Industrials Sector Jerod Hickey Logan Smyth Jing He

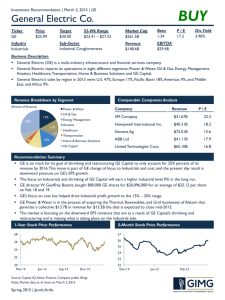

advertisement

Industrials Sector Jerod Hickey Logan Smyth Jing He Agenda ● Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendations Q&A Overview Industrials Overview The Sector has a 1.34 T market capitalization It is the 4th largest sector in the S&P 500 Accounts for 11.26% of the S&P 500, Underweight 1.35% Current SIM Holdings Company Shares held Market price Overall gain Gain % Danaher 12600 $663,894 $19,783 3.07% Flowserve 7000 $735,840 $61,950 9.19% United Technologies 8000 $706,640 $37,280 5.57% $2,106,374 $119,013 Total Industries Within The Sector Sector Performance Top 5 Holdings General Electric: 10.95% United Technologies: 5.84% Caterpillar: 5.36% United Parcel Services: 5.13% 3M: 4.83% Top 5 Segments Machinery: 24.99% Aerospace & Defense: 24.51% Industrial Conglomerates: 17.94% Airfreight & Logistics: 9.03% Road & Rail: 8.49% Business Analysis Analyzing Demand: Life Cycle Industrials are in the Maturity Phase of the life cycle Companies in this sector will display: Sales growth similar to that of the economy Earnings still growing, but at a declining rate Late entrant competitors trying to steal market share Analyzing Demand: Steve Stovall’s Theoretical Model of Sector Rotation According to the model of sector rotation, with a firm belief that we are in the “early recovery” stages of the recession, now might just be the right time to invest in the industrial sector Profitability and Pricing Industrials serve a very large and diverse customer base Companies in Sector are already well established, but there is much competition Products are well established, but could eventually be replaced Raw material for this sector are readily available Economic Analysis Economic Analysis Economic Analysis Economic Analysis Economic Analysis Financial Analysis Absolute EPS by Industry Sector EPS Growth Industry Sector Sales Per Share Net Profit Margin Net Profit Margin relative to S&P 500 Sector Cash Flow Per Share Valuation Analysis Sector Valuations Absolute Relative Average Current Average Current Trailing P/E 18.3 16.9 1.1 1.2 Forward P/E 16.7 14.3 1.1 1.0 P/B 3.2 2.9 1.1 1.3 P/S 1.4 1.3 1.0 1.0 P/CF 11.2 11.1 1.1 1.2 Industry Comparison Aerospace Defense Construction & Engineering Industrial Congolm. Industrial Machinery Trailing P/E 14.1 26.5 15.0 17.7 Forward P/E 13.1 17.9 13.5 13.4 P/S 3.2 2.1 1.9 2.5 P/B 1.0 0.6 1.4 1.5 P/CF 10.6 18.4 9.1 12.6 Forward P/E Trailing P/E Price/Cash Flow Technical Analysis Technical Analysis Technical Analysis Recommendation Recommendation Under-weight the Industrials relative to the S&P Current: U/W 135bp Target: U/W 200bp Industrials outperform in the early stages of a recovery Performance since March 2009 low Industrials: +141% S&P 500: +98% Recommendation Catalysts: Continuation of global recovery Future performance driven by strong growth/demand from emerging markets (BRIC) Weaker dollar helping exports and repatriation of earnings Risks: Considerable macroeconomic uncertainty Sector has already outperformed the S&P 500 Mixed technical picture Recommendation Attractive valuation Aerospace and Defense Industrial Conglomerates Fair valuation Industrial Machinery Unattractive valuation Construction and Engineering Recommendation Aerospace Defense Construction & Engineering Industrial Congolm. Industrial Machinery Trailing P/E 14.1 26.5 15.0 17.7 Forward P/E 13.1 17.9 13.5 13.4 P/S 3.2 2.1 1.9 2.5 P/B 1.0 0.6 1.4 1.5 P/CF 10.6 18.4 9.1 12.6