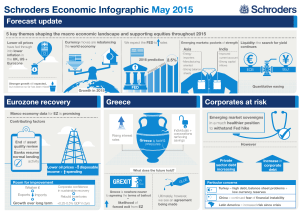

Schroders Economic Infographic May 2015 Forecast update

advertisement

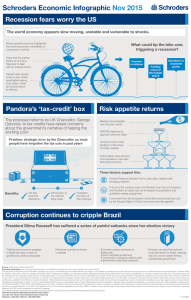

Schroders Economic Infographic May 2015 Forecast update 5 key themes shaping the macro economic landscape and supporting equities throughout 2015 Currency moves are rebalancing the world economy Lower oil prices have fed through into lower inflation in the UK, US + Eurozone We expect the FED to rates Emerging markets: pockets of strength Liquidity: the search for yield Asia 2016 prediction 2.5% est ter es rat in Stronger growth still expected, but evidence so far has been mixed Greece Greece is facing pressures Individuals + corporations removing savings Banks resume normal lending activity Lower oil prices = disposable income + spending Room for improvement Weaker € Exports Imports Growth over long term Corporate confidence in sustainable recovery Rebuild inventories +0.25-0.5% GDP in 2yrs BoJ ECB Corporates at risk Contributing factors Rising interest rates continues Quantitative easing Marco economy data for EZ is promising End of asset quality review -Improved current account -Strong capital inflows FED Growth in 2015 Eurozone recovery -Energy importers -Manufacturing oriented -Strong balance sheets India Greece is nowhere nearer to agreeing the terms of bailout = likelihood of forced exit from EZ However Private sector debt increasing What does the future hold? GREXIT Emerging market sovereigns in a much healthier position to withstand Fed hike E GLU Increase in corporate debt Particular concerns Turkey = high debt, balance sheet problems + low currency reserves Ultimately, however, we see an agreement being made China = continued fear of financial instability Latin America = increased risk since crisis Source of data: Schroders, as at May 2015 Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 0515/HKEN