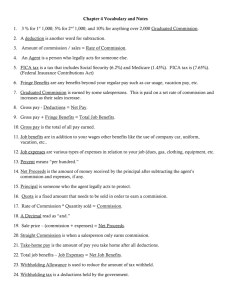

Money Management Terms are listed in Alphabetical Order

advertisement

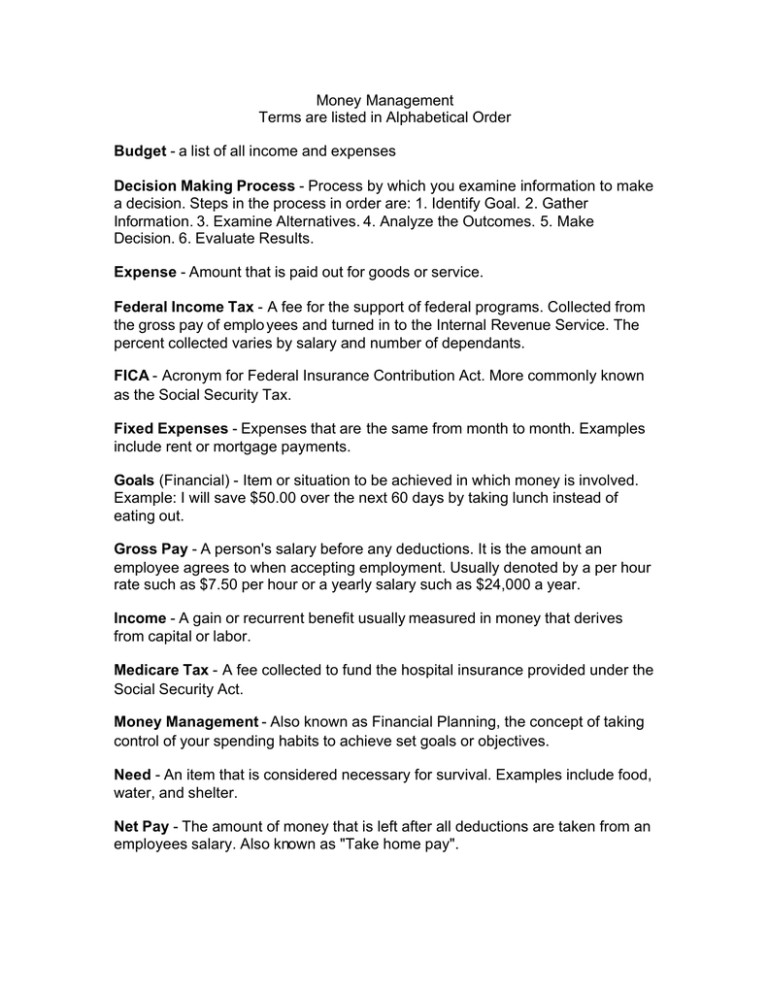

Money Management Terms are listed in Alphabetical Order Budget - a list of all income and expenses Decision Making Process - Process by which you examine information to make a decision. Steps in the process in order are: 1. Identify Goal. 2. Gather Information. 3. Examine Alternatives. 4. Analyze the Outcomes. 5. Make Decision. 6. Evaluate Results. Expense - Amount that is paid out for goods or service. Federal Income Tax - A fee for the support of federal programs. Collected from the gross pay of emplo yees and turned in to the Internal Revenue Service. The percent collected varies by salary and number of dependants. FICA - Acronym for Federal Insurance Contribution Act. More commonly known as the Social Security Tax. Fixed Expenses - Expenses that are the same from month to month. Examples include rent or mortgage payments. Goals (Financial) - Item or situation to be achieved in which money is involved. Example: I will save $50.00 over the next 60 days by taking lunch instead of eating out. Gross Pay - A person's salary before any deductions. It is the amount an employee agrees to when accepting employment. Usually denoted by a per hour rate such as $7.50 per hour or a yearly salary such as $24,000 a year. Income - A gain or recurrent benefit usually measured in money that derives from capital or labor. Medicare Tax - A fee collected to fund the hospital insurance provided under the Social Security Act. Money Management - Also known as Financial Planning, the concept of taking control of your spending habits to achieve set goals or objectives. Need - An item that is considered necessary for survival. Examples include food, water, and shelter. Net Pay - The amount of money that is left after all deductions are taken from an employees salary. Also known as "Take home pay". Payroll Deductions - Amounts taken away from Gross pay. Generally there are four common deductions: Federal Income tax, State Income tax, Social Security Tax, and Medicare Tax. However other deductions include; retirement, insurance, and savings bonds. Social Security Tax - A fee to pay for the retirement and other social insurance needs and is collected under the Federal Insurance Contribution Act (FICA) State Income Tax - A fee collected to pay for Values - Items, ideals, or concepts considered of importance to an individual. Variable Expenses - Amounts paid out monthly that change from month to month. Examples could include; electric bills, grocery bills, and medical expenses. Want - Items that a person would like to obtain b ut that are not needed for survival. Examples include new clothes, new car, or cable television.