October 13, 2013 - University of Waterloo

advertisement

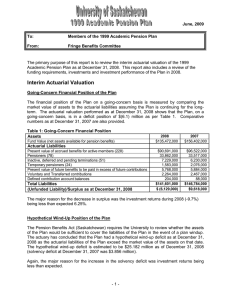

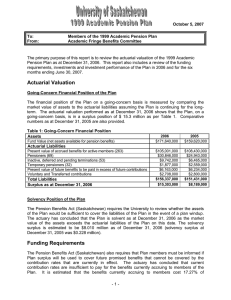

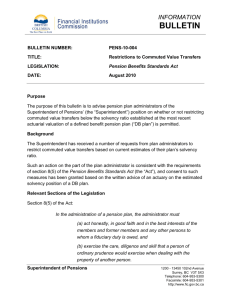

Pension and Benefits Committee Report to UWRA Board Meetings held on September 20, 2013 and October 11, 2013 1. Update on Government Pension Plan Initiatives a) New Guidance re: Solvency and Hypothetical Wind-up Valuations Alan Shapira informed the committee of new guidance from the Canadian Institute of Actuaries that might affect our next valuation filing which is due in January. These included new mortality tables based on Canadian experience with public sector defined benefit plans. These show a life expectancy of nearly ninety years. Also guidance regarding costing of annuity purchases under solvency and hypothetical wind-up valuations were reviewed. Under the new assumptions, the January 2013 solvency deficit for the UW plan was $248M with a solvency ratio (market value of assets/ solvency liabilities) of 0.815. The January 2013 hypothetical wind-up deficiency was $807M with a ratio of 0.575. While this ratios are not a major concern for the actual health of the plan, under regulations they do have an impact on required short-term funding by the University. b) Government Initiatives Alan Shapira updated the committee on the current state of the provincial government’s plan for reform of public sector pension plans. This initiative appears to have a much lower priority at present. The working group with representation from the Ontario pension board, WSIB, the U of T asset management board, COU, Ontario Power Generation Corporation and Hydro One is continuing to considering asset consolidation. However, action would require legislation which appears unlikely under the current minority government. COU, MCTU, Finance and OCUFA are continuing to look at issues involved with a single sector plan. Any action is likely to be permissive rather than mandatory. 2. Pension Plan Protocol on Restoring Full Indexing A new protocol on when and how to restore full indexing of the plan was approved at the October meeting of the committee. The protocol will guide the future committee with respect to annual decisions, without guarantees. The required conditions are not expected to be met for many years. 3. Review of Fees and Expenses The committee reconsidered the fees and expenses charged to the pension plan for both 2012 and 2011. When adjusted to an accrual basis 2012 fees declined slightly. 4. Portfolio Reallocation The committee approved moving funds ($30M) into the Canadian equity fund managed by Sionna Investment Managers. This move is designed to reduce the overinvestment in cash. 5. Benefits Review Working Group The working group has be meeting monthly. It is reviewing all insured benefits and will look specifically at LTD, and sick leave benefits. A survey was conducted in June with 1284 employees responding. Analysis continues. A request was made that if a second survey is undertaken, it should include any retirees who may be affected. Proposed changes will be discussed later in the year. 6. Report from RPPI The committee received a report from RPPI (the registered pension plan investment committee) on the performance of the overall fund and that of the individual fund managers. Active fund managers are expected to outperform the relevant market index by between 50 and 200 basis points. The overall fund target is CPI plus 3.85%. As of June 30, the annual return on the fund was 6.2%, the two year annualized return was 7.3%. The going concern deficit as of January 1, 2013 was $118.2M. The going concern deficit, as well as the solvency and hypothetical wind-up deficits are largely the result of low interest rates rather than the return on investment. Next meeting: October 25, 2013 (joint with RPPI and F&I) and November 15, 2013 Jim Brox October 11, 2013