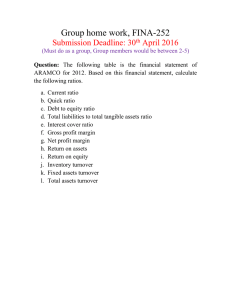

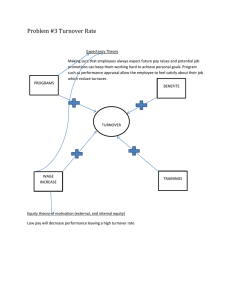

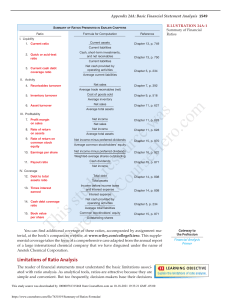

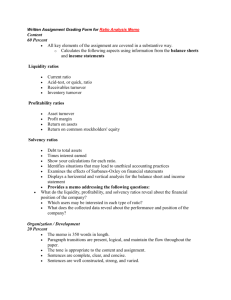

Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. The numbers found on a company’s financial statements – balance sheet, income statement, and cash flow statement – are used to perform quantitative analysis and assess a company’s liquidity, leverage, growth, margins, profitability, rates of return, valuation, and more. Liquidity Ratio Analysis The first type of financial ratio analysis is the liquidity ratio. It aims to determine a business’s ability to meet its financial obligations during the short term and maintain its short-term debt-paying ability. Liquidity ratio can be calculated in multiple ways they are as follows: – #1 – Current Ratio The Current ratio is a working capital ratio or banker’s ratio. The current ratio expresses the relationship of a current asset to current liabilities. Formula = Current Assets / Current Liabilities One can compare a company’s current ratio with the past current ratio; this will help to determine if the current ratio is high or low at this period in time. The ratio of 1 is ideal that if current assets are twice a current liability, no issue will be in repaying liability. However, if the ratio is less than 2, repayment of liability will be difficult and affect the work. #2 – Acid Test Ratio/ Quick Ratio The current ratio is generally used to evaluate an enterprise’s overall shortterm solvency or liquidity position. Still, it is often desirable to know a firm’s more immediate status or instant debt-paying ability than that indicated by the current ratio for this acid test financial ratio. That is because it relates the most liquid assets to current liabilities. Acid Test Formula = (Current Assets -Inventory)/(Current Liability) One can write the quick ratio as: – Quick Ratio Formula = Quick Assets / Current Liabilities Or Quick Ratio Formula = Quick Assets / Quick Liabilities #3 – Absolute Liquidity Ratio Absolute liquidity helps to calculate actual liquidity. And for that, inventory and receivables are excluded from current assets. In addition, some assets are banned to understand better liquidity. Ideally, the ratio should be 1:2. Absolute Liquidity = Cash + Marketable Securities + Net Receivable and Debtors #4 – Cash Ratio The Cash ratio is useful for a company undergoing financial trouble. Cash Ratio Formula = Cash + Marketable Securities / Current Liability If the ratio is high, then it reflects the underutilization of resources. If the ratio is low, it can lead to a problem in the repayment of bills. Turnover Ratio Analysis The second type of financial ratio analysis is the turnover ratio. The turnover ratio is also known as the activity ratio. This type of ratio indicates the efficiency with which an enterprise’s resources are utilized. Again, the financial ratio can be calculated separately for each asset type. The following are financial ratios commonly calculated:#5 – Inventory Turnover Ratio This financial ratio measures the relative inventory size and influences the cash available to pay liabilities. Inventory Turnover Ratio Formula = Cost of Goods Sold / Average Inventory #6 – Debtors or Receivable Turnover Ratio The receivable turnover ratio shows how often the receivable was turned into cash. Receivable Turnover Ratio Formula = Net Credit Sales / Average Accounts Receivable #7 – Capital Turnover Ratio The capital turnover ratio measures the effectiveness with which a firm uses its financial resources. Capital Turnover Ratio Formula = Net Sales (Cost of Goods Sold) / Capital Employed #8 – Asset Turnover Ratio This financial ratio reveals the number of times the net tangible assets are turned over during a year. The higher the ratio better it is. Asset Turnover Ratio Formula = Turnover / Net Tangible Assets #9 – Net Working Capital Turnover Ratio This financial ratio indicates whether or not working capital has been effectively utilized in making sales. Net Working capital signifies the excess of current assets over current liabilities. Net Working Capital Turnover Ratio Formula = Net Sales / Net Working Capital #10 – Cash Conversion Cycle The Cash conversion cycle is the total time taken by the firm to convert its cash outflows into cash inflows (returns). Cash Conversion Cycle Formula = Receivable Days + Inventory Days – Payable Days Operating Profitability Ratio Analysis The third type of financial ratio analysis is the operating profitability ratio. The profitability ratio helps to measure a company’s profitability through this efficiency of business activity. The following are the important profitability ratios:#11 – Earning Margin It is the ratio of net income to turnover expressed in percentage. It refers to the final net profit used. Earning Margin formula = Net Income / Turnover * 100 #12 – Return on Capital Employed or Return On the Investment This financial ratio measures profitability concerning the total capital employed in a business enterprise. Return on Investment formula = Profit Before Interest and Tax / Total Capital Employed #13 – Return On Equity Return on equity is derived by dividing net income by shareholder’s equity. It provides a return that management realizes from the shareholder’s equity. Return on Equity Formula = Profit After Taxation – Preference Dividends / Ordinary Shareholder’s Fund * 100 #14 – Earnings Per Share EPS is derived by dividing the company’s profit by the total number of shares outstanding. It means profit or net earnings. Earnings Per Share Formula = Earnings After Taxation – Preference Dividends / Number of Ordinary Shares Before investing, the investor uses all the above ratios to maximize profit and analyze risk. It is easy for him to compare and predict a company’s future growth through ratio. It also simplifies the financial statement. Business Risk Ratios The fourth type of financial ratio analysis is the business risk ratio. Here, we measure how sensitive the company’s earnings are concerning its fixed costs and the assumed debt on the balance sheet. #15 – Operating Leverage Operating leverage is the percentage change in operating profit relative to sales, and it measures how sensitive the operating income is to the change in revenues. The greater the use of fixed costs, the greater the impact of a change in sales on a company’s operating income. Operating Leverage Formula = % change in EBIT / % change in Sales #16 – Financial Leverage Financial leverage is the percentage change in net profit relative to operating profit, and it measures how sensitive the net income is to the change in operating income. Financial leverage primarily originates from the company’s financing decisions (debt usage). Financial Leverage formula = % Change in Net Income / % Change in EBIT #17 – Total Leverage Total leverage is the percentage change in net profit relative to its sales. The total leverage measures how sensitive the net income is to the change in sales. Total Leverage Formula = % Change in Net Profit / % Change in Sales Financial Risk Ratio Analysis The fifth type of financial ratio is the financial risk ratio. Here, we measure how leveraged the company is and placed concerning its debt repayment capacity. #18 – Debt Equity Ratio Debt Equity Formula = Long Term Debts / Shareholder’s Fund It helps to measure the extent of equity to repay debt. It is used for long-term calculation. #19 – Interest Coverage Ratio Analysis This financial ratio signifies the ability of the firm to pay interest on the assumed debt. Interest Coverage Formula = EBITDA / Interest Expense Higher interest coverage ratios imply the greater ability of the firm to pay off its interests. If interest coverage is less than 1, then EBITDA is insufficient to pay off interest, implying finding other ways to arrange funds. #20 – Debt Service Coverage Ratio (DSCR) Debt Service Coverage Ratio tells us whether the operating income is sufficient to pay off all obligations related to debt in a year. Debt Service Coverage Formula = Operating Income / Debt Service Operating Income is nothing but EBIT Debt Service is Principal Payments + Interest Payments + Lease Payments A DSCR of less than 1.0 implies that the operating cash flows are insufficient for debt servicing, indicating negative cash flows. Stability Ratios The sixth type of financial ratio analysis is the stability ratio. It is used with a vision of the long-term and to check the company’s stability in the long run. One can calculate this type of ratio analysis in multiple ways. They are as follows: – #21 – Fixed Asset Ratio This ratio is used to know whether the company is having good fun or not to meet the long-term business requirement. Fixed Asset Ratio Formula = Fixed Assets / Capital Employed The ideal ratio is 0.67. If the ratio is less than 1, one can use it to purchase fixed assets. #22 – Ratio to Current Assets to Fixed Assets Ratio to Current Assets to Fixed Assets = Current Assets / Fixed Assets If the ratio increases, profit increases and reflects the business expansion, and if the ratio decreases, trading is loose. #23 – Proprietary Ratio The proprietary ratio is the ratio of shareholder funds upon total tangible assets; it talks about a company’s financial strength. Ideally, the ratio should be 1:3. Proprietary Ratio Formula = Shareholder Fund / Total Tangible Assets Coverage Ratios The seventh type of financial ratio analysis is the coverage Ratio. This type of ratio analysis is used to calculate dividends needed to be paid to investors or interest to the lender. The higher the cover, the better it is. It can be estimated in the below ways: – #24 – Fixed Interest Cover It is used to measure business profitability and its ability to repay the loan. Fixed Interest Cover Formula = Net Profit Before Interest and Tax / Interest Charge #25 – Fixed Dividend Cover It helps to measure the dividends needed to pay the investor. Fixed Dividend Cover Formula = Net Profit Before Interest and Tax / Dividend on Preference Share Control Ratio Analysis The eighth type of financial ratio analysis is the control ratio. It is used to control things by management. For example, this ratio analysis helps management check favorable or unfavorable performance. #26 – Capacity Ratio For this type of ratio analysis, one can use the formula given below for the same. Capacity Ratio Formula = Actual Hour Worked / Budgeted Hour * 100 #27 – Activity Ratio For calculating a measure of activity below, the formula is used. Activity Ratio Formula = Standard Hours for Actual Production / Budgeted Standard Hour * 100 #28 – Efficiency Ratio For calculating productivity, the below formula is used. Efficiency Ratio Formula = Standard Hours for Actual Production / Actual Hour Worked * 100 If it is 100% or more, it is considered favorable. But, if it is less than 100%, then it is unfavorable.