The Industrials Sector The Ohio State University SIM Program

advertisement

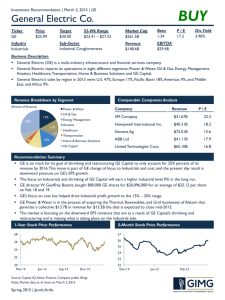

The Industrials Sector The Ohio State University SIM Program Analysts Name Contact information Nicole Heffle heffle.1@osu.edu Jingyuan Huang huang.1039@osu.edu Meng Jea Joo joo.50@osu.edu Dun Hou hou_49@fisher.osu.edu Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendations Overview of the Sector SIM Fund at Ohio State Overview Industrials Companies that provide industrial and commercial equipment and services, transportation, and distribution operations The sector has a vast exposure to emerging markets Cyclical Sector Sector Size – Market Cap = $1.428 Trillion As a percent of the S&P: Industries Within the Sector Aerospace & Defense Machinery Industrial Conglomerates Air Freight & Logistics Road & Rail Commercial Services & Supplies Electrical Equipment Trading Companies & Distributors Construction & Engineering Thrifts & Mortgage Finance Household Durables Airlines Building Products Largest Companies in Industrials Recent Sector Performance Last Year Last Quarter Earnings Per Share Up 8% Earnings Per Share Up 5.78% Revenues (% Change) 5% Revenues (% Change) 5.65% Business Analysis Key Performance Drivers Gross Domestic Product (GDP) Government Spending Infrastructure and Military, primarily Commodity Prices Oil and metals Manufacturing Capacity Utilization Capital Spending Phase of the Life Cycle Currently in the Maturity Phase “Mid-to-late” part of the cycle Growth – still occurring through Technology and M&A Selling in large volumes = maximizing profits External Factors Raw Material / Natural Resource Costs Government Regulation & Laws Government / Capital Spending Environmental Issue Rising Competition from Emerging Markets Porter’s Five Forces Industry Force Factors Barriers to Entry • Requiring Significant Startup Capital Analysis High • • • • Requiring High Technology Patents Economic of Scale Distribution/Dealers network Buyer Power • • • Product Differentiation is big Switching Cost is low No substitutes for industrial equipment Moderate Supplier Power • • • Supplier is relatively less important to the industry Raw materials are common Large purchasing power from manufacturing companies Low Substitutes • • • • Products can be replaced by other brands Specialized equipment is fewer. Like engine. Unspecialized products are more. Like raw materials Stability in market growth Moderate Rivalry Intensity • Public tender bidding • • Powerful Player s Price and quality competition High Economic Analysis Highly Correlated Index S&P 500 Price Index Real GDP Labor Market New Manufacturing Orders PPI on Gasoline S&P 500 Price Index Real GDP Labor Market New Manufacturing Orders Relatively lower correlative index But, it’s worth to take a look. Oil Price New Housing Starts PPI – Aluminum PPI - Steel Oil Price New Housing Starts PPI-Aluminum PPI-Steel Financial Analysis Industrials Select Sector SPDR (XLI) vs. S&P 500 Industrials Sector Performance Industry Performance Sales Growth Rates of the Major Companies Ticker Company GE Sales Growth (%) MRQ TTM 5-yr General Electric 3.57 0.05 -3.10 UTX United Technologies Corp 14.37 3.50 0.71 UNP Union Pacific Corp 2.78 7.00 5.15 MMM 3M Co 4.20 0.99 4.10 CAT Caterpillar Inc -6.77 9.54 7.94 UPS United Parcel Service Inc 2.86 1.92 1.72 HON Honeywell International Inc 1.14 3.11 1.72 BA Boeing Co 14.05 18.86 4.24 EMR Emerson Electric Co 4.60 2.75 1.98 DHR Hanaher Corp 5.48 13.49 10.62 5.65 7.00 5.87 Sector Industrials Sector Revenue Industrials Sector Revenue Industrials Sector Earnings Industrials Sector Earnings Industrials vs. S&P500 EBITDA Margin Industrials vs. S&P500 Net Profit Margin Industrials vs. S&P500 ROE Margin Sales & Cash Flow Per Share Valuation Analysis Sector Valuation Absolute Basis High Low Median Current P/Trailing E 24 7.1 17.6 15.3 P/Forward E 20.9 9.2 16.2 14.7 P/B 3.6 1.4 3.0 2.9 P/S 1.6 0.6 1.3 1.3 P/CF 14 6 10.6 10.5 Relative to SP500 High Low Median Current P/Trailing E 1.2 0.66 1.1 1.0 P/Forward E 1.2 0.84 1.0 1.0 P/B 1.3 0.9 1.1 1.3 P/S 1.1 0.8 1.0 0.9 P/CF 1.2 0.8 1.1 1.1 Sector Valuation (cont’d) Trend Industry Valuation Absolute Basis High Low Median Current P/Trailing E 31 5.2 14.7 11.3 P/Forward E 36.1 6.7 13.1 12.6 P/B 6.3 1.5 4.0 3.7 P/S 1.7 0.3 1.0 1.0 P/CF 14.5 4.8 8.8 8.3 Relative to SP500 High Low Median Current P/Trailing E 1.8 0.48 0.92 0.76 P/Forward E 2.2 0.56 0.91 0.88 P/B 2.6 1.0 1.4 1.6 P/S 1.3 0.5 0.7 0.7 P/CF 1.5 0.6 0.9 0.8 Valuations Variation Across Industries Industry Aerospace/Defense Machinery Industrial Machinery Cons/Farm Electrical Component Conglomerates Absolute Median Current Median Current Median Current Median Current Median Current P/Trail E 16.4 13.6 27.6 7.6 15.9 13.2 20.4 17.3 17.3 14.9 P/Forw E 16.1 13.6 16 13.1 14.1 10.9 18.1 15.6 16.4 13.6 P/B 3.1 3.6 2.8 2.3 4.0 4.3 3.8 3.6 3.1 2.0 P/S 1.0 1.0 1.4 1.3 0.9 1.1 1.7 1.8 1.9 1.5 P/CF 11.4 10.1 11.4 10.8 9.0 9.0 13.4 13.2 11.6 9.6 Valuations Variation Across Industries (cont’d) Industry Aerospace/Defense Machinery Industrial Machinery Cons/Farm Electrical Component Conglomerates Relat SP Median Current Median Current Median Current Median Current Median Current P/Trail E 1.0 0.99 1.1 1.1 1.0 0.97 1.2 1.3 1 1.1 P/Forw E 0.99 0,99 1.0 0.96 0.94 0.79 1.1 1.1 1.0 0.99 P/B 1.2 1.6 1.0 1.0 1.4 1.9 1.5 1.6 1.1 0.9 P/S 0.7 0.8 1.0 1.0 0.6 0.9 1.2 1.4 1.3 1.2 P/CF 1.1 1.1 1.1 1.2 0.9 1.0 1.3 1.4 1.1 1.0 Recommendations SIM Portfolio Recommendation SIM Portfolio Select Sector SPDR Fund Current Industrials Sector Weight Annualized Three Five Ten Year Year Year 9.72% 1.32% 10.24% Health Care (XLV) 13.65% 7.92% 7.08% Cons Stap (XLP) 15.40% 9.93% 9.96% Cons Disc (XLY) 20.28% 12.01% 9.98% Energy (XLE) 13.47% 2.20% 15.07% Financials (XLF) 7.77% -5.35% 0.44% Industrials (XLI) 14.80% 4.80% 10.00% Technology (XLK) 12.69% 7.51% 8.76% Utilities (XLU) 13.23% 3.91% 11.74% Materials (XLB) Total = 44.25 % Industrials Sector Portion = 10.85 % S&P 500: 10.19% SIM Weight: 10.25% Recommendation: Overweight 60 BPS Suggested Weight: 10.85 % U.S. Macro Indicators Major Positives Continuous Strength in Consumer Spending Rebound in Housing Expanding Commercial Construction Improved Manufacturing Purchasing Managers Index (PMI) Major Risks Threats from Emerging Markets (i.e. China) Natural Resource/Raw Material Price Fluctuation Any Questions??