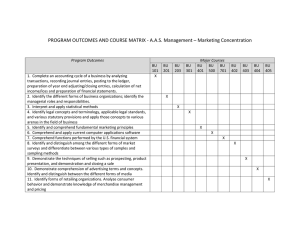

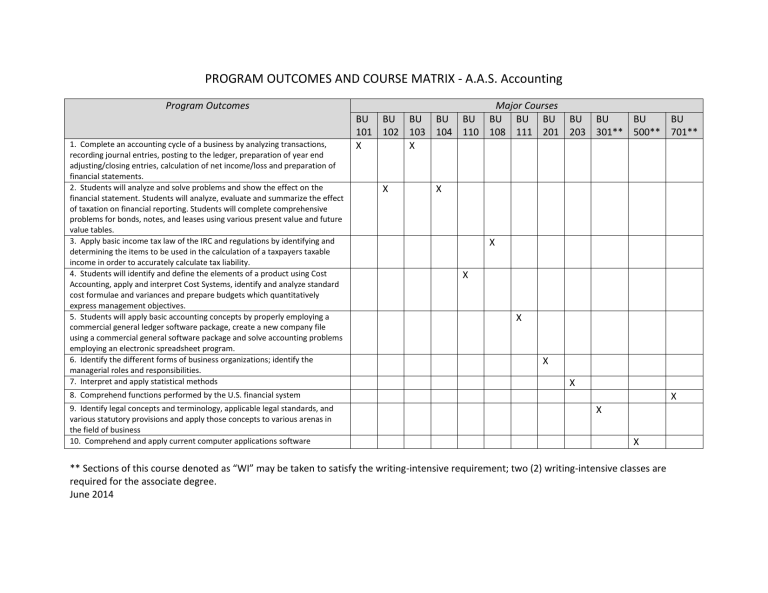

PROGRAM OUTCOMES AND COURSE MATRIX - A.A.S. Accounting Program Outcomes Major Courses BU

PROGRAM OUTCOMES AND COURSE MATRIX - A.A.S. Accounting

Program Outcomes

BU

101

X

BU

102

BU

103

X

BU

104

BU

110

Major Courses

BU

108

BU

111

BU

201

BU

203

BU

301**

BU

500**

1. Complete an accounting cycle of a business by analyzing transactions, recording journal entries, posting to the ledger, preparation of year end adjusting/closing entries, calculation of net income/loss and preparation of financial statements.

2. Students will analyze and solve problems and show the effect on the financial statement. Students will analyze, evaluate and summarize the effect of taxation on financial reporting. Students will complete comprehensive problems for bonds, notes, and leases using various present value and future value tables.

3. Apply basic income tax law of the IRC and regulations by identifying and determining the items to be used in the calculation of a taxpayers taxable income in order to accurately calculate tax liability.

4. Students will identify and define the elements of a product using Cost

Accounting, apply and interpret Cost Systems, identify and analyze standard cost formulae and variances and prepare budgets which quantitatively express management objectives.

5. Students will apply basic accounting concepts by properly employing a commercial general ledger software package, create a new company file using a commercial general software package and solve accounting problems employing an electronic spreadsheet program.

6. Identify the different forms of business organizations; identify the managerial roles and responsibilities.

7. Interpret and apply statistical methods

X X

X

X

X

X

8. Comprehend functions performed by the U.S. financial system

X

9. Identify legal concepts and terminology, applicable legal standards, and various statutory provisions and apply those concepts to various arenas in the field of business

10. Comprehend and apply current computer applications software

X

X

** Sections of this course denoted as “WI” may be taken to satisfy the writing-intensive requirement; two (2) writing-intensive classes are required for the associate degree.

June 2014

X

BU

701**