Document 12090485

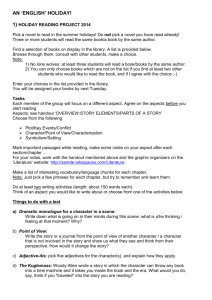

advertisement