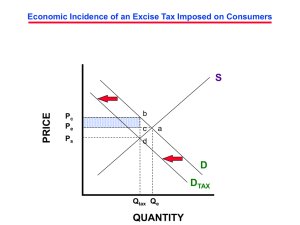

Homework: October 7, 2015 tax incidence

advertisement

Homework: October 7, 2015 Tax Incidence and Deadweight Loss - Read pages 416-419 1. Explain what is meant by tax incidence. 2. What does the phrase “division of burden” mean when applied to a sales or excise tax? 3. Explain how elasticities of supply and demand affect the incidence of a sales or excise tax. 4. If an excise tax is placed on a good for which price elasticities of demand and supply are relatively equal, describe what will happen to: Equilibrium price Equilibrium quantity Revenue per unit for the supplier 5. Explain the importance of the four graphs on page 590. 6. On a graph of a market that includes an excise tax, where will you find the deadweight loss (efficiency loss) created by the tax? 7. Draw three graphs of a market that includes an excise tax. a. Elasticities of supply and demand are both moderate and similar. b. Elasticity of demand is high, but elasticity of supply is low. c. Elasticity of demand is low, but elasticity of supply is high. On your graphs, identify the area of tax paid by the consumer, tax paid by the producer, and deadweight loss.

![Efficiency_and_Deadweight_Loss[1]](http://s3.studylib.net/store/data/009434002_1-f7581b2930e0def184879bc9efc1b24b-300x300.png)