment of funds provided by creditors and investors. Indirect Method for C.F. NI Before Dividends + non-cash expenses (Depreciation, depletion, amortization) + decreases in assets + increases in liabilities - increases in assets - decreases in liabilities = C.F. from Operating Activities Purchase or Sale of Security ± Securities issued or repurchased ± Δ Principal on securities ± Δ in L.T. Asset = C.F. from Investing Activities 𝐷1 𝐸𝑃𝑆 = 𝑅 𝑅 𝐷1 ̂0 = 𝐷𝐷𝑀 𝑤𝑖𝑡ℎ 𝐶𝑜𝑛𝑠𝑡𝑎𝑛𝑡 𝐺𝑟𝑜𝑤𝑡ℎ = 𝑃 (𝑅 − 𝑔) ̂0 = 𝐷𝐷𝑀 𝑤𝑖𝑡ℎ 𝑍𝑒𝑟𝑜 𝐺𝑟𝑜𝑤𝑡ℎ = 𝑃 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝐶𝑜𝑛𝑠𝑡𝑎𝑛𝑡 𝐺𝑟𝑜𝑤𝑡ℎ 𝑆𝑡𝑜𝑐𝑘 = 𝑅̂ = Cash Flows from Investing Activities Cash flows from a company's activities relating to asset acquisition and disposal. 1 ] 𝐹 (1 + 𝑟)𝑡 + (1 + 𝑟)𝑡 𝑟 C = Coupon paid each period r = Rate per period t = Number of periods F = Bond’s face value Cash Flows from Operating Activities Cash flows from company's primary business activities. E.g. Production and delivery of goods & services for sale. Reflects cash effects of transaction, which are included in the determination of N.I. Δ in notes payable (use vs. source of cash) ± Δ L.T. Debt ± Preferred or Common Stock on B/S + Dividend Payments = C.F. from Financing Activities