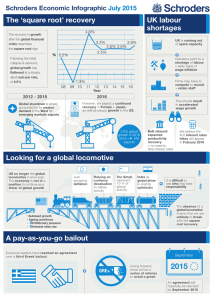

The ‘square root’ recovery UK labour shortages

Schroders Economic Infographic

July 2015

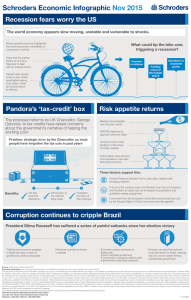

The ‘square root’ recovery

of 2.5%

The recovery in growth after the global financial crisis resembles the square root sign

Following the initial collapse & rebound, global growth has flattened at a steady, albeit sub-par rate,

2012 - 2015

Global slowdown is largely accounted for by weaker demand in the West for emerging markets exports

2.2%

4.6%

3.3%

2.5%

2016

2.6% 2.6%

2.9%

-1.3%

08 09 10 11 12 13 14 15 16

However, we expect a continued recovery in Europe + Japan, as well as steady growth in the US.

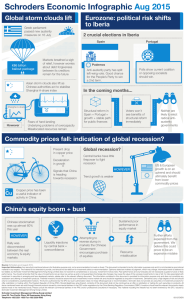

UK labour shortages

UK is running out of spare capacity

2

1

3

Indicators point to a shortage of labour

+ early signs of wage inflation

Firms may have to compete to recruit

+ retain staff

This should result in accelerated wage growth

2.9% global growth in 2016

2016 = EM

exports

%

BoE relaxed: expected productivity recovery

= no need to hike interest rates

We believe the first interest rates hikes will appear in Febuary 2016

Looking for a global locomotive

US no longer the global locomotive it once was:

The economy is not in a position to continue as a driver of global growth

Just escaping deflation

Relying on currency devaluation to reflate activity

Too Small, represent

10 % of global activity

India as global driver is slightly optimistic

It is difficult to see who may take responsibility

The absence of a global locomotive means that we are unlikely to break with the square root recovery

•

Subdued growth

•

Ageing workforce

•

Inflationary pressure

•

Interest rates rise

A pay-as-you-go bailout

Eurozone leaders have reached an agreement

over a third Greek bailout

GREXIT

Going forward, there will be a series of reforms

to avoid a grexit

September

2015

An agreement will

hopefully be reached by September 2015

Source: Schroders as at July 2015.

Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management

(Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products.

Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management

(Hong Kong) Limited.

Schroder Investment Management (Hong Kong) Limited

Level 33, Two Pacific Place, 88 Queensway, Hong Kong

Telephone +852 2521 1633 Fax +852 2530 9095 0715/HKEN