Topic 4: Financial markets and the

advertisement

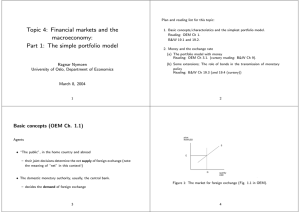

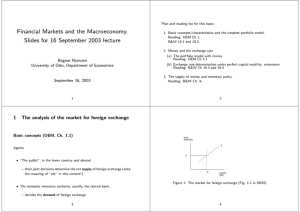

Plan and reading list for this topic: Topic 4: Financial markets and the macroeconomy: Part 1: The simple portfolio model 1. Basic concepts/characteristics and the simplest portfolio model. Reading: OEM Ch 1. B&W 19.1 and 19.2. 2. Money and the exchange rate (a) The portfolio model with money Reading: OEM Ch 3.1. (cursory reading: B&W Ch 9). Øystein Børsum Temporary Lecturer, University of Oslo (b) Some extensions; The role of bonds in the transmission of monetary policy Reading: B&W Ch 19.3 (and 19.4 (cursory)) March 14, 2005 2 1 price: NOK/USD Basic concepts (OEM Ch. 1.1) S Agents E • “The public”, in the home country and abroad — their joint decisions determine the net supply of foreign exchange Q • The domestic monetary authority, usually, the central bank. — decides the demand of foreign exchange 3 quantity USD Figure 1: The market for foreign exchange (Fig. 1.1 in OEM). 4 In the graph we have drawn the (governments) demand for foreign currency (here USD) as a vertical line. A synonym is the foreign exchange reserve and it denoted Q in the graph. Q is the whole stock of foreign currency deposited in the central bank, less any debt (incurred by the government) in foreign currency. The supply schedule is market “S” and is upward sloping, i.e., supply is increasing in price. Note:demand and supply relate to the whole stock of foreign currency What determines net supply of foreign currency? • In the short-run, it cannot be the trade balance (primary current account), which is a flow variable. • instead factors that can, in any point in time, effect a revaluation of existing assets. Hence, in the short-run, factors like GDP-growth and inflation are of little importance compared to the factors capable of shifting the net demand for the whole currency stock, for example the interest rates at home and abroad and exchange rate expectations. Thus, the market for foreign exchange has characteristics in common with other asset markets (residential housing, stock markets, world market for some raw materials): Supply (or demand) is fixed in the short-run, so a sudden shift in “the other side of the market” will typically result in an immidiate price change. Important difference from market for manufactures and labour! In the longer term, the primary current account is of importance, since a persistent surplus for example gradually shift the S-schedule rightward, since accumulated private and government savings will have to be allocated to foreign or domestic assets (see Ch 1.6 in OEM) 6 5 Return to Figure 1 to define the main regimes on the foreign exchange market: Apart from the discourse on the effect of the PCA surplus, the assumed horizon of the analysis in this section is the very short run (daily, monthly,...up to a year) The formal model will be static, meaning that the adjustments lags are so short that they can be ignored: Demand and supply in the market for foreign exchange are always equated. After an exogenous shock, equilibrium is momentarily restored by appropriate adjustment of the exchange rate (float regime) or the demand of foreign currency. Assume that the initial situation is where the two schedules intersect, A. Thus the exchange rate E is equilibrium exchange rate. Assume that there is a positive (horizontal) shift in the S-curve. The new equilibrium depends in the exchange rate regime: • A →B Floating exchange rate. • A → C Fixed exchange rate. The central bank intervenes in the market and increases its demand for USD (the foreign exchange reserves increases). 7 8 The balance sheet (OEM, Ch 1.2) Government Kr-assets Bg USD-assets Fg Net assets (in kroner) Bg + EFg 3 sectors (“agents”), 2 types of assets: Kroner assets and USD assets. Private Bp Fp EFp + Bp Foreign B∗ F∗ B∗ + EF∗ Sum 0 0 0 Table 2: Net financial assets, by sector (Table 1.1) • g = “government”, i.e., the domestic monetary authority (central government and the central bank), The two first rows give • p = private domestic investors, • ∗ = foreign investors. Note: In the following the exchange rate are defined as in OEM. Hence the nominal rate is E = Kroner/U SD. (This correspond to 1/S where S is the B&W definition). Correspondingly: the real exchange rate is defined as EP∗/P (against SP/P∗ in B&W). Bg + Bp + B∗ = 0 (1.1) Fg + Fp + F∗ = 0 (1.2) We can also use the table to define the sectors’ real wealth: B + EFi Wi = i , i = g, p P B∗ + F∗ , (same as foreign debt) W∗ = E P∗ 9 10 P and P∗ denotes domestic and foreign price levels. After multiplication of W∗ EP∗ by the real exchange rate , foreign and domestic wealths cancel: P Wg + Wp + EP∗ W∗ = 0 P Bp0 + EFp0 P B∗0/E + F∗0 W∗ = P∗ r = i − i∗ − ee Wp = For reference, we write Fg as Fg = −(Fp + F∗), stating that the net supply of foreign exchange is the negative of the net demand of the two other sectors’ demand. Next add a subscript “0” which indicates net assets at the start of the period. If the period is short in calendar time, financial wealth is unchanged at the end of the period: Bi + EFi = Bi0 + EFi0, i = g, p, ∗ A simple portfolio model (OEM (1.3) and 1.4) (1.5) however Bi and Fi can change a lot in the period, through asset-trade. In a floating exchange rate regime, this is what drives the short run fluctuations in the exchange rate. 11 ee EFp P F∗ P∗ Fg + Fp + F∗ (1.11) (1.12) (1.13) = ee(E) (1.14) = f (r, Wp), fr < 0, 0 < fW < 1 (1.15) = W∗ − b(r, W∗), 0 < bw < 1, br > 0 (1.16) =0 (1.17) (1.11), (1.12) and (1.17) are lifted from the balance sheet. (1.12) defines the risk premium r (see Ch 1.3). i∗ denotes the foreign interest 12 rate and ee is the expected rate of depreciation ee = e ( dE dt ) E In (1.14), the expected rate of depreciation is a function of the exchange rate: 0 regressive expectations 0 extrapolative 0 constant ee < 0 ee > 0 ee = 0 To define the supply function corresponding to the S-curve formally: Start with (1.17): Fg = −(Fp + F∗), Equation (1.15) and(1.16) are demand functions (for domestic and foreign investors (see Ch. 1.3)). and substitute Fp and F∗ with the expressions in the other equations of the model. The result is equation (1.18) in the book, or in more compact notation: Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o) (*) 7 equations. • Endogenous: Wp, W∗, r, ee, Fp, F∗ and Fg or E (depending on regime) • Exogenous: P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o and Fg or E (depending on regime) 14 13 Exercise 0.1 Differentiate (1.18) in the book and show that (subject to Fp = Fp0 and B∗ = B∗0 (see top of p 20) ) SE ≡ ∂Fg P 0 P = 2 γ − κee ∂E E E (1.19) where EFp0 B + (1 − bw ) ∗0 P P EP∗ κ = −fr + br > 0 P Use this to show that a set of sufficient conditions for an increasing supply curve is γ = (1 − fW ) Fp0 > 0, Bo∗ > 0, 0 fW < 1, bw < 1, ee < 0. We have established the supply function of foreign currency (to the central bank) as a key relationhip: Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o) The sign of the derivative SE is very important. Fp0 > 0, Bo∗ > 0, 0 fW < 1, bw < 1, ee < 0. is a sufficient set of conditions for SE > 0. ((1.21)) Exercise 0.2 Under which conditions is the supply curve downward sloping? Use B&W chpt. 20.4 and try to make these conditions correspond to cases of currency crises. 15 (*) 16 (1.21) What about the market for kroner? The demand for kroner (domestic and foreign investors): Capital mobility (OEM Ch.1.5) The expression for the slope of the supply curve is Bp + B∗ = P [Wp − f (r, Wp)] + EP∗b(r, W∗). in equilibrium this must be equal to the kroner supply (by the government): −Bg , hence −Bg = P [Wp − f (r, Wp) + EP∗b(r, W∗) and substitution Wp, r and W∗ from the model gives an equation that defines a demand function for kroner. The condition (1.21) secures that the demand for kroner is rising in E (puzzled? Remember that E is the inverse of the price of the “kroner-good”). SE = P P 0 γ − κee 2 E E (1.19) where EFp0 B + (1 − bw ) ∗0 “rebalance effect” P P EP∗ “expectations effect”. br ) > 0 κ = (−fr + P We define κ as the coefficient of capital mobility. It measures by how much the supply changes when the risk premium increases by one percentage point. γ = (1 − fW ) The marked for kroner is the mirror image of the market for foreign currency. 17 18 Capital mobility affects the supply curve fundamentally: • From (1.19): The higher κ is, the more elastic S-curve (“flatter”) • The higher κ is, the larger horizontal shift results from a 1 pp increase in the rate of interest, i.e., from (1.8): Si = P κ>0 E The degree of capital mobility and policy regimes As long as κ < ∞ (we say that) capital mobility is imperfect (due to risk aversion, transaction costs, differing expectations etc.). In fact we can write SE as 0 P γ − Siee E2 showing again the decomposition into a rebalance effect and an expectations effect. The expectations effect operates as follows: SE = When κ → ∞ capital mobility becomes perfect. Then: SE (and Si) → ∞ as κ → ∞ E %→ ee &→ r %−→ demand for kroner increases 19 20 price: NOK/USD low cap mob Fixed exchange rate, Fg as the policy instrument E In this regime, E is the target of (monetary) policy. The policy instrument is either foreign exchange reserves, Fg or the interest rate i. We maintain that 0 ee < 0 and γ > 0. S high cap mob When Fg is the instrument, Fg is endogenous, while E and i are exogenous (when we later introduce the domestic money market the exogeneity of i does not necessarily follow). Fg Figure 2: The impact of capital mobility on the supply curve The degree of capital mobility is essential for operation of this regime, since it affects how much Fg must change in order to stabilize E after a shift in the S−curve. 21 22 Fixed exchange rate, i as the policy instrument Formally, assume an increase in i∗. From the equilibrium condition: ½ ¾ P f (r, Wp) + P∗(W∗ − b(r, W∗)) (E Bp0 + EFp0 P Fg = − f (i − i∗ − ee(E), ) E P ) B∗0/E + F∗0 B∗0/E + F∗0 +P∗( − b(i − i∗ − ee(E), )) , P∗ P∗ Fg = − take E as exogenous and find the partial derivative of Fg (the instrument), with respect to i∗: P ∂Fg = −Si = − κ < 0 ∂i∗ E If κ is large, reserves can be emptied “overnight”. Assume again that i∗ increases. From the eq. condition, i must increase by the same amount, irrespective of κ (since both Fg and E are exogenous). Another source of change in i in the case of this regime is expectations driven runs of speculative attacks. If large probability of devaluation in the near future, the rise in short interest rates (overnight, monthly) may be huge. Example (see OEM p 31) P rob(10% devaluation within one month) = 0.5. 0.5 × 10% = 5% expected rate of depreciation over the next month. 23 24 Floating exchange rate Maintain Per annum, this corresponds to a interest rate differential of 0.5 × 10% × 12 = 60% If this is to be compensated completely, the domestic one-month interest rate (annualised rate) must increase by 60 percentage points. In practice, governments have often tried to defend the exchange rate by a combination of Fg and i policies. Sweden and Norway in November-December 1992 are good examples. 0 ee < 0 and γ > 0 In a clean float, Fg is (exogenous) and constant. The policy instrument, i, is now free to target other variables. For example money supply of the price level/rate of inflation. Hence i is not determined in the market for foreign exchange. On the other hand, setting the interest rate to attain e.g., the inflation rate has important spill-over effects to the exchange rate. For later reference we therefore note that the eq condition Fg = S(E, P, P∗, i, i∗, Bp0, Fp0, B∗0, F∗o), now defines E as a function of i. The derivative of this function is ∂E 0 = SE + Si, hence ∂i P κ ∂E 1 E <0 =−P 0 = − γ P 0 ∂i γ − E κee − ee E2 κE 25 E (1.24) 26 Ei curve, high cap mob Note κ→∞⇒ Ei curve, low cap mob ∂E 1 = 0 <0 ∂i ee hence the Ei-curve is downward sloping also when there is perfect capital mobility, as long as expectations are regressive. i Figure 3: The impact of captial mobility on the Ei-curve 27 28 The role of the current account (section 1.6) 1 The result ∂E ∂i = 0 can be obtained directely by invoking the uncovered interest ee rate (UIP) condition i = i∗ + ee(E). This is logical, since the whole model reduces to the UIP condition in the case of perfect capital mobility. In general, the model has 7 equations, but when capital mobility is perfect, the model collapses into the uncovered interest rate parity (UIP) condition With perfect capital mobility, there is no risk-premium so r = 0. There are no separate demand functions for the two currencies. The Supply curve is a horizontal line. The model we consider is a stock model. Sudden revaluation of the stocks accounts for the short-run dynamics in the market. This contrasts with the older flow based models of the market for foreign currency. In these models the surplus (or deficit) on the current account is the main explanatory variable. However, we can include the effect of the current account. Assume a stable situation where both the price level and the exchange rate change only gradually, with rates e and p (π in B&W). Private wealth: P Wp = Bp + EFp Differentiate with respect to time: pWp + Ẇp = 1 E EFp Bp + Ḟp + e P P P 30 29 The forward market (section 1.7) 1 E P Bp + P Ḟp are net financial investments, which are equal to D − Dg , the current account surplus minus the government surplus, hence Ẇp = D − Dg + eFp − pWp By differentiating the eq. condition Fg = − ½ ¾ P f (r, Wp) + P∗(W∗ − b(r, W∗)) E with respect to time, it becomes clear that Ḟp depends on Ẇp, and therefore also D. Graphically, the supply curve “glides” rightwards as a result of D > 0. However, over a short period of time which is the foucus of the stock model, the influence of D > 0 on the market is negligible. See figure 1.7 in the book! 31 Suppose you need 1$ tomorrow (in period t + 1). You can use the spot market, and buy 1/(1 + i∗) $ today. In terms of kroner, the outlay is Et , 1 + i∗ where Et is the spot exchange rate. If you borrow to do this foreign currency transaction, you must pay one period interest, i.e., Et (1 + i). 1 + i∗ An alternative is to use the forward market. Then you agree today (period t) to pay Ft,t+1 kroner for one USD in period t + 1. Note that this eliminates the risk of seeing the spot rate change unfavourably from t to t + 1. 32 The arbitrage principle implies that the two ways of securing one USD tomorrow has the same cost, hence Ft,t+1 = or Et (1 + i). 1 + i∗ (1.30) Ft,t+1 (1 + i∗) − 1 (1.31) Et Both expression are referred to as the covered interest rate parity condition. In discrete time, the UIP condition can be written i= e Et+1 (1 + i∗) − 1 (1.32) Et Forward parity means that all forward contracts can be translated into assets and liabilities in the two currencies and we can think as if these are included in the balance sheets that we started out with. i= Empirically, more support for covered interest rate parity than for UIP. 33