2-6 HOW DO WE CALCULATE NET PAY FROM AN EARNINGS

advertisement

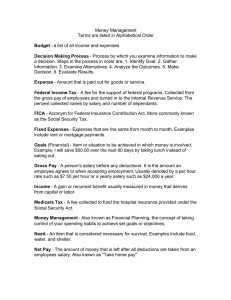

ANSWERS…………. 1. $28.91 + 17.79 + 9.18 = $55.88 2. $10.31 + 11.20 + 20.00 + 5.00 = $46.51 3. $456.78 - $56.19 = $400.59 4. $45.23 + $41.50 = $86.73 1 2-6 HOW DO WE CALCULATE NET PAY FROM AN EARNINGS STATEMENT? The earnings statement attached to your paycheck lists all your deductions, your gross pay, and your net pay for the pay period. Net Pay= Gross Pay – Total Deductions 2 LET’s PRACTICE Juan’s gross weekly salary is $400. He is married and claims 2 allowances. The social security tax is 6.2% of the first $62,700. The medicare tax is 1.45% of gross pay. The state tax is 1.5% of gross pay. Each week he pays $10.40 for medical insurance and $2.50 for charity. Is Juan’s earnings statement correct? (Use P.643 in text for FIT) Dept. Employee 04 Check # WEEK ENDING 20566 4/16/04 Teijeiro,J. TAX DEDUCTIONS FIT SOC. SEC. 38.00 24.80 MEDICARE 5.80 STATE 6.00 LOCAL ------ 312.50 PERSONAL DEDUCTIONS MEDICAL 10.40 NET PAY UNION DUES ----- OTHERS 2.50 Solution: Find the total deductions Federal Withholding: (From P.643)……………………..$38.00 Social Security: 6.2% of $400……………………………...24.80 Medicare: 1.45% of $400……………………………………5.80 State tax: 1.5% of $400…………………………………….....6.00 Medical insurance: …………………………………………10.40 Charity: ……………………………………………………….2.50 Net Pay is Gross Pay minus Total Deductions or $400 - $87.50 = $312.50 3