Questions for Term Paper in Open Economy Macroeconomics

advertisement

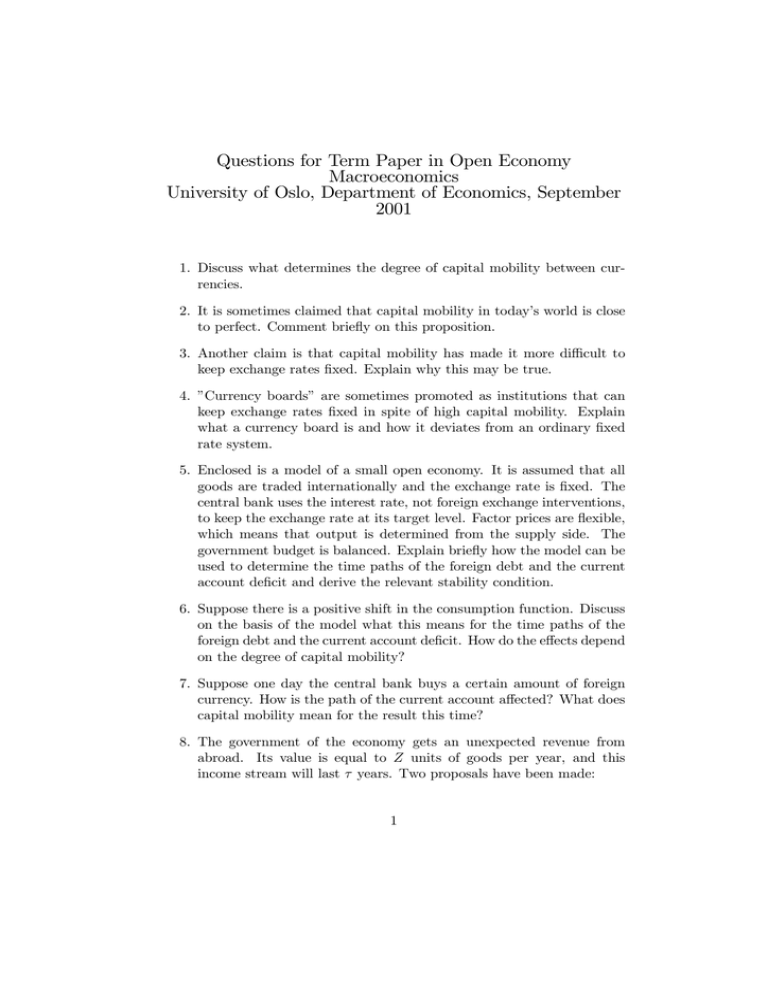

Questions for Term Paper in Open Economy Macroeconomics University of Oslo, Department of Economics, September 2001 1. Discuss what determines the degree of capital mobility between currencies. 2. It is sometimes claimed that capital mobility in today’s world is close to perfect. Comment brießy on this proposition. 3. Another claim is that capital mobility has made it more difficult to keep exchange rates Þxed. Explain why this may be true. 4. ”Currency boards” are sometimes promoted as institutions that can keep exchange rates Þxed in spite of high capital mobility. Explain what a currency board is and how it deviates from an ordinary Þxed rate system. 5. Enclosed is a model of a small open economy. It is assumed that all goods are traded internationally and the exchange rate is Þxed. The central bank uses the interest rate, not foreign exchange interventions, to keep the exchange rate at its target level. Factor prices are ßexible, which means that output is determined from the supply side. The government budget is balanced. Explain brießy how the model can be used to determine the time paths of the foreign debt and the current account deÞcit and derive the relevant stability condition. 6. Suppose there is a positive shift in the consumption function. Discuss on the basis of the model what this means for the time paths of the foreign debt and the current account deÞcit. How do the effects depend on the degree of capital mobility? 7. Suppose one day the central bank buys a certain amount of foreign currency. How is the path of the current account affected? What does capital mobility mean for the result this time? 8. The government of the economy gets an unexpected revenue from abroad. Its value is equal to Z units of goods per year, and this income stream will last τ years. Two proposals have been made: 1 (a) Reduce taxes by the amount of the extra revenue for as long as the revenue lasts. (b) Reduce taxes forever by an amount equal to the annuity equivalent of the extra revenue (1 − e−ρ∗ τ )Z. In other words, only the permanent income that the extra revenue gives rise to is handed out as tax reductions. Compare the time paths of the currenct account and the interest rate in the two cases. 9. Discuss the adequacy of the given model for discussing the question raised in 8 in real life situations. Deadline: 15 October 2001. The papers will be marked by Asbjørn Rødseth, who will also go through the answers in a lecture planned for week 45 (date and time later). Answers can be given in Norwegian or English. 2 Model Equations: Ẇ∗ = ρ∗ W∗ + C − Y C = C(Yp , Wp , ρ∗ + r, ρ∗ ), 0 < CY < 1, CW > 0, Cρ∗ < 0 Yp = Y − ρ∗ W∗ r = i − i∗ − Ė/E Wp = −W∗ − Wg Fg = −f(r, −Wg − W∗ ) − W∗ , 0 < fW < 1 < 1, fr0 < 0 P∗ Variables: W∗ = foreign debt C = consumption Y = output Yp = privat disposable income ρ∗ = foreign real interest rate r = risk premium i = nominal interest rate i∗ = foreign interest rate Wp = private net assets Wg = government net assets E = exchange rate Fg = foreign exchange reserve P∗ = foreign price level (1) (2) (3) (4) (5) (6) Initial conditions: M0 + B0 + EFp0 E(0)P∗ (0) −M0 − B0 + EFg0 = E(0)P∗ (0) F∗0 = P∗ (0) Wp = Wg W∗ Determination: Endogenous: W∗ , Wp , C, Yp , r, i Exogenous: ρ∗ , i∗ , P∗ , E, Y, Fg Predetermined: M0 , B0 , Fp0 , Fg0 , F∗0 Wg is determined by initial condition and Ẇg = 0. 3 (7)

![CHEER Seminar Promo: 2nov2015 [DOC 142.50KB]](http://s3.studylib.net/store/data/007520556_1-22ae8f83ff74a912c459b95ac2c7015c-300x300.png)