Earning an Income Standard 1 Assessment

advertisement

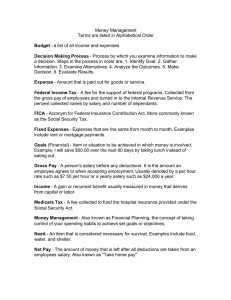

Earning an Income Standard 1 Assessment 1. What is the opportunity cost of dropping out of school? 2. Which of the following statements would NOT be considered human capital? 3. Which of the following is NOT a required payroll deduction? 4. Which of the following are subtracted from your gross pay? 5. Which of the following do many employers offer as benefits to employees? 6. John Taxpayer had a gross income of $2823.08 and $892.34 in deductions. How much would John’s paycheck this month? 7. A goal may be all of the following EXCEPT 8. Setting a goal to purchase a new car in four years is the example of a goal. 9. The BEST description of a budget is a 10. If you sign a lease on an apartment, your rent is a 11. A budget can help you do any of the following EXCEPT 12. Which of the following statements is TRUE? 13. Which of the following statements BEST explains the difference between a job and a career? 14. When setting long-term goals, 15. A federal government program providing retirement, survivor and disability benefits, funded by a tax on income, which appears on workers pay stubs as a deduction labeled FICA 16. A piece of work usually done on order at an agreed-upon rate; also a paid position of regular employment. 17. A plan for managing money, dividing up expected income and expenses among spending and saving options based on personal goals during a given time period. 18. A purposeful course of action or purpose in life that generally provides income. 19. A statement about what a person wants to be, do, or have, accomplished by taking certain steps; provides direction to a plan of action. 20. Desired results from one’s efforts to achieve personal economic satisfaction. 21. Employer deductions from employees’ earnings to pay employees’ taxes. 22. Expenditures that are the same from week to week or month to month, such as mortgage or rent payments and car payments. 23. Expenditures that change from week to week or month to month—for food, clothing, recreation, and entertainment, for example. 24. Federal Insurance Contributions Act 25. Gross wage or salary, plus bonuses, minus deductions such as for taxes, health care premiums, and retirement savings. 26. Income that stays the same from week to week or month to month. 27. Income that varies from week to week or month to month. 28. Investment of time, effort, and resources in education and training – to increase one’s own knowledge, skills, health, etc., or to develop those assets in others. 29. Money earned from investments and employment. 30. Money received from work performed; may include salary, wages, tips, professional fees, commissions, etc. 31. Payments earned by households for selling or renting their productive resources; may include salaries, wages, interest and dividends. 32. The cost of goods and services, including those that are fixed (such as rent and auto loan payments) and those that are variable (such as food, clothing, and entertainment). 33. The process used to determine what an individual wants to be, do, or have, i.e., what a person wants to accomplish. 34. The quantity and quality of human effort available to produce goods and services. 35. Wages or salary before deductions for taxes and other purposes.