Eric Hatch Christina Haubrock Melissa Hickey November 3, 2009

advertisement

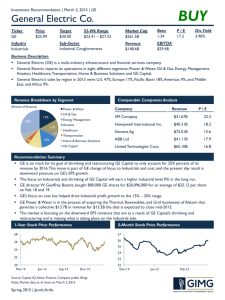

Eric Hatch Christina Haubrock Melissa Hickey November 3, 2009 Industrials Sector Overview Economic & Business Analysis Financial Analysis Valuation & Recommendation Currently overweight by 188 BP S&P 500 Weight vs. SIM Weight 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% S&P 500 Weight SIM Weight Industrials 12.50% 12.00% 11.50% 11.00% 10.50% 10.00% 9.50% 9.00% 11.97% 10.09% S&P 500 Weight SIM Weight Aerospace & Defense Building Products Construction & Engineering Capital Goods Electrical Equipment Industrial Conglomerates Machinery Trading Companies & Distributors Commercial & Professional Services Commercial Services & Supplies Professional Services Air Freight & Logistics Airlines Transportation Marine Road & Rail Transportation Infrastructure Industrials # of % of % of SIM Companies Industry Portfolio Transportation Commercial & Professional Services 61 19.70% 17.99% 96 4.90% 0.00% Capital Goods 248 75.40% 82.01% SIM OWNED COMPANIES Emerson Electric Co. Capital Goods EMR First Solar Inc. Capital Goods FSLR General Electric Co. Capital Goods GE Oshkosh Truck Corp. Capital Goods OSK UTI Worldwide Inc. Transportation UTIW Media Financial Services Industrials Hardware Software Energy QTD (% Return) Consumer Goods YTD (% Return) Consumer Services Business Services Telecommunications Health Care Utilities 0 10 20 30 40 50 60 70 80 Capital Goods: Capital spending tends to increase midway through the business cycle, as the economy is heating up and higher demand for products leads companies to expand their production capacity. Demand in global export markets is key for agricultural equipment, industrial machinery, and machine tools. http://personal.fidelity.com/products/funds/content/sector/cycle.shtml#7 The Industrials industry as a whole can be placed in the Maturity phase. Companies in the maturity phase can have new product lines that exist in the Introduction or Growth phases (Oshkosh). Other companies within the sector can be in the Introduction or Growth phase (First Solar). Many mature companies can be entering large, untapped growth markets internationally (Emerson or GE). Outlook for U.S. Industrial activity much better for the rest of ’09 and into ’10 (Morningstar Q4 Outlook 9/30/09). ISM purchasing managers survey: ratio of new orders to inventories indicates industrial production will be materially higher. Ratio’s highest point in 30 years. Been at this level only 10 out of 740 months measured. The Fed Beige Book offers mixed expectations for near-term outlook on manufacturing (10/21/09). Expecting slight gains and modest economic growth. Deferred projects and maintenance to conserve capital. Increasing optimism leading to more new hires and increased spending on capital goods. The Industrials sector is strongly correlated with the S&P 500, real GDP, commercial and industrial loans, and durable goods orders. Industrials appear to be correlated to Capital Spending with the sector acting as a leading indicator by approximately 6 months. Don’t wait for Capital Spending to completely return before jumping on board Industrials? 0.0000 15.0000 10.0000 5.0000 04/01/2009 09/01/2008 02/01/2008 07/01/2007 12/01/2006 05/01/2006 10/01/2005 03/01/2005 08/01/2004 01/01/2004 06/01/2003 11/01/2002 04/01/2002 09/01/2001 02/01/2001 07/01/2000 12/01/1999 CF per Share 35.0000 30.0000 25.0000 CF per Share 20.0000 High Low Median Current 30.86 16.39 20.70 30.44 Absolute Net Profit Margin 08/01/2009 04/01/2009 12/01/2008 08/01/2008 04/01/2008 12/01/2007 08/01/2007 04/01/2007 12/01/2006 08/01/2006 04/01/2006 12/01/2005 08/01/2005 04/01/2005 12/01/2004 08/01/2004 04/01/2004 12/01/2003 08/01/2003 04/01/2003 12/01/2002 08/01/2002 04/01/2002 12/01/2001 08/01/2001 04/01/2001 12/01/2000 08/01/2000 04/01/2000 12/01/1999 Absolute Net Profit Margin 9.00% 8.00% 7.00% 6.00% 5.00% Absolute Net Profit Margin 4.00% High 8.40% 3.00% Low 6.40% 2.00% Median 7.10% 1.00% Current 6.90% 0.00% Net Profit Margin Relative to S&P 500 08/01/2009 04/01/2009 0.40 12/01/2008 0.60 08/01/2008 04/01/2008 12/01/2007 08/01/2007 04/01/2007 12/01/2006 08/01/2006 04/01/2006 12/01/2005 08/01/2005 04/01/2005 12/01/2004 08/01/2004 04/01/2004 12/01/2003 08/01/2003 04/01/2003 12/01/2002 08/01/2002 04/01/2002 12/01/2001 08/01/2001 04/01/2001 12/01/2000 08/01/2000 04/01/2000 12/01/1999 Net Profit Margin Relative to S&P 500 1.40 1.20 1.00 0.80 Net Profit Margin Relative to S&P 500 High Low Median Current 0.20 0.00 1.20 0.80 0.90 1.10 14.00 12.00 10.00 % 8.00 6.00 4.00 High Low CONGL 11.1 9.2 10.6 9.2 EEQPM 10 6.1 8.8 8.8 TRKPT 7.3 2 4.8 4.8 AIRFR 7.5 3.4 5.7 4.8 INDUST 8.4 6.4 7.1 6.9 2.00 0.00 Ind'l Conglomerates Electrical Component Airfrght & Logistics Industrial Sector Machinery Const/Farm Median Current Industrial Companies EPS Growth (YoY) Industry EPS Growth (YoY) 120.00 100.00 100.00 80.00 80.00 60.00 60.00 40.00 40.00 20.00 20.00 0.00 0.00 -20.00 -20.00 -40.00 -40.00 -60.00 -60.00 -80.00 -80.00 Ind'l Conglomerates Airfrght & Logistics Machinery Const/Farm Electrical Component Industry EPS Growth (YoY) CONGL EEQPM TRKPT AIRFR INDUST High Low 23.4 30.8 100.8 24.8 22 -44.7 -38.9 -66.5 -36 -35.3 General Electric Siemens AG United Parcel Service 3M Company Company EPS Growth (YoY) Median Current 7.7 14.4 6.6 5.8 9.9 -28 -17.8 -45.7 -28.2 -21.3 GE SI UPS MMM High Low 19 208 28.2 22.8 -49 -96 -38.3 -19.1 Median Current 6.8 20.4 8.7 10.6 -36.5 -56.4 -16 -19.1 0.0000 07/01/2009 02/01/2009 09/01/2008 04/01/2008 11/01/2007 06/01/2007 01/01/2007 08/01/2006 03/01/2006 10/01/2005 05/01/2005 12/01/2004 07/01/2004 02/01/2004 09/01/2003 04/01/2003 11/01/2002 06/01/2002 01/01/2002 08/01/2001 03/01/2001 10/01/2000 05/01/2000 12/01/1999 Industrial Sector Absolute ROE 25.0000 20.0000 Absolute ROE 15.0000 10.0000 5.0000 High Low Median Current 21.3 16.2 17.8 21.3 Correlation = .86 with 0 Lag time One Year Absolute Basis High Low Median Current P/Forward E 26.9 9.2 17.8 16.9 % Current to LT Median -5% P/B 5.9 1.4 3.3 2.5 -24% P/S 1.9 0.6 1.5 0.9 -40% P/CF 16.7 4.9 11.9 7.3 -39% Relative to SP500 P/Forward E High Low 1.2 0.8 1.0 1.0 % Current to LT Median 0% P/B 1.4 0.9 1.1 1.2 9% P/S 1.1 0.8 1.0 0.9 -10% P/CF 1.2 0.7 1.1 0.7 -36% Median Current Ratios indicate that the industrials sector is currently undervalued. 3-MTD YTD P/E P/S Dividend Yield Industrials 5.46% 8.35% 22.8x 0.8x 2.41% Transportation 0.30% 5.42% 54.1x 0.8x 1.88% Commercial & Professional Services 3.50% 5.38% 65.4x 0.7x 1.83% Capital Goods 6.72% 9.34% 19.2x 0.9x 2.58% Capital Goods Commercial & Professional Services Transportation Aerospace & Defense Building Products Construction & Engineering Electrical Equipment Industrial Conglomerates Machinery Thomson Best Best Fit Ticker Correlation Fit Lag aerod 0.57 0.59 2 bldgp 0.45 0.53 12 engnr 0.39 0.5 11 eeqpm 0.66 0.66 congl 0.75 0.75 machn 0.45 0.45 Trading Companies & Distributors Trade 0.28 0.3 Commercial Services & Supplies print 0.56 0.56 airfr ARLNS shipp railr Truck 0.28 0.24 0.26 0.45 0.31 0.32 0.43 0.39 0.29 0.45 0.43 0.37 0.43 0.48 Professional Services Air Freight & Logistics Airlines Marine Road & Rail Transportation Infrastructure Average Electrical Equipment and Machinery have a higher correlation with the S&P 500 than the other industries within the Industrials Sector 2 11.5 12 2 11 12 One Year High Low Median Current 1.4 .7 1.2 .8 One Year High Low Median Current 1.1 .48 .8 .97 INDUSTRIALS SECTOR SHOULD MAINTAIN THE CURRENT LEVEL OF 188 BASIS POINTS OVERWEIGHT Positives: FINANCIAL Sector ratios indicate that the sector is undervalued ECONOMIC Improving global economic recovery Increasingly global in scope Favorable impact anticipated from the infrastructure spending Risks: Slower economic recovery than anticipated Lag time associated with the Industrials Sector