University of Saskatchewan 1999 Academic Pension Plan

advertisement

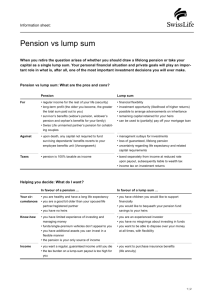

University of Saskatchewan 1999 Academic Pension Plan AGM Presentation – December 31, 2012 November 18, 2013 November Prepared by 8, Aon2013 Hewitt Aon Hewitt | © 2013 Aon Hewitt. All Rights Reserved Agenda Governance Structure Going-Concern Position Current Contribution Schedule Solvency Position Transfer Deficiency Lump Sum Transfer Option Current Pension Landscape Plan Membership 1 Pension Committee Governance Structure Board of Governors Pension Committee Investment - Investment Policy - Investment Monitoring Benefit, Financial, Accounting and Controls Administration and Compliance - Plan Design - Funding Policy - Communication/ Education - Expense Controls - Financial Statement Accounting - Daily Administration - Plan Documentation - Regulatory Filings and Compliance 2 Going-Concern Position Interim Dec 31, 2010 Interim Dec 31, 2011 Filed Dec 31, 2012 $ 145,841,000 $ 143,560,000 $ 151,158,000 142,056,000 154,373,000 160,040,000 3,785,000 $(10,813,000) $(8,882,000) Funded ratio 103% 93% 94% Current service cost 17.7% 20.5% 20.9% Total Assets Total Actuarial Liabilities Surplus / (Unfunded Liability) $ • All going-concern positions are based on 5% margin 3 Current Contribution Schedule University is currently matching employee contributions per plan requirements and contributes an additional amount based on most recent valuation results and legislation: 2012 2013 2014 Member 8.50% 8.50% 8.50% University – matching 8.50% 8.50% 8.50% University – additional 0.15% ($2,753 per month) 0.15% ($2,753 per month) 8.50% $113,833 per month 4 Solvency Position Interim Dec 31, 2010 Total Assets Total Actuarial Liabilities Surplus / (Solvency Deficiency) Interim Dec 31, 2011 Filed Dec 31, 2012 $ 145,641,000 $ 143,360,000 $ 150,958,000 172,808,000 194,415,000 205,201,000 $ (27,167,000) $ (51,055,000) $ (54,243,000) 84% 74% 74% Solvency Ratio • Solvency valuation assumes the plan will wind-up and pay out lump sum values or purchase annuities • Effective June 2013, the Plan is classified as a “Specified Plan” under the Pension Benefits Act and therefore solvency funding is not required • Transfer deficiencies still apply if members transfer out value of pension 5 Transfer Deficiency – Applies to individuals who terminate employment and elect to transfer the lump sum value of their entitlement out of the Plan – When a Plan has a solvency deficiency, legislation requires that a portion of every lump sum (LS) payment be held back – Transfer Deficiency = Portion of LS held back = (1- solvency ratio) x total lump sum entitlement – Transfer Deficiency paid out, with interest, at end of five year period following the date of payout – No impact on members retiring and commencing a pension from the Plan 6 Transfer Deficiency - continued Example – Transfer Deficiency – – – – – Date of termination = Jan 1, 2013 Total lump sum entitlement = $100,000 Solvency ratio = 0.74 LS payment on Jan 1, 2013 = 0.74 x $100,000 = $74,000 Transfer Deficiency payment on Jan. 1, 2018 = (1–0.74) x $100,000 = $26,000 (plus interest) 7 Lump Sum Transfer Option Members retiring from the Plan have the option to: 1. Take a pension from the Plan; or 2. Transfer their lump sum entitlement out of the Plan Reserves are included in going-concern balance sheet to account for this option 8 Lump Sum Transfer Option - Experience Year # electing a pension from the Plan # electing a lump sum transfer from the Plan 2012 13 2011 7 Total lump sum payments out of the Plan during year $3,192,000 Average lump sum payment out of the Plan in year $456,000 9 7 $5,066,000 $724,000 2010 9 4 $4,804,000 $1,201,000 2009 1 9 $5,685,000 $632,000 2008 2 6 $3,923,000 $654,000 2007 7 17 $11,007,000 $647,000 2006 12 6 $4,961,000 $827,000 2005 9 14 $8,604,000 $615,000 2004 6 11 $6,899,000 $627,000 2003 8 9 $6,405,000 $712,000 Total 76 (46%) 90 (54%) – The Total lump sum payments out of the Plan during the year do not include the portion held back due to the solvency deficiency 9 Lump Sum Transfer Option – Going-Concern December 31, 2012 With LS Option Without LS Option $ 151,158,000 $ 151,158,000 Total Actuarial Liabilities 160,040,000 150,770,000 Surplus / (Unfunded Liability) $(8,882,000) $388,000 20.9% 19.1% 94% 100% $113,800 per month $0 Total Assets Current service cost Funded ratio University special payments 10 Current Pension Landscape Challenges facing DB pension plans: – Sustainability and affordability – Margins in plans may not be adequate • Saskatchewan Superintendent of Pensions putting pressure on plan sponsors to enhance margin to 10% by next valuation – Pensions being paid for longer • Canadian Institute of Actuaries released study in 2013 suggesting mortality forecast may need to be enhanced long-term to account for increased life expectancies amongst Canadians – Investment markets volatile and uncertain – Pension plans have grown to a size that is often a multiple of the operating budget of the sponsoring organization • Hiccup with the pension plan means significant burden for the sponsor and its employees 11 Plan Membership Active Members Dec 31, 2011 Dec 31, 2012 181 166 Average age 58.1 years 58.7 years Average years of service 19.6 years 20.3 years Average annual salary $ 119,583 $ 123,612 Accumulated employee contributions with interest $ 33,942,908 $ 34,425,396 Accumulated University contributions with interest $ 36,015,200 $ 36,371,425 Expected average remaining service lifetime 6.3 years 6.0 years Number 12 Plan Membership - continued Pensioners and Survivors Dec 31, 2011 Dec 31, 2012 98 111 70.0 years 70.3 years Average annual pension $ 39,280 $ 39,327 Average period since retirement 7.0 years 7.1 years Number Average age Temporary Pensioners Number Average monthly pension Average period since retirement Average total number of payments remaining 13 Dec 31, 2011 Dec 31, 2012 19 22 $ 4,202 $ 3,962 2.5 years 2.6 years 30.9 months 31.9 months Plan Membership - continued Other Members Total Contributions with Interest Dec 31, 2011 Dec 31, 2012 48 43 Deferred $ 1,207,962 $ 814,777 Pending Terminations $ 3,426,199 $ 3,471,209 $ 282,348 $0 Pending Retirements $ 2,702,326 $ 1,494,544 Total $ 7,618,835 $ 5,780,530 Number Pending Deaths 14 Questions 15