Efficiency_and_Deadweight_Loss[1]

advertisement

![Efficiency_and_Deadweight_Loss[1]](http://s3.studylib.net/store/data/009434002_1-f7581b2930e0def184879bc9efc1b24b-768x994.png)

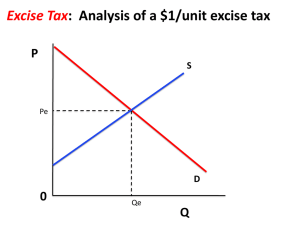

Efficiency and Deadweight Loss Consumer Surplus, Producer Surplus and Efficiency 1. The gains from trade a. Total Surplus i. It is the sum of consumer and producer surplus ii. This illustrates another core principle of economics: There are gains from trade. 2. The Efficiency of Markets a. A market is efficient if there is no way to make some people better off without making other people worse off b. Once a market is in equilibrium there is no way to increase gains from trade c. An efficient market performs four important function i. It allocates consumption of the good to the potential buyers who most value it, as indicated by the fact they have the highest willingness to pay ii. It allocates sales to the potential sellers who most value the right to sell the good, as indicated by the fact that they have the lowest cost. iii. It ensures that every consumer who makes a purchase values the good more than every seller who makes a sale, so that all transactions are mutually beneficial iv. It ensures that every potential buyer who doesn’t make a purchase values the good less than every potential seller who doesn’t make a sale, so that no mutually beneficial transactions are missed. d. There are three caveats i. Although the market may be efficient is isn’t necessarily fair ii. Markets sometimes fail iii. Even when the market equilibrium maximizes total surplus, this does not mean that it results in the best outcome for every individual consumer and producer. 3. Equity and Efficiency a. There is often a trade-off between equity and efficiency: Policies that promote equity often come at the cost of decreased efficiency and policies that promote efficiency often result in decreased equity b. Equity and efficiency is at the core of most debates about taxation i. Economists classify taxes according to how they vary with the income of individuals 1. Progress Tax: rises more than in proportion to income 2. Regressive Tax: rises less than in proportion to income 3. Proportional Tax: rises in proportion to income 4. Effects of Taxes on Total Surplus a. To understand the economics of taxes it is helpful to look an excise tax i. A tax charged on each unit of a good or service that is sold b. Effect of an excise tax on quantities and prices i. An excise tax drives a wedge between the price paid by consumers and the price received by producers ii. It leads to inefficiency by distorting incentives and creating missed opportunities for mutually beneficial transactions iii. Tax incidence is the distribution of the tax burden c. Price elasticities and tax incidence i. The incidence of an excise tax depends on the price elasticity surplus and price elasticity of demand ii. When an excise tax is paid mainly by consumers 1. The price elasticity of demand is low and the price elasticity of supply is high, the burden of an excise tax falls mainly on consumers iii. When an excise tax is paid mainly by producers 1. The price elasticity of demand is high and the price elastic of supply is low , the burden of an excise tax falls mainly on producers 5. The Benefits and Cost of Taxation a. The revenue from an excise tax i. The revenue collected by an excise tax is equal to the area of a rectangle with the height of the tax wedge between the supply price and demand price and the width of the quantity sold under the tax b. The cost of taxation i. Prevents mutually beneficial transactions from occurring. The value of the forgone mutually beneficial transactions is called the deadweight loss. ii. In considering the total amount of inefficiency caused by the tax we must also take into account administrative costs 1. Administrative costs of a tax are the resources used by government to collect the tax and by taxpayers to pay (or to evade) it, over and above the amount collected. iii. Also consider lump-sum tax 1. Is a tax of a fixed amount paid by all taxpayers 2. It is the same for everyone regardless of any actions people take.