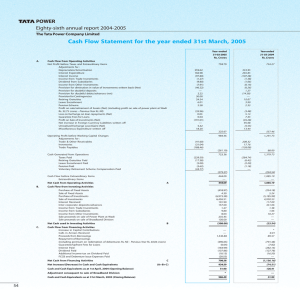

POWER Eighty-sixth annual report 2004-2005

advertisement

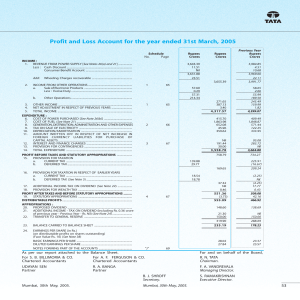

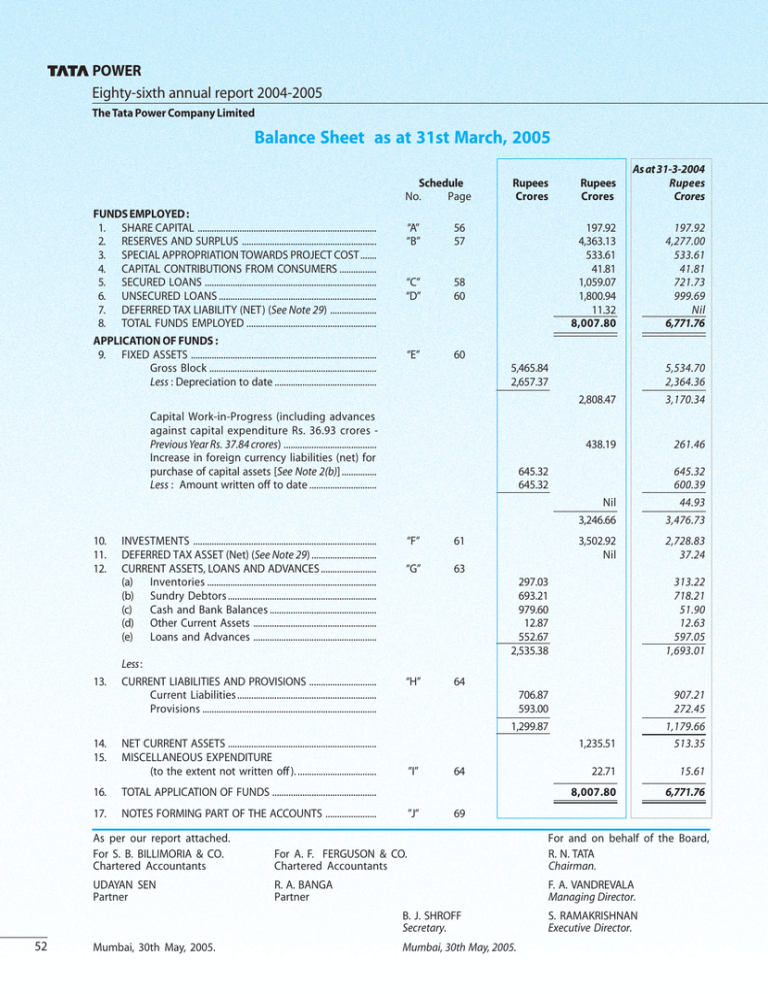

POWER Eighty-sixth annual report 2004-2005 The Tata Power Company Limited Balance Sheet as at 31st March, 2005 Schedule No. Page FUNDS EMPLOYED : 1. SHARE CAPITAL ............................................................................. 2. RESERVES AND SURPLUS .......................................................... 3. SPECIAL APPROPRIATION TOWARDS PROJECT COST ....... 4. CAPITAL CONTRIBUTIONS FROM CONSUMERS ................ 5. SECURED LOANS .......................................................................... 6. UNSECURED LOANS .................................................................... 7. DEFERRED TAX LIABILITY (NET) (See Note 29) .................... 8. TOTAL FUNDS EMPLOYED ........................................................ APPLICATION OF FUNDS : 9. FIXED ASSETS ................................................................................ Gross Block ........................................................................ Less : Depreciation to date ............................................ “A” “B” 56 57 “C” “D” 58 60 “E” 60 Rupees Crores 13. 14. 15. INVESTMENTS ............................................................................... DEFERRED TAX ASSET (Net) (See Note 29) ............................ CURRENT ASSETS, LOANS AND ADVANCES ........................ (a) Inventories ......................................................................... (b) Sundry Debtors ................................................................ (c) Cash and Bank Balances .............................................. (d) Other Current Assets ..................................................... (e) Loans and Advances ..................................................... Less : CURRENT LIABILITIES AND PROVISIONS ............................. Current Liabilities ............................................................ Provisions ........................................................................... TOTAL APPLICATION OF FUNDS ............................................. 17. NOTES FORMING PART OF THE ACCOUNTS ...................... “F” 61 “G” 63 197.92 4,277.00 533.61 41.81 721.73 999.69 Nil 6,771.76 2,808.47 5,534.70 2,364.36 3,170.34 438.19 261.46 Nil 3,246.66 645.32 600.39 44.93 3,476.73 3,502.92 Nil 2,728.83 37.24 “H” ”I” ”J” 297.03 693.21 979.60 12.87 552.67 2,535.38 313.22 718.21 51.90 12.63 597.05 1,693.01 706.87 593.00 1,299.87 1,235.51 907.21 272.45 1,179.66 513.35 22.71 15.61 8,007.80 6,771.76 64 64 69 As per our report attached. For S. B. BILLIMORIA & CO. Chartered Accountants For A. F. FERGUSON & CO. Chartered Accountants For and on behalf of the Board, R. N. TATA Chairman. UDAYAN SEN Partner R. A. BANGA Partner F. A. VANDREVALA Managing Director. B. J. SHROFF Secretary. 52 197.92 4,363.13 533.61 41.81 1,059.07 1,800.94 11.32 8,007.80 645.32 645.32 NET CURRENT ASSETS ................................................................ MISCELLANEOUS EXPENDITURE (to the extent not written off ). .................................. 16. As at 31-3-2004 Rupees Crores 5,465.84 2,657.37 Capital Work-in-Progress (including advances against capital expenditure Rs. 36.93 crores Previous Year Rs. 37.84 crores) ........................................ Increase in foreign currency liabilities (net) for purchase of capital assets [See Note 2(b)] ............... Less : Amount written off to date ............................. 10. 11. 12. Rupees Crores Mumbai, 30th May, 2005. Mumbai, 30th May, 2005. S. RAMAKRISHNAN Executive Director.