Budgeting “Pay Yourself First”

advertisement

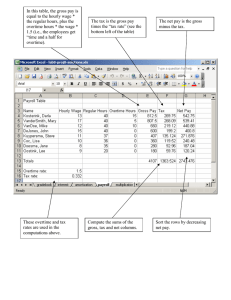

Budgeting “Pay Yourself First” Personal Budget Working Tool Take Control Directs flow of cash received towards financial goals Must be Flexible! Takes discipline Creating a Budget ? Reasons for a Spending …Helps you determine where you are spendingPlan your money currently. …Helps you decide where to spend your money in the future. …You have an organized way to save for things that cost more. …Puts you in control of your financial future, beginning NOW. People Without a Budget… …Are less likely to know what they have. …Have no plan, often coming up short before their next paycheck or allowance. …Are almost certain to have no plan to save for more expensive spending goals. PAY YOUR$ELF FIRST! S etting aside money for “big ticket items” A voids borrowing, which costs you a lot! It’s a V ery wise thing to do, because Every time you pay yourself first, you are developing a saving habit that leaves you with more money to spend later on for things that are really important to you! 2 Parts of Budgeting 1. Income: Money Received from any source (limited source) 2. Expenses: Money spent to satisfy needs/wants GROSS VS NET Gross pay is the total amount you earn before any deductions are subtracted. $6.50 X40=$260.00 Net pay is the amount you “take home” after deductions. Overtime is time worked beyond the regular hours A standard workday is 8 continuous hours with scheduled breaks plus an unpaid lunch period. A standard work week is 40 hours in a 5 day period of time. OVERTIME Fair Labor Standards Act states that: “employers must pay hourly workers for overtime at the rate of 1 1/2 times the regular rate of pay.” So… if regular pay is $6.50, then overtime would be $9.75. 40 hours X $6.50 = $260.00 5 hours X $9.75 = $48.75 Gross pay = $308.75 Paycheck Stub Salaried employees do not receive additional pay for overtime work. Their gross pay is the same month after month. The employer divides the salary into equal amounts for each pay period. Under the “YTD” heading, your gross pay is added up throughout the year. Income- Payroll Deductions Money subtracted from Gross Income: Union Dues Health Insurance Savings plans Taxes Taxes are the largest deductionsrequired by law 4 Payroll Taxes 1. Federal Income Tax 2. State Income Tax 3. Social Security Tax (FICA) 4. Medicare Tax (FICA) May be able to collect at age 62, average payout $1,230 per month Can collect at age 65 FICA- Federal Insurance Contribution Act Employees match contributions of employers to SS Progressive Income tax Your tax bracket is the rate you pay on the taxable income that you earn The U.S. uses a progressive tax rate. As a result, as the amount of money you earn increases so does the rate at which you are taxed Tax Brackets For example, if you earned $10,000 during the year,, then $8,700 would be taxed at 10% and the remaining $1,300 would be taxed at 15%. This works out to be a total of $1,065, which is less than it would be if the $10,000 was taxed at a flat rate of 15%, which would yield a total of $1,500 in income taxes. http://www.forbes.com/sites/kellyphillipserb/2013/10/31/irs -announces-2014-tax-brackets-standard-deductionamounts-and-more/ W-4 Form Withholding Allowance Certificate Purpose: So your employer can withhold the correct federal income tax from your pay NET PAY When all deductions are taken out of your gross pay, the amount left is your net pay. Net pay is the amount of money you can actually spend. Net pay is often called “take-home pay” because it is the amount you can actually use as you wish Regular wages or salary + Overtime= Gross Pay Gross Pay - Deductions = Net Pay Example: Federal W-2 Wage & Tax Statement Employees receive at beginning of year (JanuaryFebruary) Itemizes money earned & withheld by IRS Based on previous year income Employee can determine if paid too much/ too little to IRS Tax refund- too much Taxes owed- too little IRS Internal Revenue Service Responsible for collecting taxes When & how to file your tax return Single tax payers who earn less than $8,500 do not have to file a tax return Gather your W-2 and any other documents you need Complete a 1040EZ if you are single or married with no dependents and have income less than $50,00 Go to irs.gov for more info & forms April 15 is the deadline to file! nd 2 part of Budgeting: Expenses! Money spent to satisfy needs/wants Working Budget: Expenses & income balance Expenses should not exceed income Limited resources- choices on how to spend money Opportunity costs vs. delayed gratification Expenses included in Budget VARIABLE EXPENSES FIXED EXPENSES Savings- PYF (Leftover approach never works) Example: Car payment Insurance Same amount of payment each time Examples: Gas, Food, Entertainment costs, clothing Can change month to month How to Build a Budget l Decide on a time frame for tracking expenses (week, two weeks, month). l List all money you have coming in (income). l Make categories for all expenses. l Subtract total expenses from income. l Study your budget and your financial plan to make sure it fits with your plans and goals.