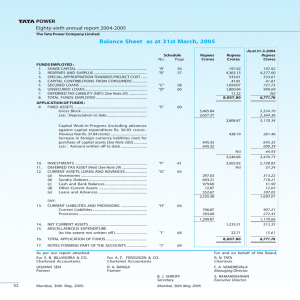

Previous Year Rupees Crores Schedule

advertisement

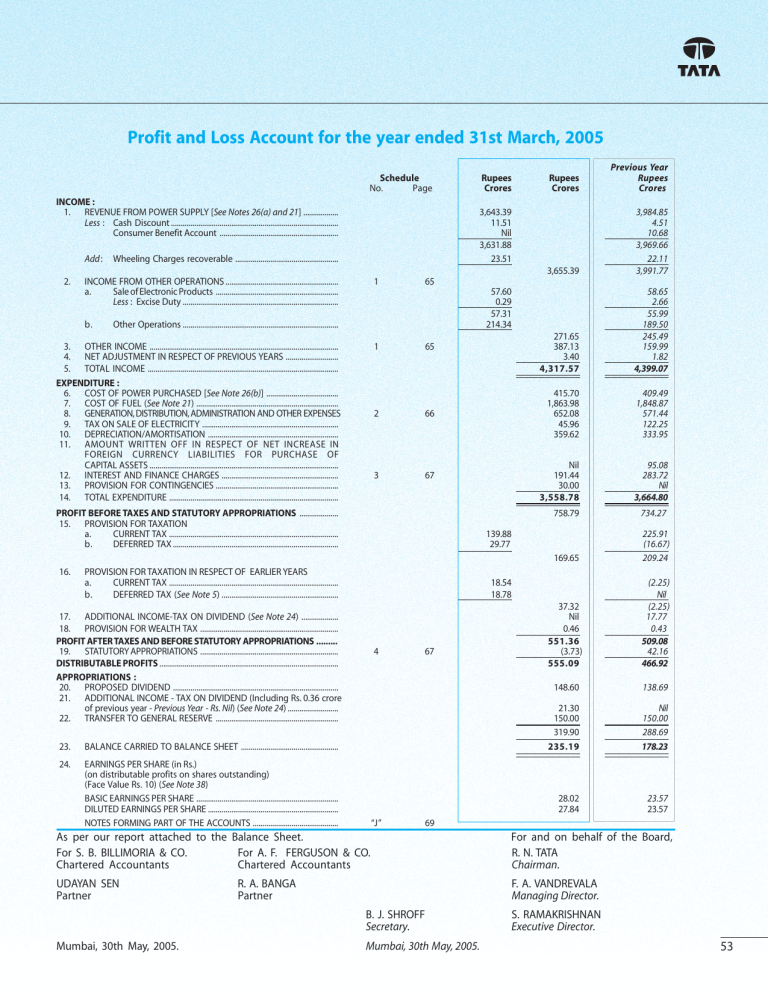

Profit and Loss Account for the year ended 31st March, 2005 Schedule No. Page INCOME : 1. REVENUE FROM POWER SUPPLY [See Notes 26(a) and 21] .................. Less : Cash Discount ...................................................................................... Consumer Benefit Account ............................................................. Add : 2. Wheeling Charges recoverable ..................................................... 1 1 65 2 66 3 67 PROFIT BEFORE TAXES AND STATUTORY APPROPRIATIONS .................... 15. PROVISION FOR TAXATION a. CURRENT TAX ....................................................................................... b. DEFERRED TAX ..................................................................................... EARNINGS PER SHARE (in Rs.) (on distributable profits on shares outstanding) (Face Value Rs. 10) (See Note 38) BASIC EARNINGS PER SHARE ......................................................................... DILUTED EARNINGS PER SHARE ................................................................... NOTES FORMING PART OF THE ACCOUNTS ............................................ 415.70 1,863.98 652.08 45.96 359.62 409.49 1,848.87 571.44 122.25 333.95 Nil 191.44 30.00 3,558.78 95.08 283.72 Nil 3,664.80 758.79 734.27 169.65 225.91 (16.67) 209.24 37.32 Nil 0.46 551.36 (3.73) 555.09 (2.25) Nil (2.25) 17.77 0.43 509.08 42.16 466.92 148.60 138.69 21.30 150.00 319.90 235.19 Nil 150.00 288.69 178.23 28.02 27.84 23.57 23.57 18.54 18.78 17. ADDITIONAL INCOME-TAX ON DIVIDEND (See Note 24) ................... 18. PROVISION FOR WEALTH TAX ....................................................................... PROFIT AFTER TAXES AND BEFORE STATUTORY APPROPRIATIONS ......... 19. STATUTORY APPROPRIATIONS ....................................................................... DISTRIBUTABLE PROFITS ............................................................................................ APPROPRIATIONS : 20. PROPOSED DIVIDEND ..................................................................................... 21. ADDITIONAL INCOME - TAX ON DIVIDEND (Including Rs. 0.36 crore of previous year - Previous Year - Rs. Nil) (See Note 24) .......................... 22. TRANSFER TO GENERAL RESERVE ............................................................... BALANCE CARRIED TO BALANCE SHEET .................................................. 271.65 387.13 3.40 4,317.57 58.65 2.66 55.99 189.50 245.49 159.99 1.82 4,399.07 139.88 29.77 PROVISION FOR TAXATION IN RESPECT OF EARLIER YEARS a. CURRENT TAX ....................................................................................... b. DEFERRED TAX (See Note 5) ............................................................ 24. 3,655.39 3,984.85 4.51 10.68 3,969.66 22.11 3,991.77 65 Other Operations ................................................................................ 23. Previous Year Rupees Crores 57.60 0.29 57.31 214.34 3. OTHER INCOME ................................................................................................. 4. NET ADJUSTMENT IN RESPECT OF PREVIOUS YEARS ........................... 5. TOTAL INCOME .................................................................................................. EXPENDITURE : 6. COST OF POWER PURCHASED [See Note 26(b)] ..................................... 7. COST OF FUEL (See Note 21) ......................................................................... 8. GENERATION, DISTRIBUTION, ADMINISTRATION AND OTHER EXPENSES 9. TAX ON SALE OF ELECTRICITY ...................................................................... 10. DEPRECIATION/AMORTISATION ................................................................... 11. AMOUNT WRITTEN OFF IN RESPECT OF NET INCREASE IN FOREIGN CURRENCY LIABILITIES FOR PURCHASE OF CAPITAL ASSETS ................................................................................................. 12. INTEREST AND FINANCE CHARGES ............................................................ 13. PROVISION FOR CONTINGENCIES ............................................................... 14. TOTAL EXPENDITURE ....................................................................................... 16. Rupees Crores 3,643.39 11.51 Nil 3,631.88 23.51 INCOME FROM OTHER OPERATIONS .......................................................... a. Sale of Electronic Products ............................................................... Less : Excise Duty ................................................................................ b. Rupees Crores 4 67 “J” 69 As per our report attached to the Balance Sheet. For S. B. BILLIMORIA & CO. For A. F. FERGUSON & CO. Chartered Accountants Chartered Accountants For and on behalf of the Board, R. N. TATA Chairman. UDAYAN SEN Partner F. A. VANDREVALA Managing Director. R. A. BANGA Partner B. J. SHROFF Secretary. Mumbai, 30th May, 2005. Mumbai, 30th May, 2005. S. RAMAKRISHNAN Executive Director. 53