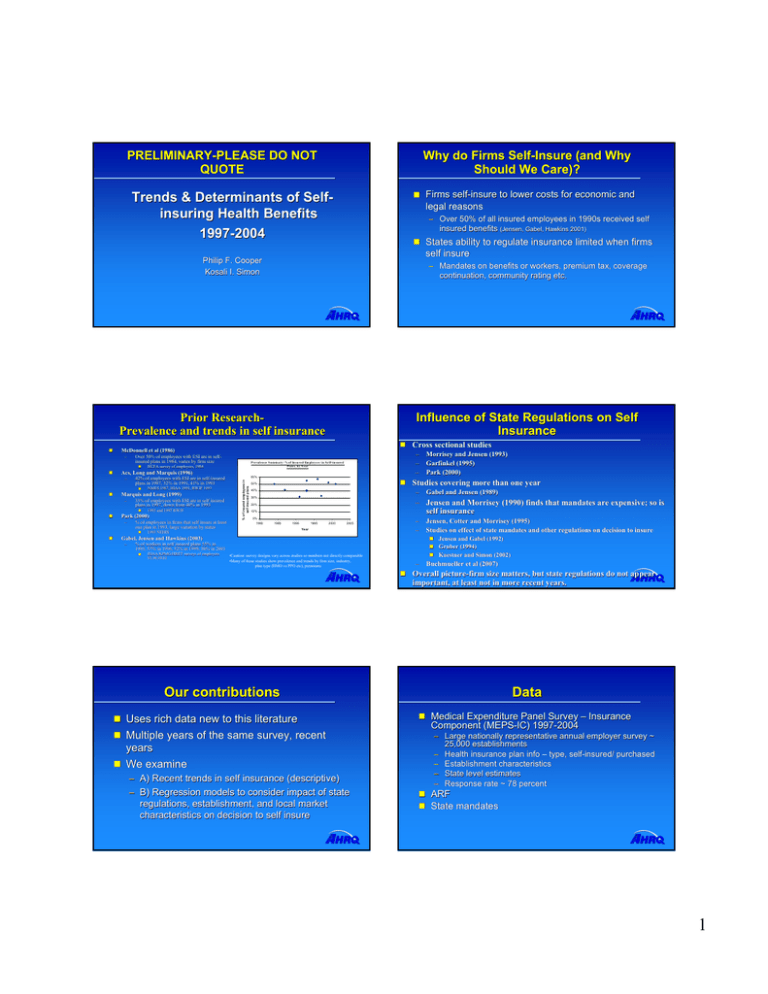

Trends & Determinants of Self - insuring Health Benefits 1997

advertisement

PRELIMINARYPRELIMINARY-PLEASE DO NOT QUOTE Why do Firms SelfSelf-Insure (and Why Should We Care)? Firms selfself-insure to lower costs for economic and legal reasons Trends & Determinants of SelfSelfinsuring Health Benefits 19971997-2004 – Over 50% of all insured employees in 1990s received self insured benefits (Jensen, Gabel, Hawkins 2001) States ability to regulate insurance limited when firms self insure Philip F. Cooper Kosali I. Simon – Mandates on benefits or workers, premium tax, coverage continuation, community rating etc. Influence of State Regulations on Self Insurance Prior ResearchResearchPrevalence and trends in self insurance – Over 50% of employees with ESI are in selfselfinsured plans in 1984, varies by firm size Acs, Acs, Long and Marquis (1996) Marquis and Long (1999) – 42% of employees with ESI are in selfself-insured plans in 1987, 32% in 1991, 41% in 1993 – 33% of employees with ESI are in self insured plans in 1997, down from 40% in 1993 1993 and 1997 RWJF Park (2000) – % of employees in firms that self insure at least one plan in 1993, large variation by states NMES 1987, HIAA 1991, RWJF 1993 – – – Pre val e n ce S u m m ary: % of In su re d Em pl oye e s i n Se lf-in sure d Pl an s, by Ye ar HCFA survey of employers, 1984 Cross sectional studies McDonnell et al (1986) 60% % of insured employees in self-insured plans Studies covering more than one year 50% 40% – 30% 10% 1985 1990 1995 2000 2005 Ye ar 1993 NEHIS – – % of workers in self insured plans 55% in 1993, 57% in 1996, 52% in 1999, 50% in 2001 HIAA/KPMG/HRET surveys of employers 93,96,99,01 •Caution: survey designs vary across studies so numbers not directly comparable •Many of these studies show prevalence and trends by firm size, industry, plan type (HMO vs PPO etc), premiums Jensen, Cotter and Morrisey (1995) Studies on effect of state mandates and other regulations on decision decision to insure Jensen and Gabel (1992) Gruber (1994) Kaestner and Simon (2002) Gabel, Jensen and Hawkins (2003) – Gabel and Jensen (1989) – Jensen and Morrisey (1990) finds that mandates are expensive; so is self insurance 20% 0% 1980 Morrisey and Jensen (1993) Garfinkel (1995) Park (2000) – Buchmueller et al (2007) Overall picturepicture-firm size matters, but state regulations do not appear important, at least not in more recent years. Our contributions Data Uses rich data new to this literature Multiple years of the same survey, recent Medical Expenditure Panel Survey – Insurance Component (MEPS(MEPS-IC) 19971997-2004 years We examine – A) Recent trends in self insurance (descriptive) – B) Regression models to consider impact of state regulations, establishment, and local market characteristics on decision to self insure – Large nationally representative annual employer survey ~ 25,000 establishments – Health insurance plan info – type, selfself-insured/ purchased – Establishment characteristics – State level estimates – Response rate ~ 78 percent ARF State mandates 1 Number of Workers Enrolled in SelfSelfinsured Plans State Mandates State regulation mandated benefits Small group reform 40,000,000 Premium taxes Stop loss regulation 20,000,000 30,000,000 10,000,000 0 1997 1998 1999 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 Percent of Active Enrollees in SelfSelfinsured Plans Percent of Establishments that offer a SelfSelf-insured Plan 40 60 50 40 30 20 10 0 30 20 10 0 1997 1998 1999 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 1997 1998 1999 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 Percent of Establishments that Offer a SelfSelf-Insured Plan by Firm Size Percent of Establishments that Offer a SelfSelf-Insured Plan by Whether Multiple Location Firm 80 100 80 60 Less than 50 More than 50 500 or more 60 40 20 0 One More than one 40 20 0 1997 1998 1999 2000 2001 2002 2003 2004 1997 1998 1999 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 Source MEPSMEPS-IC 19971997-2004 2 Average Single Premium Average Family Premium $4,000 $3,000 Purchased Self-Insured $2,000 $1,000 $0 1999 2000 2001 2002 2003 2004 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $0 Purchased Self-Insured 1999 Source MEPSMEPS-IC 19971997-2004 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 Percent of Establishments that SelfSelf-Insure and Offer a Purchased Plan Logit Results Probability of Offering A SelfSelf-Insured Plan(significant) Plan(significant) Increase likelihood 25 20 – Firms size – Multiple locations 15 10 Decrease likelihood – Low wage – Retail trade, services relative to manufacturing 5 0 1997 1998 1999 2000 2001 2002 2003 2004 Source MEPSMEPS-IC 19971997-2004 Conclusion No statistically significant effects from mandated – Suggests they don’ don’t drive the decision to selfself-insure Multiple location and size matter Future work will add more state regulation (re(reinsurance limits) 3