Budget Assignment - JL Ilsley High School

advertisement

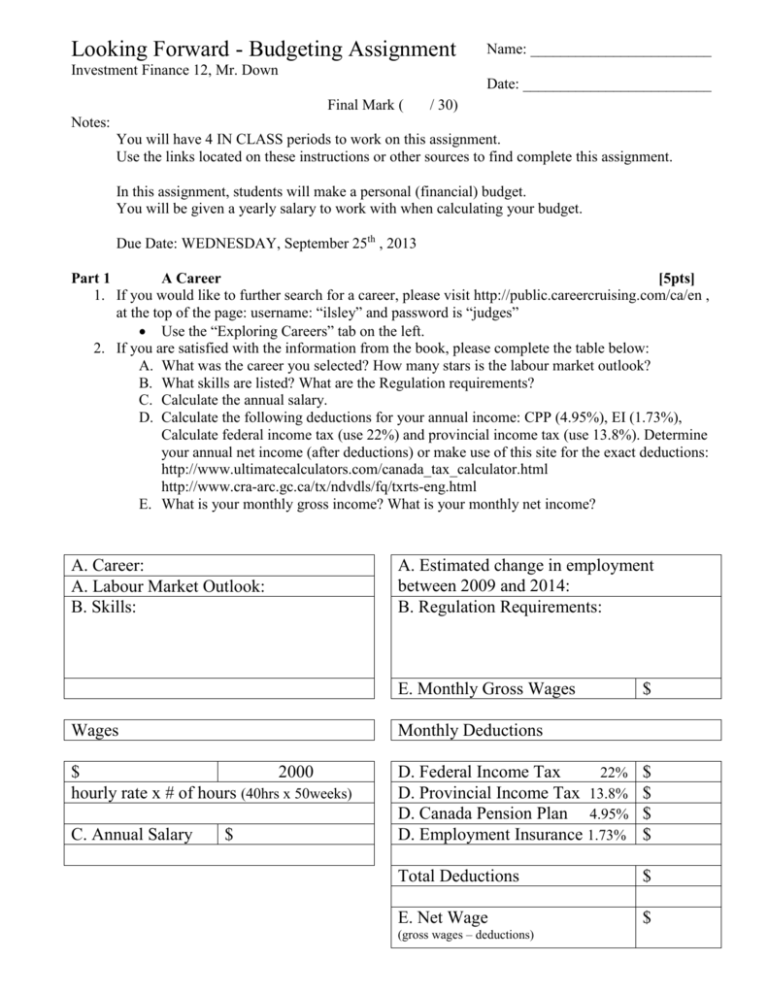

Looking Forward - Budgeting Assignment Name: ________________________ Investment Finance 12, Mr. Down Date: _________________________ Final Mark ( / 30) Notes: You will have 4 IN CLASS periods to work on this assignment. Use the links located on these instructions or other sources to find complete this assignment. In this assignment, students will make a personal (financial) budget. You will be given a yearly salary to work with when calculating your budget. Due Date: WEDNESDAY, September 25th , 2013 Part 1 A Career [5pts] 1. If you would like to further search for a career, please visit http://public.careercruising.com/ca/en , at the top of the page: username: “ilsley” and password is “judges” Use the “Exploring Careers” tab on the left. 2. If you are satisfied with the information from the book, please complete the table below: A. What was the career you selected? How many stars is the labour market outlook? B. What skills are listed? What are the Regulation requirements? C. Calculate the annual salary. D. Calculate the following deductions for your annual income: CPP (4.95%), EI (1.73%), Calculate federal income tax (use 22%) and provincial income tax (use 13.8%). Determine your annual net income (after deductions) or make use of this site for the exact deductions: http://www.ultimatecalculators.com/canada_tax_calculator.html http://www.cra-arc.gc.ca/tx/ndvdls/fq/txrts-eng.html E. What is your monthly gross income? What is your monthly net income? A. Career: A. Labour Market Outlook: B. Skills: A. Estimated change in employment between 2009 and 2014: B. Regulation Requirements: E. Monthly Gross Wages $ Wages Monthly Deductions $ 2000 hourly rate x # of hours (40hrs x 50weeks) D. Federal Income Tax 22% D. Provincial Income Tax 13.8% D. Canada Pension Plan 4.95% D. Employment Insurance 1.73% $ $ $ $ Total Deductions $ E. Net Wage $ C. Annual Salary $ (gross wages – deductions) Part 2 Accommodations [5pts] You won't be living at home forever. In this section you will find a place to live and negotiate purchase of that residence. 1. Use www.realtor.ca/ to locate residential homes for sale in Halifax (or Nova Scotia) and determine which one you would like to buy. I recommend clicking on the map of Canada to search by geographical area, similar to using Google Maps. I recommend copying a few pictures of what you wish to live in, and imbedding them in the document you will submit for this assignment. 2. Consider the location you like, but keep it in mind that you will need a place to work nearby (within 100 km). Include pictures and the MLS number of the home you choose. Please include as many details regarding this house as you see fit. You may copy this information from the site (control print screen), and include it in you document. 3. You will likely want to know what the Assessment Value for the home is. Use www.nsassessmentonline.ca/ to complete your “Property Search” by “Location”. You will type the Number and Street, choose a Suffix, and Community, then “Search”. You click the address of the property below “Location” and will find the Assessment values for the last 12 years. A. Include the current assessment value of the house you have chosen. You may copy this information from the site (control print screen), and include it in you document. B. Let's assume you settle on a price which is 10% below the asking price, show all calculations and purchase price. 4. Google search Mortgage Calculator and use the link from www.rbcroyalbank.com, specifically https://www.rbcroyalbank.com/cgi-bin/mortgage/mpc/start.cgi , it is the easiest calculator I have found. A. You have 10% of the house cost as a down payment, so your mortgage should be for 90% of the purchase price + 4.5% for closing costs (CMHC fees, deed transfer tax, lawyer costs) B. With a “Fixed” Rate, “3%” Interest Rate, “5” year Interest Term and “25” year Amortization Period determine what your monthly payments will be. C. You may make note of the biweekly under the previous conditions, and may also wish to note what your monthly and biweekly payments would be for a “15” year Amortization Period. 5. If you have chosen to purchase a condo, please include condo fees on your mortgage payment; be sure to check to see what utilities these fees include. You may not have a heating, electric or water bill under living expenses. 6. If you have chosen to purchase a mobile home that is in a park, you must include a lot rental fee. This fee is $300 a month in addition to your mortgage payment. Part 3 Living expenses [7pts] Assume that you have purchased your home and are all moved in. Now you need to calculate your monthly living expenses. Provide the details for each item and show calculations where necessary. 1. Heat and Electricity: A. For consistency among you peers, let’s assume that you house uses electric heat, and on average 2000 kWh are used each month. The current residential rate is 13.336 cents/kilowatt hour (plus 15% HST). Calculate your power bill. B. If you have time, please visit www.nspower.ca , under the “Energy Savings” tab choose “Energy Calculator”. Use the calculator to estimate your monthly electricity bill each month. 2. Water: A. For consistency among your peers, let’s assume that your usage is 15m3 per month. Calculate your water bill. Visit www.halifax.ca/hrwc/RatesAndFees.html B. You will add the Water Base monthly amount (in blue column) to the Wastewater Base monthly amount (in green column) to obtain your total monthly water cost. 3. Communication: A. What is your current cell phone bill each month? Who is your provider? B. Do you need regular land telephone service? Visit www.bellaliant.net/ C. Do you need high speed internet and cable TV? Visit www.eastlink.ca/ You may wish to purchase a bundle. 4. Food: A. You need to buy food. Plan on $100 per week on groceries, snacks, and restaurants. 5. Insurance: A. Plan on $400 per year for your home (how much is that each month?) B. Plan on $100 per month for your car (how much is that each year?) 6. Entertainment: A. How much money will you spend each month on entertainment? B. Consider going to a movie, a coffee on the way to work each morning, etc. C. You must include at least 10 different expenses in this category. 7. Property Tax You will pay each year property tax to the Halifax Regional Municipality. A. How much is this each month? Remember you may have found that number earlier during your information search on the property. B. If your listing did not contain tax info, you can calculate it yourself, for every $100 dollars, you are charges $1.10 property tax. Use the following formula: (House Price)/x0.011 Part 4 Transportation [2pts] 1. You may have just leased a new car for 4 years. Decide on a car you want, or need. Go to their company website, and look for information on financing your vehicle. Assume you make a 0% down payment, and sign a 48 month lease, and you’re paying 5% interest). How much are your monthly payments? Where did you buy it from? You may choose to use public transportation. Please indicate these costs and show calculations to support this method of transport. 2. You need to buy gas if you bought a car, if you are taking the bus, you may proceed to Part 5. Assume that you will drive 1000km each month. Determine your car's city mileage (kilometre) from the Natural Resources Fuel Consumption Rating Website. Visit http://oee.nrcan.gc.ca/transportation/tools/fuelratings/ratings-search.cfm Multiply the L/100km amount by 15 to get the number of litres of gas you will need. Based on the current cost of gas, what will it cost to drive your car each month? Use the current price of $1.34/L. (Take the number of litres you consume and multiply by the cost of one litre of gas to get monthly cost). Part 5 Putting It All Together [3pts] 1. Calculate you household's monthly total expenses. A. Do you have enough money to survive? Will you run a deficit or surplus each month? B. What percent of your monthly income are you spending on housing, transportation and life categories? C. Does this leave you anything left for debt repayment or savings? 2. If you do not have a balanced budget, what areas of your budget could you change to make your income equal your expenses? Part 6 Reflection [8pts] 1. What did you learn from this exercise? (300-400 words) My advice is to write a paragraph articulating your thoughts and rationale behind the choices you made during each of the “5 Parts” of this Assignment. If you organize this reflection into five paragraphs it should write itself nicely. All “Amounts” in this table must be the correct amounts on a MONTHLY basis. Some will be blank. Monthly Budget Amount $ Gross Salary Gross Pay Deductions Federal Income Tax Provincial Income Tax Canadian Pension Plan Employment Insurance Total Deductions Net Salary Net Pay Extra Earnings Total Take Home Insurance Medical Ins. Life Ins. Home Ins. Car Ins. Total Expenses Mortgage Groceries Entertainment Car Payment Bus Pass/ Petroleum Phone Bill Power Bill Water Bill Property Tax Total Budget Money Spent Difference Donations Tithing/ Charity Savings Savings RRSP TFSA Total