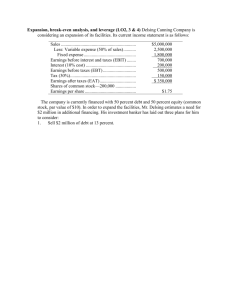

EBIT-EPS (or Indifference) Analysis

advertisement

EBIT-EPS (or Indifference) Analysis: Different financing decisions will have differing impacts on EPS. We can examine the effects of various financing alternatives through an EPS-EBIT analysis, which involves determining the crossover or 'indifference' EBIT at which the EPS is the same between two financing alternatives. Suppose that the firm is comparing the two possible capital structures, 1 and 2. Then, EBIT*, the indifference EBIT, is such that EPS1 EPS2 ( EBIT * I 1 )(1 T ) D p1 N1 ( EBIT * I 2 )(1 T ) D p 2 N2 where EBIT* =the indifference EBIT I = the interests T= tax rate DP = the dividends for the preferred shares N = the number of shares outstanding In the absence of tax and preferred shares in the capital structure of the firm, the above expression becomes EBIT * I 1 EBIT * I 2 N1 N2 Other Capital Structure Analysis Tools: (1) Coverage ratios. (2) Lender requirements or debt covenants (3) Bond ratings (4) Industry norms (5) Detailed cash flow analysis including sensitivity and scenario analysis Example 1 (An EBIT-EPS Indifference Analysis) The NBA Corporation is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, NBA would have 200 shares of stock outstanding. Under Plan II, NBA would have 100 shares of stock and $5,000 in debt outstanding. The interest rate is 12 percent and there are no taxes. (a) If EBIT is $1,000, which plan results in the higher EPS? (b) If EBIT is $2,000, which plan results in the higher EPS? (c) What is the break-even EBIT; that is, what EBIT generates exactly the same EPS under both plans? Solutions (a) If EBIT is $1,000, which plan results in the higher EPS? Plan I EPS I Plan II EPS II EBIT 1000 $5 N 200 EBIT I 1000 5000(012 . ) 1000 600 $4 N 100 100 The plan I has a higher EPS given EBIT = $1000. (b) If EBIT is $2,000, which plan results in the higher EPS? Plan I EPS I Plan II EPS II EBIT 2000 $10 N 200 EBIT I 2000 5000(012 . ) 2000 600 $14 N 100 100 The plan II has a higher EPS given EBIT = $2000. (c) What is the break-even EBIT; that is, what EBIT generates exactly the same EPS under both plans? EPS I EPS II EBIT * EBIT * I NI N II EBIT * EBIT * 600 200 100 * EBIT $1200 EPS * $6 For financial leverage to be beneficial, operations must be reasonably profitable. Example 2 A firm presently has 100,000 common shares outstanding and currently has $1M of bonds outstanding with annual interest of 10%. Their effective tax rate is 40%. They need to raise $500,000. The following options are available. (1) Issue common shares at $50 each (i.e. n2 = $500,000/$50 = 10,000 new shares). (2) Issue new debt at 12% annually. Which should they choose if they expect EBIT to be $1 million for the upcoming year? Solution The EPS equations for the financing alternatives are given below: EPS(1) EPS( 2 ) ( EBIT I (1) )(1 T ) Dp n(1) ( EBIT I ( 2 ) )(1 T ) Dp n( 2 ) ( EBIT 100,000)(0.60) 0 .6 EBIT 60,000 110,000 110,000 ( EBIT 160,000)(0.60) 0 .6 EBIT 96,000 100,000 100,000 Setting EPS (1) EPS ( 2 ) and solving for EBIT*, we obtain EBIT * =$760,000 Therefore, since expected EBIT >$760,000, then the plan with more debt (i.e., plan (2)) ($1m)(.60) 60,000) will be preferred. I.e., EPS(1) $4.90 , and 110,000 ($1m)(.60) 96,000) EPS( 2 ) $5.04 100,000 If expected EBIT <$760,000, then the plan with less debt (i.e., plan (1)) will be preferred.