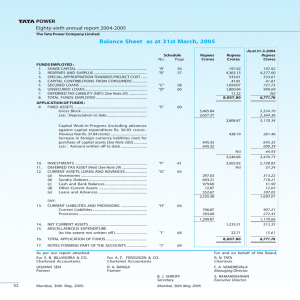

HINDUSTAN UNILEVER LIMITED I. ABOUT THE COMPANY: Hindustan Unilever (HUL) Ltd is India`s largest fast moving consumer goods company, with leadership in Home & Personal Care Products and Foods & Beverages.HUL`s brands - like Lifebuoy, Lux, Surf Excel, Rin, Wheel, Fair & Lovely, Pond`s, Sunsilk, Clinic, Pepsodent, Close-up, Lakme, Brooke Bond, Kissan, Knorr-Annapurna, Kwality Walls are household names across the country and span many categories - soaps, detergents, personal products, tea, coffee, branded staples, ice cream and culinary products. The company`s product portfolio includes Home & Personal Care-Personal WashLux, Breeze, Lifebuoy, Dove, Liril, Pears, Hamam & Rexona.Laundry-Surf Excel, Rin, Wheel& Sunlight. Hair care. Deodorant-Axe &Rexona.Ayurvedic Personal & Health CareAyush. Skin Care-Fair & Lovely, Pond`s, Vaseline, & Aviance. Oral Care-Pepsodent & Closeup. Colour Cosmetic-Lakme. Foods-Tea-Brooke Bond & Lipton. Coffee-Brooke Bond Bru. Foods-Kissan, Annapurna & Knorr. Ice Cream-Kwality Wall`s. The company also engaged in the business of Beverages, Packaged Foods, Other Operations, Personal Products, Soaps & Detergents. 1 2 3 4 Company Name Years in existence Industry details Competitors Hindustan Unilever Ltd 87 years 6 months FMCG • Marico • L'Oréal • Nirma Ltd • ITC Limited • Colgate-Palmolive • Procter and Gamble • Dabur India 5 6 7 Sales in the last reported full year Net profit after taxes in the reported full year Some important ratios 38,785 Cr 6,738 Cr Per Share Ratio (Rs):31.17 Net Profit Margin (%):16.98 Return on Net worth / Equity (%):82.00 8 Balance Sheet size (total of either assets or liabilities) Total Assets: 8,886 Cr Total Liabilities: 9,104 Cr BALANCE SHEET Previous Years » Hindustan Unilever --- Standalone Balance Sheet Mar 20 in Rs. Cr. Mar 19 Mar 18 Mar 17 Mar 16 12 mths 12 mths 12 mths 12 mths 12 mths 216.00 216.00 216.00 216.00 216.00 EQUITIES AND LIABILITIES SHAREHOLDER'S FUNDS Equity Share Capital 216.00 216.00 Reserves and Surplus 7,815.00 7,443.00 6,859.00 6,274.00 6,063.00 Total Reserves and Surplus Total Shareholders’ Funds NON-CURRENT LIABILITIES 7,815.00 7,443.00 6,859.00 6,274.00 6,063.00 8,031.00 7,659.00 7,075.00 6,490.00 6,279.00 Other Long-Term Liabilities Long Term Provisions 1,269. 00 1,198.00 804.00 1,049. 00 666.00 772.00 574.00 485.00 395.00 594.00 Total Non-Current Liabilities 2,467.00 1,853. 00 1,438.00 1,059.00 989.00 Trade Payables 7,399.00 7,070.00 7,013.00 6,006.00 5,498.00 Other Current Liabilities 1,287.00 782.00 972.00 809.00 864.00 501.00 651.00 387.00 290.00 8,636.00 7,202.00 Total Share Capital 216.00 216.00 216.00 CURRENT LIABILITIES Short Term Provisions Total Current Liabilities Total Capital and Liabilities 418.00 9,104.00 8,353.00 19,602.00 17,865.00 17,149.00 14,751.00 13,920.00 6,652.00 4,625.00 3,907.00 ASSETS NON-CURRENT ASSETS Tangible Assets 3,776.00 3,654.00 Intangible Assets 431.00 436.00 366.00 370.00 12.00 Capital Work-ln-Progress 513.00 373.00 430.00 203.00 386.00 4,716.00 4,572.00 4,227.00 3,300.00 Fixed Assets 5,569.00 2,902.00 Non-Current Investments Deferred Tax Assets [Net] 252.00 261.00 256.00 339.00 256.00 255.00 260.00 160.00 319.00 168.00 Long Term Loans and Advances 453.00 396.00 404.00 352.00 162.00 523.00 387.00 419.00 Other Non-Current Assets 1,159.00 784.00 Total Non-Current Assets CURRENT ASSETS 7,694.00 6,491.00 6,010.00 5,386.00 4,368.00 Current Investments 1,248.00 2,693.00 2,855.00 3,519.00 2,461.00 Inventories 2,636.00 2,422.00 2,359.00 2,362.00 2,528.00 928.00 1,064.00 Trade Receivables 1,046.00 1,673.00 1,147.00 Cash and Cash Equivalents 5,017.00 3,688.00 3,373.00 Other Current Assets Total Current Assets 1,961.00 11,908.00 898.00 1,405.00 11,374.00 11,139.00 Total Assets 19,602.00 17,865.00 17,149.00 14,751.00 13,920.00 1 ,671.00 2,759.00 885.00 9,365.00 740.00 9,530.00 1. MANAGING RISK FINANCIAL RISK MANAGEMENT The Company’s business activities are exposed to a variety of financial risks, namely liquidity risk, market risk, credit risk and commodity risk. The Company’s senior management has the overall responsibility for establishing and governing the Company’s risk management framework. The Company has constituted a Risk Management Committee, which is responsible for developing and monitoring the Company’s risk management policies. The Company’s risk management policies are established to identify and analyse the risks faced by the Company, to set and monitor appropriate risk limits and controls, periodically review the changes in market conditions and reflect the changes in the policy accordingly. The key risks and mitigating actions are also placed before the Audit Committee of the Company. A. Management of Liquidity Risk: Liquidity risk is the risk that the Company will face in meeting its obligations associated with its financial liabilities. The Company’s approach in managing liquidity is to ensure that it will have sufficient funds to meet its liabilities when due without incurring unacceptable losses. In doing this, management considers both normal and stressed conditions. The Company maintained a cautious liquidity strategy, with a positive cash balance throughout the year ended 31st March, 2020 and 31st March, 2019. Cash flow from operating activities provides the funds to service the financial liabilities on a day-to-day basis. The Company regularly monitors the rolling forecasts to ensure it has sufficient cash on an on-going basis to meet operational needs. Any short-term surplus cash generated, over and above the amount required for working capital management and other operational requirements, is retained as cash and cash equivalents (to the extent required) and any excess is invested in interest bearing term deposits and other highly marketable debt investments with appropriate maturities to optimise the cash returns on investments while ensuring sufficient liquidity to meet its liabilities. B. Management of Market Risk: The Company’s size and operations result in it being exposed to the following market risks that arise from its use of financial instruments: • currency risk; • price risk; • interest rate risk; and • commodity risk a) Currency Risk: The Company is subject to the risk that changes in foreign currency values impact the Company’s exports revenue and imports of raw material and property, plant and equipment. As at 31st March, 2020, the unhedged exposure to the Company on holding financial assets (trade receivables) and liabilities (trade payables) other than in their functional currency amounted to ` 5 crores payable (net) [31st March, 2019: ` 11 crores] Observation: A 5% strengthening of the INR against key currencies to which the Company is exposed (net of hedge) would have led to approximately an additional ` 0 crore gain in the Statement of Profit and Loss (2018-19: ` 1 crore gain). A 5% weakening of the INR against these currencies would have led to an equal but opposite effect. b) Price Risk: The Company is mainly exposed to the price risk due to its investment in debt mutual funds. The price risk arises due to uncertainties about the future market values of these investments. At 31st March, 2020, the investments in debt mutual funds amounts to ` 1,248 crores (31st March, 2019: ` 1,813 crores). These are exposed to price risk. Observation: A 1% increase in prices would have led to approximately an additional ` 12 crores gain in the Statement of Profit and Loss (2018-19: ` 18 crores gain). A 1% decrease in prices would have led to an equal but opposite effect. c) Interest Rate Risk: The Company is mainly exposed to the interest rate risk due to its investment in treasury bills. The interest rate risk arises due to uncertainties about the future market interest rate on these investments. In addition to treasury bills, the Company invests in term deposits. Considering the short-term nature, there is no significant interest rate risk pertaining to these deposits. As at 31st March, 2020, the investments in treasury bill amounts to Nil (31st March, 2019: ` 880 crores). These are exposed to interest rate risk. Observation: A 0.25% decrease in interest rates would have led to approximately Nil amount in the Statement of Profit and Loss (2018-19: ` 1 crore gain). A 0.25% increase in interest rates would have led to an equal but opposite effect d) Commodity Risk: The Company is exposed to the risk of changes in commodity prices in relation to its purchase of certain raw materials. At 31st March, 2020, the Company had hedged its exposure to future commodity purchases with commodity derivatives valued at ` 32 crores (31st March, 2019: Nil). Hedges of future commodity purchases resulted in cumulative losses of ` 12 crores (31st March, 2019: Nil) being reclassified to the income statement as an adjustment to inventory purchase. Observation: A 10% increase in prices of open trades would have led to approximately ` 21 crores gain in OCI (2018-19: Nil). A 10% decrease in prices would have led to an equal but opposite effect. C. Management of Credit Risk: Credit risk is the risk of financial loss to the Company if a customer or counter-party fails to meet its contractual obligations. Trade receivables: Concentration of credit risk with respect to trade receivables are limited, due to the Company’s customer base being large and diverse. All trade receivables are reviewed and assessed for default on a quarterly basis. Our historical experience of collecting receivables indicate a low credit risk. Hence, trade receivables are considered to be a single class of financial assets. Other financial assets: The Company maintains exposure in cash and cash equivalents, term deposits with banks, investments in treasury bills, Government securities, money market liquid mutual funds and derivative instrument with financial institutions. The Company has set counterparty limits based on multiple factors including financial position, credit rating, etc. The Company has given inter-corporate deposits (ICD) only to its subsidiaries amounting ` 226 crores (31st March, 2019: ` 191 crores). Observation: The Company’s maximum exposure to credit risk as at 31st March, 2020 and 31st March, 2019 is the carrying value of each class of financial assets. 2. DECISION MAKING: The Administrative Matters Committee has been set up to oversee routine operations that arise in the normal course of the business, such as decision on banking relations, delegation of operational powers, appointment of nominees under statutes, etc. The Committee comprises three Executive Directors of the Board. The Committee reports to the Board and the minutes of these meetings are placed before the Board for information. 3. RESEARCH & DEVELOPMENT: HUL continues to derive sustainable benefit from the strong foundation and long tradition of R&D at Unilever, which differentiates it from others. New products, processes and benefits flow from work done in various Unilever R&D centres across the globe, including in India. The Unilever R&D labs in Mumbai and Bengaluru work closely with the business to create exciting innovations that help us win with our consumers. With worldclass facilities, and a superior science and technology culture, Unilever attracts the best talent to provide a significant technology differentiation to its products and processes. Effective 1st April, 2020, HUL added a new R&D facility for the Nutrition business based at Gurgaon, consequent to the merger of GSK CH with the Company. The R&D programmes, undertaken by Unilever globally, are focused on the development of breakthrough and proprietary technologies with innovative consumer propositions. The global R&D team comprises highly qualified scientists and technologists working in the areas of Home Care, Beauty & Personal Care, Foods & Refreshment and Water Purification and critical functional capability teams in the areas of Regulatory, Clinicals, Digital R&D, Product & Environment Safety and Open Innovation. 4. MINIMIZING MANUFACTURING COST: Against this challenging backdrop, we are focusing on the long-term health of the business, keeping our savings ambition unchanged. HUL are driving cost agility, judiciously reviewing cash flows and reallocating spends with rigorous discipline. 5. RAISING CAPITAL Equity share capital and other equity are considered for the purpose of Company’s capital management. The Company manages its capital so as to safeguard its ability to continue as a going concern and to optimise returns to shareholders. The capital structure of the Company is based on management’s judgement of its strategic and day-to-day needs with a focus on total equity so as to maintain investor, creditors and market confidence. The management and the Board of Directors monitor the return on capital as well as the level of dividends to shareholders. The Company may take appropriate steps in order to maintain, or if necessary, adjust, its capital structure. 6. EFFECTIVE FUNCTIONING Financial Year 2019-20 has been a challenging year with weakening macro-economic conditions, slowing market growths in FMCG sector and finally, COVID-19 outbreak and containment measures towards the end of the year. Against this challenging backdrop, we have delivered competitive and profitable growth. Our financial year 2019-20 performance was steady at 2% Domestic Consumer Growth supported by 2% Underlying Volume Growth. This resilient performance is a reflection of the strength of our brands, execution prowess and rigour and discipline in implementing a consistent strategy. We have grown competitively overall in the segments in which we operate, in financial year 2019-20. Its bottom-line performance was good with a healthy 100 bps EBITDA margin expansion on a comparable basis. Its profit after tax and before exceptional items (PAT bei) grew at 11%. The margin expansion is a result of our strong savings agenda, scale efficiencies achieved on the back of healthy volume growth, mix impact given our strong portfolio of premium brands and market development cells. 7. GROWTH AND DIVERSIFICATION For the nine months, ended December 2019, Domestic Consumer Growth was at 6%, reflective of our strong performance delivery. Given the disruptions to supply chain arising from COVID-19 in March 2020, for the full year 2019-20, Domestic Consumer Growth was 2% with Underlying Volume Growth of 2%. Our EBITDA margin improved by 100 bps on comparable basis, PAT (bei) *, grew by 11% to ` 6,743 crores and PAT at ` 6,738 crores was up by 12%. We sustained our track record of strong cash generation. The Board of Directors have proposed a final dividend of ` 14 per share, subject to the approval of the shareholders at the AGM. Together with the interim dividend of ` 11 per share, the total dividend for the financial year ending 31st March 2020 amounts to ` 25 per share; an increase of 14%. Our endeavour is to shape a Growth Culture based on three tenets: Human, Purposeful and Accountable. HUL remain committed to listening to our employees and build these insights into actions. Our annual employee survey, Uni Voice garnered a participation from 94% of our workforce this year, reaching around 15,000+ employees. The survey showed improvements across all dimensions. Overall Engagement stood at 90%, 94% of our employees believe we have the right strategy to win and 90% of employees believe we care about their well-being. The employee voice through these encouraging scores is testimony to our actions and how our employees experience your Company every day. 8. SHORT-TERM AND LONG-TERM GOALS • • • • • • • • • Improve people’s health, confidence and well-being Improve the health of the planet Contribute to a fairer and more socially inclusive world Deliver long-term, superior value Serve people everywhere Use our scale for good Create capability through lifelong learning Unlock capacity for growth Deepen our culture of pioneering by driving performance through leadership and innovation in all we do. 9. MARKETING A COMPANY / PRODUCT HUL are one of the largest advertisers in the country based on media spend. They create an increasing amount of tailored digital content themselves to connect with consumers and make it easy for them to choose their brand. HUL uses a combination of channels, which includes product labels, websites, careline phone numbers and leaflets to communicate openly with its consumers. 10. DIVIDEND AND INTEREST HUL Directors recommend a Final Dividend of ` 14/- per equity share of face value of ` 1/each for the year ended 31st March, 2020. The Interim Dividend of ` 11/- per equity share was paid on Tuesday, 5th November, 2019. The Final Dividend, subject to the approval of Members at the Annual General Meeting on Tuesday, 30th June, 2020, will be paid on or after Friday, 3rd July, 2020, to the Members whose names appear in the Register of Members, as on the Book Closure date, i.e., from Thursday, 23rd June, 2020, to Tuesday 30th June, 2020, (both days inclusive). The total dividend for the financial year, including the proposed Final Dividend, amounts to ` 25/- per equity share and will absorb ` 6,141 crores (including Dividend Distribution Tax of ` 470 crores on Interim Dividend). In view of the changes made under the Income-tax Act, 1961, by the Finance Act, 2020, dividends paid or distributed by the Company shall be taxable in the hands of the Shareholders.