Topic 4: Financial markets and the

advertisement

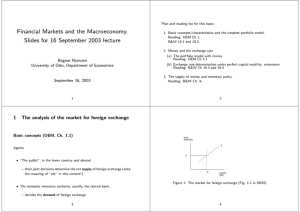

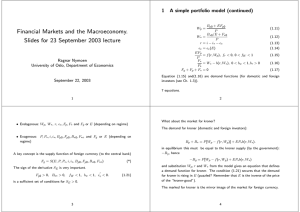

Plan and reading list for this topic: Topic 4: Financial markets and the macroeconomy: Part 1: The simple portfolio model 1. Basic concepts/characteristics and the simplest portfolio model. Reading: OEM Ch 1. B&W 19.1 and 19.2. 2. Money and the exchange rate (a) The portfolio model with money Reading: OEM Ch 3.1. (cursory reading: B&W Ch 9). Ragnar Nymoen University of Oslo, Department of Economics (b) Some extensions; The role of bonds in the transmission of monetary policy Reading: B&W Ch 19.3 (and 19.4 (cursory)) March 8, 2004 2 1 Basic concepts (OEM Ch. 1.1) price: NOK/USD Agents S • “The public”, in the home country and abroad E — their joint decisions determine the net supply of foreign exchange (note: the meaning of “net” in this context!) Q • The domestic monetary authority, usually, the central bank. quantity USD Figure 1: The market for foreign exchange (Fig. 1.1 in OEM). — decides the demand of foreign exchange 3 4 In the graph we have drawn the (governments) demand for foreign currency (here USD) as a vertical line. A synonym is the foreign exchange reserve and it denoted Q in the graph. Q is the whole stock of foreign currency deposited in the central bank, less any debt (incurred by the government) in foreign currency. The supply schedule is market “S” and is upward sloping, i.e., supply is increasing in price. Note:demand and supply relate to the whole stock of foreign currency What determines net supply of foreign currency? • In the short-run, it cannot be the trade balance (primary current account), which is a flow variable. • instead factors that can, in any point in time, effect a revaluation of existing assets. Hence, in the short-run, factors like GDP-growth and inflation are of little importance compared to the factors capable of shifting the net demand for the whole currency stock, for example the interest rates at home and abroad and exchange rate expectations. Thus, the market for foreign exchange has characteristics in common with other asset markets (residential housing, stock markets, world market for some raw materials): Supply (or demand) is fixed in the short-run, so a sudden shift in “the other side of the market” will typically result in an immidiate price change. Important difference from market for manufactures and labour! In the longer term, the primary current account is of importance, since a persistent surplus for example gradually shift the S-schedule rightward, since accumulated private and government savings will have to be allocated to foreign or domestic assets (see Ch 1.6 in OEM) 6 5 Return to Figure 1 to define the main regimes on the foreign exchange market: Apart from the discourse on the effect of the PCA surplus, the assumed horizon of the analysis in this section is the very short run (daily, monthly,...up to a year) The formal model will be static, meaning that the adjustments lags are so short that they can be ignored: Demand and supply in the market for foreign exchange are always equated. After an exogenous shock, equilibrium is momentarily restored by appropriate adjustment of the exchange rate (float regime) or the demand of foreign currency. Assume that the initial situation is where the two schedules intersect, A. Thus the exchange rate E is equilibrium exchange rate. Assume that there is a positive (horizontal) shift in the S-curve. The new equilibrium depends in the exchange rate regime: • A →B Floating exchange rate. • A → C Fixed exchange rate. The central bank intervenes in the market and increases its demand for USD (the foreign exchange reserves increases). 7 8 The balance sheet (OEM, Ch 1.2) Government Kr-assets Bg USD-assets Fg Net assets (in kroner) Bg + EFg 3 sectors (“agents”), 2 types of assets: Kroner assets and USD assets. Private Bp Fp EFp + Bp Foreign B∗ F∗ B∗ + EF∗ Sum 0 0 0 Table 2: Net financial assets, by sector (Table 1.1) • g = “government”, i.e., the domestic monetary authority (central government and the central bank), The two first rows give • p = private domestic investors, • ∗ = foreign investors. Note: In the following the exchange rate are defined as in OEM. Hence the nominal rate is E = Kroner/U SD. (This correspond to 1/S where S is the B&W definition). Correspondingly: the real exchange rate is defined as EP∗/P (against SP/P∗ in B&W). (1.1) Fg + Fp + F∗ = 0 (1.2) We can also use the table to define the sectors’ real wealth: B + EFi Wi = i , i = g, p P B∗ + F∗ , (same as foreign debt) W∗ = E P∗ 9 10 P and P∗ denotes domestic and foreign price levels. After multiplication of W∗ EP∗ by the real exchange rate , foreign and domestic wealths cancel: P EP∗ Wg + Wp + W∗ = 0 P For reference, we write Fg as Fg = −(Fp + F∗), stating that the net supply of foreign exchange is the negative of the net demand of the two other sectors’ demand. Next add a subscript “0” which indicates net assets at the start of the period. If the period is short in calendar time, financial wealth is unchanged at the end of the period: Bi + EFi = Bi0 + EFi0, i = g, p, ∗ Bg + Bp + B∗ = 0 How do we define “short period”? A period so short that net financial savings has negligible influence on total wealth, see ch 1.6. April 1992: Trade in the market for foreign exchange : Foreing trade with goods (exports + imports) (1.5) however Bi and Fi can change a lot in the period, through asset-trade. In a floating exchange rate regime, this is what drives the short run fluctuations in the exchange rate. 11 12 300 bill 30 bill rate and ee is the expected rate of depreciation A simple portfolio model (OEM (1.3) and 1.4) Bp0 + EFp0 P B∗0/E + F∗0 W∗ = P∗ r = i − i∗ − ee Wp = ee EFp P F∗ P∗ Fg + Fp + F∗ (1.11) (1.12) regressive expectations 0 extrapolative 0 constant ee > 0 ee = 0 (1.13) (1.14) = f (r, Wp), fr < 0, 0 < fW < 1 (1.15) = W∗ − b(r, W∗), 0 < bw < 1, br > 0 (1.16) =0 (1.17) ≈ 0 ee < 0 = ee(E) e ( dE dt ) d ln E e E dt In (1.14), the expected rate of depreciation is a function of the exchange rate: ee = Equation (1.15) and(1.16) are demand functions (for domestic and foreign investors (see Ch. 1.3)). 7 equations. (1.11), (1.12) and (1.17) are lifted from the balance sheet. • Endogenous: Wp, W∗, r, ee, Fp, F∗ and Fg or E (depending on regime) (1.12) defines the risk premium r (see Ch 1.3). i∗ denotes the foreign interest • Exogenous: P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o and Fg or E (depending on regime) 13 14 Exercise 0.1 Differentiate (1.18) in the book and show that (subject to Fp = Fp0 and B∗ = B∗0 (see top of p 20) ) To define the supply function corresponding to the S-curve formally: Start with (1.17): Fg = −(Fp + F∗), and substitute Fp and F∗ with the expressions in the other equations of the model. The result is equation (1.18) in the book, or in more compact notation: Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o) (*) SE ≡ ∂Fg P 0 P = 2 γ − κee ∂E E E (1.19) where EFp0 B + (1 − bw ) ∗0 P P EP∗ κ = −fr + br > 0 P Use this to show that a set of sufficient conditions for an increasing supply curve is γ = (1 − fW ) Fp0 > 0, Bo∗ > 0, 0 fW < 1, bw < 1, ee < 0. ((1.21)) Exercise 0.2 Food for thought: Although the model is static, it is tempting to speculate about the consequences for the stability of the market of a having a downward sloping supply..... 15 16 What about the market for kroner? The demand for kroner (domestic and foreign investors): We have established the supply function of foreign currency (to the central bank) as a key relationhip: Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o) (*) The sign of the derivative SE is very important. Fp0 > 0, Bo∗ > 0, 0 fW < 1, bw < 1, ee < 0. (1.21) is a sufficient set of conditions for SE > 0. Bp + B∗ = P [Wp − f (r, Wp)] + EP∗b(r, W∗). in equilibrium this must be equal to the kroner supply (by the government): −Bg , hence −Bg = P [Wp − f (r, Wp) + EP∗b(r, W∗) and substitution Wp, r and W∗ from the model gives an equation that defines a demand function for kroner. The condition (1.21) secures that the demand for kroner is rising in E (puzzled? Remember that E is the inverse of the price of the “kroner-good”). The marked for kroner is the mirror image of the market for foreign currency. 17 18 Capital mobility affects the supply curve fundamentally: Capital mobility (OEM Ch.1.5) • From (1.19): The higher κ is, the more elastic S-curve (“flatter”) The expression for the slope of the supply curve is P P 0 SE = 2 γ − κee E E (1.19) • The higher κ is, the larger horizontal shift results from a 1 pp increase in the rate of interest, i.e., form (1.8): where Si = EFp0 B + (1 − bw ) ∗0 “revaluation effect” P P EP∗ “expectations effect”. br ) > 0 κ = (−fr + P We define κ as the coefficient of capital mobility. It measures by how much the supply changes when the risk premium increases by one percetage point. γ = (1 − fW ) P κ>0 E In fact we can write SE as 0 P γ − Siee E2 showing again the decomposition into a revaluation effect and an expectations effect. The expectations effect operates as follows: SE = 0 E %→ ee &→ r %−→ demand for kroner increases 19 20 price: NOK/USD low cap mob E The degree of capital mobility and policy regimes As long as κ < ∞ (we say that) capital mobility is imperfect (due to risk aversion, transaction costs, differing expectations etc.). S high cap mob When κ → ∞ capital mobility becomes perfect. Then: Fg SE (and Si) → ∞ as κ → ∞ Figure 2: The impact of capital mobility on the supply curve 21 22 Fixed exchange rate, Fg as the policy instrument In this regime, E is the target of (monetary) policy. The policy instrument is either foreign exchange reserves, Fg or the interest rate i. We maintain that 0 ee < 0 and γ > 0. When Fg is the instrument, Fg is endogenous, while E and i are exogenous (when we later introduce the domestic money market the exogeneity of i does not necessarily follow). The degree of capital mobility is essential for operation of this regime, since it affects how much Fg must change in order to stabilize E after a shift in the S−curve. 23 Formally, assume an increase in i∗. From the equilibrium condition: ½ ¾ P f (r, Wp) + P∗(W∗ − b(r, W∗)) E ( Bp0 + EFp0 P Fg = − f (i − i∗ − ee(E), ) E P ) B∗0/E + F∗0 B∗0/E + F∗0 +P∗( − b(i − i∗ − ee(E), )) , P P Fg = − take E as exogenous and find the partial derivative of Fg (the instrument), with respect to i∗ P ∂Fg = −Si = − κ < 0 ∂i∗ E If κ is large, reserves can be emptied “overnight”. 24 Fixed exchange rate, i as the policy instrument Assume again that i∗ increases. From the eq. condition, i must increase by the same amount, irrespective of κ (since both Fg and E are exogenous). Per annum, this corresponds to a interest rate differential of 0.5 × 10% × 12 = 60% Another source of change in i in the case of this regime is expectations driven runs of speculative attacks. If large probability of devaluation in the near future, the rise in short interest rates (overnight, monthly) may be huge. Example (see OEM p 31) If this is to be compensated completely, the domestic monthly interest rate must increase by 60 percentage points. In practice, governments have often tried to defend the exchange rate by a combination of Fg and i policies. Sweden and Norway in November-December 1992 are good examples. P rob(10% devaluation within one month) = 0.5. 0.5 × 10% = 5% expected rate of depreciation over the next month. 25 26 Floating exchange rate Maintain 0 ee < 0 and γ > 0 In a clean float, Fg is (exogenous) and constant. The policy instrument, i, is now free to target other variables. For example money supply of the price level/rate of inflation. Hence i is not determined in the market for foreign exchange. On the other hand, setting the interest rate to attain e.g., the inflation rate has important spill-over effects to the exchange rate. Note κ→∞⇒ ∂E 1 = 0 <0 ∂i ee hence the Ei-curve is downward sloping also when there is perfect capital mobility, as long as expectations are regressive. For later reference we therefore note that the eq condition Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o), now defines E as a function of i. The derivative of this function is ∂E 0 = SE + Si, hence ∂i P κ 1 ∂E E =− γ <0 =−P P κe0 0 ∂i γ − − e e 2 E e E κE 27 (1.24) 28 1 Note that the result of ∂E ∂i = 0 is obtained directely by invoking the uncovered interest rate (UIP) condition E Ei curve, high cap mob ee i = i∗ + ee(E). This is logical, since the whole model reduces to the UIP condition in the case of perfect capital mobility. In general, the model has 7 equations, but when capital mobility is perfect, the model collapses into the uncovered interest rate parity (UIP) condition Ei curve, low cap mob i Figure 3: The impact of captial mobility on the Ei-curve With perfect capital mobility, there is no risk-premium so r = 0. There are no separate demand functions for the two currencies. The Supply curve is a horizontal line. 29 30 The role of the current account (section 1.6) The model we consider is a stock model. Sudden revaluation of the stocks accounts for the short-run dynamics in the market. This contrasts with the older flow based models of the market for foreign currency. In these models the surplus (or deficit) on the current account is the main explanatory variable. However, we can include the effect of the current account. Assume a stable situation where both the price level and the exchange rate change only gradually, with rates e and p (π in B&W). E Ḟ is net financial investments which is equal to D − D , the current account g P p surplus minus the government surplus, hence Ẇp = D − Dg + eFp − pWp By differentiating the eq. condition Fg = − ½ ¾ P f (r, Wp) + P∗(W∗ − b(r, W∗)) E with respect to time, it becomes clear that Ḟp depends on Ẇp, and therefore also D. Private wealth: P Wp = Bp + EFp Differentiate with respect to time: pWp + Ẇp = eFp + 31 Graphically, the supply curve “glides” rightwards as a result of D > 0. However, over a short period of time which is the foucus of the stock model, the influence of D > 0 on the market is negligible. See figure 1.7 in the book! E Ḟp P 32 The forward market (section 1.7) The arbitrage principle implies that the two ways of securing one USD tomorrow has the same cost, hence Ft,t+1 = Suppose you need 1$ tomorrow (in period t + 1). or You can use the spot market, and buy 1/(1 + i∗) $ today. In terms of kroner, the outlay is Et , 1 + i∗ where Et is the spot exchange rate. If you borrow to do this foreign currency transaction, you must pay one period interest, i.e., Et (1 + i). 1 + i∗ An alternative is to use the forward market. Then you agree today (period t) to pay Ft,t+1 kroner for one USD in period t + 1. Note that this eliminates the risk of seeing the spot rate change unfavourably from t to t + 1. 33 Et (1 + i). 1 + i∗ (1.30) Ft,t+1 (1 + i) − 1 (1.31) Et Both expression are referred to as the covered interest rate parity condition. In discrete time, the UIP condition can be written i= e Et+1 (1 + i) − 1 (1.32) Et Forward parity means that all forward contracts can be translated into assets and liabilities in the two currencies and we can think as if these are included in the balance sheets that we started out with. i= Empirically, more support for covered interest rate parity than for UIP. 34