SØK460/ECON460 Finance Theory, Fall semester, 2002 Exercise no. 5

advertisement

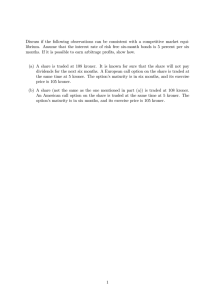

SØK460/ECON460 Finance Theory, Fall semester, 2002 Exercise no. 5 Exam Spring 1993, question 2 Discuss if the following observations can be consistent with a competitive market equilibrium. Assume that the interest rate of risk free six-month bonds is 5 percent per six months. If it is possible to earn arbitrage profits, show how. (a) A share is traded at 108 kroner. It is known for sure that the share will not pay dividends for the next six months. A European call option on the share is traded at the same time at 5 kroner. The option’s maturity is in six months, and its exercise price is 105 kroner. (b) A share (not the same as the one mentioned in part (a)) is traded at 108 kroner. An American call option on the share is traded at the same time at 5 kroner. The option’s maturity is in six months, and its exercise price is 105 kroner.