Tab 3 (pptx)

advertisement

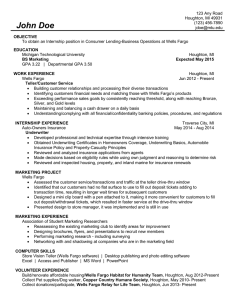

Cash Management Proposal Issue: UVU currently invests all “working capital cash” in Utah State Treasurer’s Pool. Cash is liquid and safe but only earns at the lowest “short term” rates. Proposal: That UVU take some of its not used and available “working capital cash” and invest it in “Intermediate-Term Investments,” enhancing earnings on cash (approximately four times the rate), while following all Utah Money Management Act requirements, in prudent investments in CDs, Treasuries, Agency Bonds and high-rated Corporate Bonds. Cash Management Proposal Enhance earning on cash Diversify portfolio Ladder investments for liquidity Continued compliance with the Money Management Act Jun-02 Oct-11 Jun-11 Feb-11 Oct-10 Jun-10 Feb-10 Oct-09 Jun-09 Feb-09 Oct-08 Jun-08 Feb-08 Oct-07 Jun-07 Feb-07 Oct-06 Jun-06 Feb-06 Oct-05 Jun-05 Feb-05 Oct-04 Jun-04 Feb-04 Oct-03 Jun-03 Feb-03 Oct-02 HISTORY OF UVU'S CASH BALANCE PTIF LOW BALANCES BY MONTH 120,000,000 100,000,000 80,000,000 60,000,000 AMOUNT 40,000,000 20,000,000 0 Cash Balances Cash Funds 30-Jun-11 30-Jun-07 $22,790,000 $615,000 Self-Insurance, Payroll Liabilities 20,142,000 401,000 Education and General 17,652,000 25,580,000 Gear-Up Grant and Other Scholarships 7,811,000 3,433,000 Plant Maintenance & Repairs, Debt Retirement 7,154,000 3,652,000 Continuing Education 4,968,000 245,000 Auxiliary Enterprises 4,771,000 2,089,000 Student Activities 3,783,000 1,365,000 Service Enterprises 2,775,000 1,233,000 Grants, Agency, other 2,188,000 3,850,000 Aviation 1,862,000 4,198,000 Institutional Interest Income 1,136,000 3,000 $97,032,000 $46,664,000 Plant and Equipment Projects Total Cash Management Strategy Safety of principal UVU currently deposits all its “cash” with the Utah State Treasurer’s Pool. (Safe, but all cash with single entity) Need for liquidity This “pool” is very liquid Yield on investment PTIF has a low yield UVU follows the State Money Management Act criteria for investing Proposal to Increase Yield All investments strictly follow the Utah Money Management Act Purchase intermediate-term high grade investments Investments will be laddered for liquidity All investments are held in the name of the University Money Management Act Investing may only be done through approved Certified Dealers and Advisors Dealers ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Barclays Capital Inc. Cortview Capital Securities LLC George K. Baum & Co. Jeffries & Co JP Morgan Securities, LLC LPL Financial LLC Merrill Lynch, Pierce, Fenner & Smith Morgan Stanley Smith Barney Raymond James & Associates, Inc. RCB Capital Markets Corp. Sterne, Agee & Leach, Inc. UBS Financial Services Inc. Wells Fargo Advisors LLC Wells Fargo Securities, LLC Advisors Cutwater Asset Management Morgan Stanley Smith Barney Yellowstone Partners LLC Zions Wealth Advisors DBA for Contango Capital Advisors Inc Certified Dealers: Recognized by the Federal Reserve Bank of New York Certified Advisors: Registered under Section 203 of the Investment Advisers Act of 1940 Money Management Act Requires liquidity ◦ Laddering investments allows for liquidity Outlines approved investment instruments that are rated "A" or higher or the equivalent of "A" or higher, by two nationally recognized statistical rating organizations one of which must be Moody's Investors Service, or Standard and Poor's; ◦ ◦ ◦ ◦ ◦ CDs Repurchase Agreements Commercial Paper (Commercial Bonds) US Treasury Obligations Other obligations of Federal and State Governments. Short-Term Investments (Cash) Risks How to mitigate the risks Market risk- Rise in interest Rate Hold to maturity Headline risk- Bad press in a segment Diversification <5% in each segment Liquidity risk- Sell before maturity Ladder the investments Administrative Use Certified Dealers only General market risk Follow recommendations given by Certified Dealer and Advisor’s research teams Yield Reward vs Liquidity Risk Short-term Investments Bank Deposits Money Markets Overnight Funds Intermediate-term Investments CDs Treasuries Agency Bonds Corporate Bonds Possible additional yield By actively layering liquidity over time Time What are other Universities doing for Cash Management? U of U USU WSU SLCC UVU SNOW DIXIE SUU % in PTIF 10-13% <10% 50% 25% 100% 34% 100% 66% % of time spent managing investments 10-15% 30% 10% 10% 0% 15% 0% 5% <5 Years <5 Years <5 Years <2 Years Liquid <5 Years Liquid <3 Years Wells Fargo Wells Fargo Wells Fargo Zions & Wells Fargo PTIF Zions & Wells Fargo PTIF Wells Fargo Wells Fargo Zions, Wells Fargo, George K Baum, Smith Wells Fargo Zions, Wells Fargo, George K Baum N/A Zions, Wells Fargo N/A Wells Fargo, George K Baum How far out– Maturity dates Safekeeping Certified Dealers and Advisors (Brokers) What are other Universities doing for Cash Management? U of U USU WSU SLCC UVU SNOW DIXIE SUU Dedicated Cash Investment Manager NO NO NO NO NO NO NO NO Background? Finance Acc Econ Acc Acc Acc Acc Acc Short-term investment amount ? $1 B $285 M $100 M $85 M $100 M $20 M $20 M $60 M State & US Local Bank CDs, Bank CDs, Bank CDs, Treasuries, Bank government Corporate corporate corporate Types of Federal CDs, bonds, floaters, bonds, PTIF only bonds, PTIF only investments? agencies, Federal Federal Federal corporate corporate repurchase agencies agencies, Agencies floaters floaters agreements corporate bonds What are other Universities doing for Endowments? Dedicated Endowment Manager? % of Job U of U USU WSU SLCC UVU SNOW DIXIE SUU Yes No Yes No No Small Endowment No Yes 15% 5% Part of (all with U, 95% Director of ½ basis (Entry level Acct Duties point Accounting) 100% 50% Endowment, <20% of CM, Time Foundation charge) Options Available Options Costs Continue with current PTIF Strategy Opportunity Costs- $500,000-600,000 Hire an Investment Manager $75,000 + 31,365 + 30,000 = $136,000 Salary + Benefits + Bonding *Use Wells Fargo as part of our current banking contract Fees + Commission deducted before yield is computed Request for proposal (RFP) Opportunity Costs- 4-6 months *Administration recommends using Wells Fargo and one other Certified Dealer, following the State Money Management Act “We haven’t looked at entertaining the use of an (in-house) advisor because it is difficult under the limitations of the Act to get a return large enough to cover the cost of the hiring of an (in-house) advisor.” - Mel F. Smith, Manager – Banking & Operational Investment, University of Utah