H C S P

advertisement

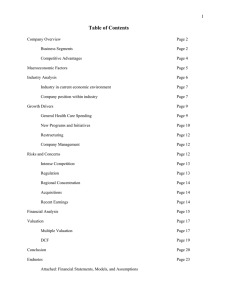

HEALTH CARE SECTOR COMPANY PRESENTATION Sarah Hemmelgarn Jason Wattier Alex Wisler Billy Wong SECTOR SUMMARY SIM Weight (as of 7/31/2009) Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecommunication Services Utilities Cash Dividend Receivables S&P 500 Weight SIM Weight 9.11% 7.19% 11.81% 11.65% 12.04% 10.74% 13.86% 8.93% 13.73% 13.30% 9.98% 12.37% 18.72% 20.41% 3.40% 4.98% 3.41% 3.39% 3.94% 3.61% 0.00% 3.38% 0.00% 0.06% +/-1.92% -0.16% -1.31% -4.93% -0.43% 2.39% 1.69% 1.58% -0.02% -0.34% 3.38% 0.06% SECTOR SUMMARY Defensive Opportunities Aging U.S. Population Universal health care may increase number of people insured Risks Branded pharmaceuticals patent cliff Lack of bargaining power under one-buyer system SECTOR SUMMARY Currently underweight vs. S&P 500 SIM weight = 13.30% S&P 500 = 13.73% Bring to even-weight with S&P500 +43 basis points SECTOR SUMMARY Current SIM Holdings: Company % of SIM Current Price Target Price Div. Yield Total Upside Cardinal Health 2.51% $33.84 $39.18 2.10% 18.68% Eli Lilly 2.39% $33.83 $37.61 5.60% 16.79% Gilead Science 0.96% $45.87 $61.93 0.00% 35.01% Johnson&Johnson 4.01% $60.72 $75.38 3.27% 27.41% Wellpoint 3.43% $51.90 $59.48 0.00% 15.30% *Prices as of market close 8/10/2009 SECTOR SUMMARY Recommended Action: Company Upside Action Current Weight Target Weight Change Cardinal Health 18.68% Hold 2.51% 2.51% 0.00% Johnson&Johnson 27.41% Hold 4.01% 4.01% 0.00% Eli Lilly 16.79% Sell 2.39% 0.00% - 2.39% Wellpoint 15.30% Sell 3.43% 2.00% - 1.43% Gilead Science 35.01% Buy 0.96% 2.50% + 1.54% TEVA 20.91% Buy 0.00% 2.71% + 2.71% 13.30% 13.73% + 0.43% SECTOR TOTAL ELI LILLY Company Overview Industry: Pharmaceuticals Founded in 1876 Develops, manufactures, and sells pharmaceutical products worldwide Offers medicinal treatments for: Schizophrenia, Bi-polar disorders, ADHD, Diabetes, Osteoporosis 2008 Sales: $20.378B Company Overview SIM Basis = $45.61 Market Price = $33.83 Dividends = $1.92 Unrealized Holding Gain (Loss) = ($11.78) After dividends = ($9.86) Return to Date (after dividends) = -21.62% $50 Dividend=$0.47 $45 $40 Dividend=$0.49 Dividend=$0.49 $35 $30 Dividend=$0.47 $25 7/31/04 8/31/04 9/30/04 10/31/04 11/30/04 12/31/04 1/31/05 2/28/05 3/31/05 4/30/05 5/31/05 6/30/05 7/31/05 Strengths & Opportunities Diversified Product Portfolio High Dividend Yield Currently at 5.6% annual yield Increased in each of last 42 years Aging population expected to drive demand for drugs Risks & Concerns Steep upcoming patent cliff 2008 US Sales Exposed: $7,277m % of 2008 Sales Exposed: Excluding biologics 28.9% Including biologics 35.7% Risks & Concerns Weak late-stage pipeline Is it adequate to replace expected lost sales? Big names to replace: Zyprexa, Cymbalta, Gemzar Up to 35.7% of 2008 sales is exposed to generic competition through 2015 Last major drug launch: 2005 Not expecting a “steady stream of product introduction” until 2013 (Annual Report) Risks & Concerns Ability to maintain current dividend payout in question Shoring up pipeline is #1 priority Two options: Increased R&D spending Purchase late-stage pipeline R&D is costly, time consuming and risky Acquisitions more likely due to immediate need for product introduction Acquisitions will be priority in use of free cash Can Eli Lilly maintain its current dividend payout? Price Target Absolute Valuation High Low Median Current Target P/Forward E 24.1 7.1 16.4 8.2 $33.65 P/S 6.0 1.6 4.0 1.9 $43.77 • Valuation target: $38.71 • DCF target price: $37.24 • Final target price: $37.61* • Current price: $33.83 • Upside potential (including dividends): 16.79% *Calculated from 75% DCF and 25% Valuation target prices Recommendation Liquidate position in LLY Why? Significant percentage of revenue at risk for generic competition, beginning in 2011 Concerns over relatively weak pipeline and impact on future revenue growth Current dividend yield may not be sustainable with acquisition becoming a priority Limited long-term upside WELLPOINT WELLPOINT Headquartered in Indianapolis, Indiana Managed Healthcare Organization—Largest in the United States Sell commercial health benefits Formed by a merger on Nov 30, 2004 by Anthem, Inc. and Wellpoint Health Networks Inc. Anthem Blue Shield and Blue Cross licensee in 14 states—brand strength WELLPOINT Sector: Healthcare Industry: Managed Healthcare Current Price: $51.90 Market Cap: 24.66 Billion Current SAP Weighting: 3.43% Proposed Change: Sell 143 basis points Proposed SAP Weighting: 2.00% Reasons for Selling Sales and Earnings projections low 2004 2005 2006 Revenu e 20,815 45,136 56,953 %Chang e 116.84% 26.18% Net Income %Change 2007 61,134 7.34% 2008 2009 61,251 60,332 2010 2011 60,936 63,068 0.19% -1.50% 1.00% 3.50% 2004 2005 2006 2007 2008 2009 2010 2011 960 2,464 3,095 3,345 2,491 2,910 2,832 2,911 -2.70% 2.78% 156.67% 25.61% 8.08% -25.53% 16.84% Reasons for Selling Government Regulation Government will likely pressure Managed Healthcare Companies to cut costs Profit Margins at risk due to increasing competition Rising Unemployment—has not yet peaked More unemployment means lower commercial enrollment in healthcare plans Wellpoint and Unemployment Obvious Negative Correlation Source: Spring 2009 Healthcare Stock Presentation Possible Reasons Against Taking a Sell Position: Healthcare reform could actually benefit Wellpoint and other Managed Healthcare companies because more people will be in the healthcare system Wellpoint is a well diversified company that often engages in mergers and acquisitions Strong brand name with their Anthem Blue and Blue Cross brands Valuation Absolute Valuation High P/Forward E 18.1 Target Media Curre Target E,S,B,etc/shar Target Low n nt Multiple e Price 6 13.9 9 13.0 5.0 65.0 P/S 1.4 0.3 0.9 0.5 0.7 104.0 72.8 P/B 2.4 0.8 1.9 1.1 1.4 44.9 62.9 P/EBITDA 18.14 2.99 8.54 5.57 7.4 9.1 67.3 P/CF 19.5 5.1 13.4 7.6 8.5 6.3 53.6 Multiple Target Price: $64.31 DCF Target Price : $58.35 Final Target Price: $59.84* *Multiple Target*25%+DCF Target*75% Current Price: 51.90 Upside: 15.3% GILEAD SCIENCE Gilead Science (GILD) •Founded in 1987 •Biopharmaceutical company that discovers, develops and commercializes therapeutics •Focus on antiviral drugs for HIV/AIDS, hepatitis and influenza •Recently began developing drugs for pulmonary diseases Why Gilead? U.S. HIV drug market share expanding Diversifying product line Increasing R&D pipeline investment Proposed changes to health care system Why Gilead? Products in pipeline Darusentant Elvitegravir GS-9350 GS-9150 Aztrenam Lysine Why Gilead? Brand Name AmBisome Atripla Emtriva Flolan Hepsera Letairis Macugen Tamiflu Truvada Viread Vistide Indication fungal infection, meningitis, candida HIV, AIDS HIV, AIDS pulmonary hypertension Hepatits B pulmonary arterial hypertension age-related macular degeneration influenza HIV, AIDS HIV, AIDS, Hepatitis B CMV retinitis Patent Expiration 2016 2021 2021 expired 2014 2015 2017 2016 2021 2017 2010 % Total Sales 6% 31% 1% <1% 7% 2% * * 41% 12% <1% Risks for Gilead Slowdown in HIV product sales Failure of pipeline products to gain FDA approval Price Target Absolute Valuation P/Forward E P/S P/B P/EBITDA P/CF High 41.1 15.7 18.2 32.24 49.7 Low 17 7.4 7.9 13.93 18.6 Median 26.2 11.9 11.2 21.77 29.4 • Valuation target: $71.31 • DCF target: $58.50 • Final target: $61.70* • Current price: $45.76 • Upside potential: 34.84% *Calculated from 75% DCF and 25% Valuation target prices Current 18.8 7.7 9 15.49 20.6 Target Price 74.15 82.82 59.63 84.69 55.27 TEVA Pharmaceuticals TEVA Company – Based in Israel, largest generic drug manufacturer in the world. Investment Thesis: Company’s position as a leader in the generic market, relatively good valuation, along with very favorable macro trends for the generic drug industry, lead us to recommend purchasing 271 basis points. Why TEVA? Favorable Macro Trends for Industry a) Availability of Generic Drugs as Substitutes for name-brands Approximately 75% of all FDA-approved drugs have generic counterparts. In 2008, 69% of all prescriptions dispensed were generics. b) Expected Growth of Generic Drug Market $80 billion in 2008, expected to be $84 billion in 2009 and $129.3 billion in 2014 CAGR of 9% for the 5-year period U.S.: projected $34B in 2009 and $54B in 2014 CAGR of 9.7% Why TEVA? c) Cost Discrepancy National Association of Chain Drug Stores [2007]: Average Retail Price (Brand-Name) = $119.51 Average Retail Price (Generic) = $34.34 d) Broad-based Support from Retailers Price Competition among retailers such as CVS, Walgreen, and Rite Aid has been a big catalyst behind the greater use of generic drugs. Walmart’s $4 generic medicine offer Generic drugs represent both lower costs and higher margins to these retailers than brand name drugs. Why TEVA? d) Regulatory Favoritism For the most part, many aspects of U.S. and international health care reforms favor generics in their attempt to curb costs. Example – Medicare Part D’s, which accounted for 19% of all retail prescriptions in 2007, “success” is attributed in large part to its significant use of generic drugs. Why TEVA? Positives: 1) Largest generic drug manufacturer in the world 2) Enjoyed a 23% sales growth through the first 6 months of 2009 despite global recession, and only had one single-digit growth year in the past 5 years. 3) Worldwide market leader and in North America, the largest generic drug market in the world, and among the leaders in Europe. 4) Has size and capacity to capitalize on the upcoming patent “cliff.” Why TEVA? Worries/Risks/Concerns: 1) Increased competition among generic manufacturer and from the “names” of the industry. 2) Prevalence of Generics in the market will reduce incentive for brand-names to invest in new drugs. 3) Presence in Asia not as strong as in Europe or North America. Valuation Valuation Method Target Per Share Amount Target Multiple Target Price P/Forward E 3.35 17 56.95 P/Sale 15.23 4 60.94 P/CF 3.61 16 57.76 P/Book 19.91 3.5 69.67 DCF 63.01 Target Price (75%-DCF, 25%-Multiple) $62.59 Current Price $51.51 Dividend Yield 1.00% Upside 22.5% Summary Recommended Action: Company Upside Action Current Weight Target Weight Change Cardinal Health 18.68% Hold 2.51% 2.51% 0.00% Johnson&Johnson 27.41% Hold 4.01% 4.01% 0.00% Eli Lilly 16.79% Sell 2.39% 0.00% - 2.39% Wellpoint 15.30% Sell 3.43% 2.00% - 1.43% Gilead Science 35.01% Buy 0.96% 2.50% + 1.54% TEVA 20.91% Buy 0.00% 2.71% + 2.71% 13.30% 13.73% + 0.43% SECTOR TOTAL QUESTIONS?