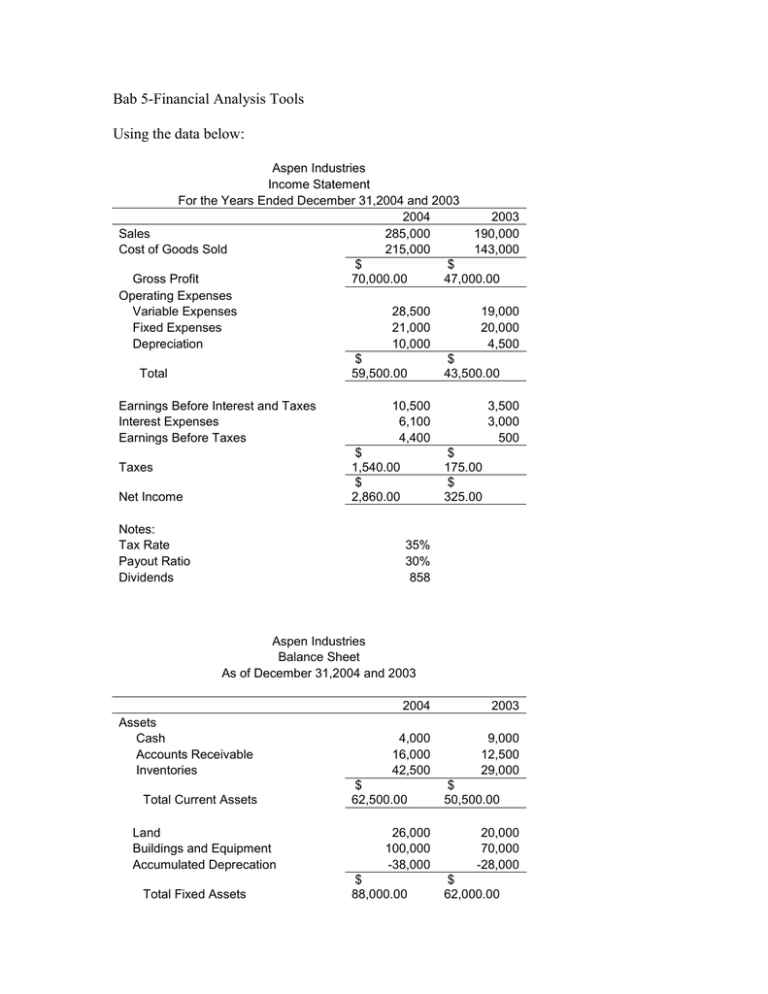

Bab 5-Financial Analysis Tools Using the data below:

advertisement

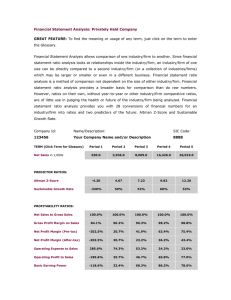

Bab 5-Financial Analysis Tools Using the data below: Aspen Industries Income Statement For the Years Ended December 31,2004 and 2003 2004 2003 Sales 285,000 190,000 Cost of Goods Sold 215,000 143,000 $ $ Gross Profit 70,000.00 47,000.00 Operating Expenses Variable Expenses 28,500 19,000 Fixed Expenses 21,000 20,000 Depreciation 10,000 4,500 $ $ Total 59,500.00 43,500.00 Earnings Before Interest and Taxes Interest Expenses Earnings Before Taxes 10,500 6,100 4,400 $ 1,540.00 $ 2,860.00 Taxes Net Income Notes: Tax Rate Payout Ratio Dividends 3,500 3,000 500 $ 175.00 $ 325.00 35% 30% 858 Aspen Industries Balance Sheet As of December 31,2004 and 2003 Assets Cash Accounts Receivable Inventories Total Current Assets Land Buildings and Equipment Accumulated Deprecation Total Fixed Assets 2004 2003 4,000 16,000 42,500 9,000 12,500 29,000 $ 62,500.00 26,000 100,000 -38,000 $ 88,000.00 $ 50,500.00 20,000 70,000 -28,000 $ 62,000.00 Total Assets Liabilities and Owner's Equity Accounts Payable Short-term Bank Notes Total Current Liabilities Long-term Debt Common Stock Retained Earnings Total Liabilities and Owner's Equity $ 150,500.00 $ 112,500.00 22,298 47,000 $ 69,298.00 10,500 17,000 $ 27,500.00 22,950 31,500 26,752 $ 150,500.00 28,750 31,500 24,750 $ 112,500.00 COMPLETED RATIO WORKSHEET FOR EPI Ratio 2004 Liquidity Ratios 2.39x 0.84x Efficiency Ratios Inventory Turnover 3.89x A/R Turnover 9.58x Average Collection Period 37.59 days Fixed Assets Turnover 10.67x Total Assets Turnover 2.33x Leverage Ratios Total Debt Ratio 58.45% Long-term Debt Ratio 25.72% LTD to Total Capitalization 38.23% Debt to Equity 1.41x LTD to Equity 61.90% Coverage Ratios Times Interest Earned 1.97x Cash Coverage Ratio 2.23x Profitability Ratios Gross Profit Margin 15.58% Operating Profit Margin 3.89% Net Profit Margin 1.15% Return on Total Assets 2.68% Return on Equity 6.45% Return on Common Equity 6.45% Current Quick Du Pont ROE 6.45% 2003 2.33x 0.85x 4.00x 9.77x 36.84 days 9.95x 2.34x 54.81% 22.02% 32.76% 1.21x 48.73% 3.35x 3.65x 16.55% 6.09% 2.56% 5.99% 13.25% 13.25% 13.25% a. Set up a ratio worksheet similar to the one in the completed ratio, and calculate all of the ratios for Aspen Industries b. Aspen Industries has shown an accounting profit in each of the past two years. Calculate their economic profit for these years. Calculate their profit for these years and compare it to net income. Assume that Aspen’s cost of capital is 11%.