Industrials

advertisement

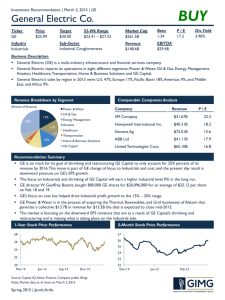

Industrials Research Analysts Fan Yang Gavin Smith Fluor Corporation Caterpillar Inc. Precision CastParts Corporation Quanta Services Inc. Agenda • • • • • • Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendations Overview SIM Portfolio Weights Sector Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecommunication Services Utilities Cash Dividend Receivables As of 9/30/13 S&P 500 Weight SIM Weight +/- 12.46% 14.33% 1.87% 10.09% 8.47% -1.62% 10.49% 14.39% 3.90% 16.30% 13.48% -2.82% 12.97% 11.90% -1.07% 10.73% 8.95% -1.78% 17.89% 19.10% 1.21% 3.51% 2.90% -0.61% 2.42% 2.11% -0.31% 3.14% 3.84% 0.70% 0.00% 0.49% 0.49% 0.00% 0.05% 0.05% Distribution of Sector Lumber, Wood Metal Fabrication Production 1% Residential 0% Construction 2% Heavy Construction 0% 2% General Contractors 4% General Building Materials 8% Farm & Construction Machinery 7% Aerospace/Defense Major Diversified 20% Aerospace/Defense - Major Diversified Aerospace/Defense Products & Services Cement Diversified Machinery Farm & Construction Machinery General Building Materials General Contractors Heavy Construction Industrial Electrical Equipment Diversified Machinery 53% Industrial Equipment & Components Lumber, Wood Production Machine Tools & Accessories Manufactured Housing Metal Fabrication Total Market Cap: 79,933.8 Billion Pollution & Treatment Controls Residential Construction Largest Companies Industrials YTD Performance – 26.4% Industrials QTD Performance – 4.48% Business Analysis Phase of Life Cycle Percent change, seasonally adjusted Phase of Life Cycle Phase of Life Cycle Classification by Business Cycle – U.S Classification by Business Cycle – Foreign • Globally linked sector since customers are over the world • China and Europe are undergoing late cycle and recession phase of business cycle. External Factors • Demographic – Low • Society – Low • Government & Regulatory – moderate • Technology – high Capacity and Utilization Intensity of Competition • Threat of Substitute Moderate Depend on different field • Bargaining Power of Customers Small Corporations & Individuals vs. Large Corporations & Government • Bargaining Power of Suppliers Low Abundant Resources such as Coal, Renewable Energy • Threat of New Entrants Low High Startup Costs, Long-term Relationship and Reputation • Intensity of Rivalry High within industries Undifferentiated Products and High Exit Barriers Economic Analysis Economic Analysis – Industrials Economic Analysis – Industrials Economic Analysis – Industrials Economic Analysis – Industrials Economic Analysis – Industrials Economic Analysis – Aerospace Economic Analysis – Building Products Financial Analysis Sector Revenue Revenue Growth 15% 10% 5% 0% -5% -10% -15% -20% 2009 2010 2011 2012 2013 2014 Major Industry Revenue 40% 30% 20% 10% Aerospace/Defense Conglomerates 0% 2009 -10% 2010 2011 2012 2013 2014 Construction Materials Homebuilding Machinery Const/Farm -20% -30% -40% -50% Machinery Industrial Sector EPS EPS Growth 24% 22% 8% 2009 -32% 2010 2011 2012 6% 2013 10% 2014 Major Industry EPS EPS Growth 150% Aerospace/Defense 100% Conglomerates 50% Homebuilding 0% 2009 2010 2011 2012 2013 2014 -50% Machinery Const/Farm Machinery Industrial -100% EPS Growth 800% 600% 400% Construction Materials 200% 0% -200% -400% -600% 2009 2010 2011 2012 2013 2014 Net Margin and Price Comparison Valuation Analysis Sector Multiples Absolute Median Relative S&P Current Median Current Trailing P/E 19.1 17.4 1.1 1.1 Forward P/E 18.1 15.7 1 1.1 P/S 1.3 1.4 1 1 P/B 3.2 3.2 1.2 1.3 P/CF 11.1 11.7 1.1 1.1 Major Industry Multiples Aerospace/Defense Absolute Median Current Construction Materials Conglomerates Median Current Median Current Trailing P/E 13.1 16.8 14.7 17.3 Forward P/E 12.8 15.7 14 15.5 94.1 P/S 0.9 1.2 1.4 1.9 P/B 3.2 4.1 1.8 P/CF 9.5 12.8 8.8 Relative S&P Aerospace/Defense Median Current 36 NM Median Current Median Machinery Industrial Current Median Current 36.7 16.6 12.9 12.7 15.8 19.3 231.9 32.9 13.7 12.6 12.7 15 17 2 2.6 0.7 1 1 1 1.3 1.6 2.4 1.4 1.8 1.4 2 3.8 3.1 2 2.8 11.5 17.8 27.1 19.4 14.4 8.5 8.5 9.4 14.2 Construction Materials Conglomerates Median Machinery Const/Farm Homebuilding Current Median Homebuilding Current Trailing P/E 0.93 1.1 1 1.1 Forward P/E 0.94 1.1 1 1 6.1 P/S 0.8 0.8 1.1 1.3 P/B 1.4 1.7 0.9 P/CF 1.1 1.2 1 Machinery Const/Farm 2.6 NM Median Current Median Machinery Industrial Current Median Current 2.7 1 0.9 0.79 1.1 1.2 15.6 2.7 0.92 0.93 0.85 1.1 1.1 1.7 1.8 0.6 0.7 0.8 0.7 1 1.1 1 0.7 0.8 0.6 0.8 1.7 1.3 0.9 1.1 1.1 2 2.6 2.2 1.4 0.9 0.8 1.1 1.3 Recommendations • SIM Portfolio is 1.78% underweight in Industrials Our Recommendation is to keep Industrials Underweight Reasons: • Based on business cycle, the U.S. is in the Mid to Late phase, and as shown in the graphs, the Industrial Sector can expect small growth rates in these periods • Based on Financial Analysis, the Industrials Sector’s revenue as a whole is going through a declining phase as is the EPS • Looking at technical analysis, the price of the Industrials Sector (SPIN) tends to decrease after there is a decrease in the Net Profit Margin, which is forecasted to happen • The Capital Utilization vs. Industrials economic graph indicates that the price of the Industrials Sector is overpriced Recommendation by Industry • Although, we believe the Industrial Sector as a whole should be underweight, we believe some industries within the sector look promising Homebuilding • Residential Construction • Manufactured Housing Thanks! Q&A