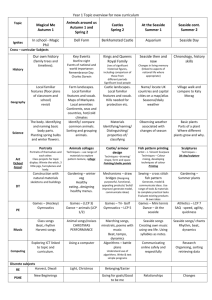

Document 13272017

advertisement