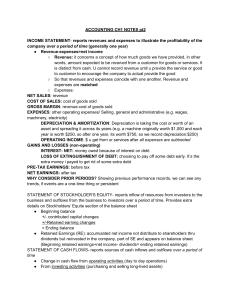

Bab 3-Income Statement: Using the data presented below:

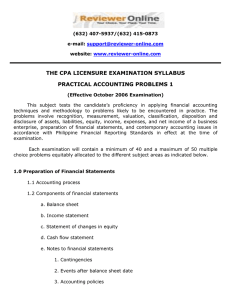

advertisement

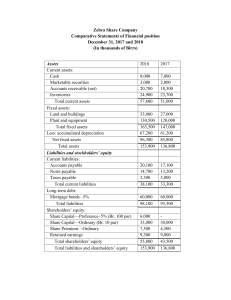

Bab 3-Income Statement: Using the data presented below: Aspen Industries Income Statement For the Years Ended December 31,2004 and 2003 2004 2003 Sales 285,000 190,000 Cost of Goods Sold 215,000 143,000 $ $ Gross Profit 70,000.00 47,000.00 Operating Expenses Variable Expenses 28,500 19,000 Fixed Expenses 21,000 20,000 Depreciation 10,000 4,500 $ $ Total 59,500.00 43,500.00 Earnings Before Interest and Taxes Interest Expenses Earnings Before Taxes 10,500 6,100 4,400 $ 1,540.00 $ 2,860.00 Taxes Net Income Notes: Tax Rate Payout Ratio Dividends 3,500 3,000 500 $ 175.00 $ 325.00 35% 30% 858 Aspen Industries Balance Sheet As of December 31,2004 and 2003 Assets Cash Accounts Receivable Inventories Total Current Assets Land Buildings and Equipment Accumulated Deprecation Total Fixed Assets 2004 2003 4,000 16,000 42,500 9,000 12,500 29,000 $ 62,500.00 26,000 100,000 -38,000 $ 88,000.00 $ 50,500.00 20,000 70,000 -28,000 $ 62,000.00 Total Assets Liabilities and Owner's Equity Accounts Payable Short-term Bank Notes Total Current Liabilities Long-term Debt Common Stock Retained Earnings Total Liabilities and Owner's Equity $ 150,500.00 22,298 47,000 $ 69,298.00 22,950 31,500 26,752 $ 150,500.00 $ 112,500.00 10,500 17,000 $ 27,500.00 28,750 31,500 24,750 $ 112,500.00 a. Recreate the income statement and balance sheet using formulas whenever possible. Each statement should be on a separate worksheet. Try to duplicate the formulating exactly. b. Suppose that sales were $320,00 in 2004 rather than $285,00. What is the 2004 net income and retained earnings? c. Undo the changes form part b, and change the tax rate to 40%. What is the 2004 net income and retained earnings?