Industrial Sector Presentation

advertisement

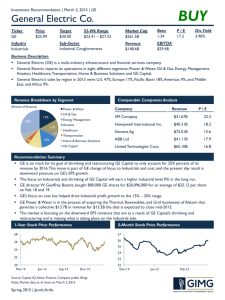

Industrial Sector Presentation PREPARED BY: ASHLEY CLARK RICHARD GROSS JON HARMACEK OLGA ISENBERG BRYON JORDAN Agenda Sector Analysis Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Q&A Sector Analysis SIM Weight Industrials Sector SIM Weight vs S&P 500 12.00% 12.36% 10.68% 11.57% 11.50% 7.50% 9.33% Consumer Discretionary Consumer Staples 11.00% Energy Financials 3.53% 10.50% S&P 500 Weight Health Care 3.87% Industrials 13.58% 3.28% Information Technology Materials Telecommunication Services 4.12% SIM Weight 10.00% 9.79% 9.50% Utilities Cash 9.00% 8.50% 20.19% S&P 500 Weight SIM Weight 11.57% The Industrials Sector makes up 11.57% of the SIM Portfolio, 178 basis points above the S&P 500. Sector Analysis – Top 10 companies General Electric Co 14.7% United Parcel Service Inc 6.1% United Technologies Corp 5.9% 3M Co 5.5% Union Pacific Corp 3.6% Boeing Co 3.5% Lockheed Martin 3.4% Emerson Electric Co 3.2% Burlington Northern Santa Fe Co 3.1% Honeywell Intl Inc 2.9% All Other 48.1% Sector Analysis – Returns by sector Returns by Sector Utilities Telecommunications Services Information Technology Financials Sector Health Care YTD Consumer Staples QTD Consumer Discretionary Industrials Materials Energy S&P 500 -10.00 % -5.00% Industrial QTD Return – 3.65% Industrial YTD Return - -4.32% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% % Return Business Analysis – Economic cycle Source: http://personal.fidelity.com/products/funds/content/sector/cycle.shtml Business Analysis – Industrials vs. S&P 500 Industrials versus S&P YTD 2009 15.00% 10.00% 5.00% 0.00% -5.00% -10.00% Industrials -15.00% S&P 500 -20.00% -25.00% -30.00% -35.00% -40.00% 1/1/2009 2/1/2009 3/1/2009 Source: http://www.yahoo.com 4/1/2009 5/1/2009 6/1/2009 7/1/2009 Residential Construction 4% Industrial Sector Breakdown Pollution & Treatment Controls 1% Textile Industrial Waste Management Small Tools & 1% 5% Accessories 1% Aerospace/Defens e - Major Diversified 7% Metal Fabrication 3% Manufactured Housing 0% Machine Tools & Accessories 1% Lumber, Wood Production 3% Industrial Equipment & Components 7% Industrial Electrical Equipment 13% Heavy Construction 4% General Contractors 2% Aerospace/Defense Products & Services 19% Cement 4% Diversified Machinery 13% Farm & Construction Machinery 10% General Building Materials 4% Business Analysis – Stages of Maturity Source: http://openlearn.open.ac.uk/mod/resource/view.php?id=281253 Economic Analysis Industrials are highly correlated to GDP, real interest rates, real private investments, federal government spending and housing market In June 2009, The Fed Beige Book report indicated that the expectations of several districts regarding the recession have improved, though they do not see the substantial increase in economic activity through the end of the year In Q2 2009, manufacturing activity declined or remained at a low level across most states Economic Analysis – GDP vs. Industrial Equipment Economic Analysis – GDP vs. Change in Real Investment Economic Analysis – GDP vs. New Single Family Home Sales Economic Analysis – Industrial Production Index vs. Recessions Economic Analysis – Capacity Utilization vs. Recessions Economic Analysis – Real Private Investment vs. Recessions 12/01/1999 03/01/2000 06/01/2000 09/01/2000 12/01/2000 03/01/2001 06/01/2001 09/01/2001 12/01/2001 03/01/2002 06/01/2002 09/01/2002 12/01/2002 03/01/2003 06/01/2003 09/01/2003 12/01/2003 03/01/2004 06/01/2004 09/01/2004 12/01/2004 03/01/2005 06/01/2005 09/01/2005 12/01/2005 03/01/2006 06/01/2006 09/01/2006 12/01/2006 03/01/2007 06/01/2007 09/01/2007 12/01/2007 03/01/2008 06/01/2008 09/01/2008 12/01/2008 03/01/2009 06/01/2009 Financial Analysis - Net Profit Margin Industrials Net Profit Margins vs. SP500 1.30 1.20 1.10 1.00 0.90 0.80 0.70 0.60 Financial Analysis - ROE ROE Industrials vs. SP500 1.70 1.60 1.50 1.40 1.30 1.20 1.10 1.00 0.90 0.80 ROE Industrials (%) 22 21 20 19 18 17 16 15 Financial Analysis - ROE Key Operating Statistics EBITDA Margin Net Profit Margin ROE 2005 2006 2007 2008 2009 18.0% 17.8% 18.5% 18.4% 18.4% 7.7% 8.2% 8.4% 7.8% 7.3% Decreasing 17.3% 17.8% 19.5% 20.7% 21.3% Increasing *Red indicates consensus estimates Stable 30 25 20 15 10 5 0 -5 -10 -15 -20 06/01/2009 03/01/2009 12/01/2008 09/01/2008 06/01/2008 03/01/2008 12/01/2007 09/01/2007 06/01/2007 03/01/2007 12/01/2006 09/01/2006 06/01/2006 03/01/2006 12/01/2005 09/01/2005 06/01/2005 03/01/2005 12/01/2004 09/01/2004 06/01/2004 03/01/2004 12/01/2003 09/01/2003 06/01/2003 03/01/2003 12/01/2002 09/01/2002 06/01/2002 03/01/2002 12/01/2001 09/01/2001 06/01/2001 03/01/2001 12/01/2000 09/01/2000 06/01/2000 03/01/2000 12/01/1999 09/01/1999 06/01/1999 09/01/1999 12/01/1999 03/01/2000 06/01/2000 09/01/2000 12/01/2000 03/01/2001 06/01/2001 09/01/2001 12/01/2001 03/01/2002 06/01/2002 09/01/2002 12/01/2002 03/01/2003 06/01/2003 09/01/2003 12/01/2003 03/01/2004 06/01/2004 09/01/2004 12/01/2004 03/01/2005 06/01/2005 09/01/2005 12/01/2005 03/01/2006 06/01/2006 09/01/2006 12/01/2006 03/01/2007 06/01/2007 09/01/2007 12/01/2007 03/01/2008 06/01/2008 09/01/2008 12/01/2008 03/01/2009 06/01/2009 25 20 15 10 5 0 -5 -10 -15 06/01/1999 Financial Analysis - EPS YOY Growth EPS Industrial YOY Growth EPS YOY Growth vs. SP500 Financial Analysis - Earnings Per Share Next Expected EPS Date: Sep 2004 2005 2006 2007 2008 2009 2010 Mar 2.91 3.48 4.06 4.52 5.05 3.12 3.09 Jun 3.37 4.08 4.52 5.24 5.73 3.21 3.58 Sep 3.34 4.07 4.72 5.22 5.4 3.36 3.88 Dec 3.6 4.37 5.16 5.63 4.72 3.62 4.03 Expected Significant Decrease in 2009 Overall Year Year to Year 13.22 Expected Increase in 2010 Overall 16.00 18.46 20.61 20.90 13.83 14.64 21% 15% 12% 1% -34% 6% *Red indicates consensus estimates Validation Analysis - Industrials Industrials Sector High Low Median Current P/E 30.5 7.1 20.2 10.7 P/S 1.6 0.6 1.4 0.8 P/B 3.6 1.4 3.2 2.3 P/CS 14.0 4.9 11.4 6.7 P/E 1.2 0.66 1.1 0.69 P/S 1.1 0.8 1.0 0.8 P/B 1.3 1.0 1.1 1.1 P/CS 1.2 0.7 1.1 0.8 vs S&P 500 Validation Analysis - P/E vs. S&P 500 Validation Analysis - P/S vs. S&P 500 Validation Analysis - P/B vs. S&P 500 Validation Analysis - P/CF vs. S&P 500 Recommendation Maintain the current overweight of 178 basis points (SIM 11.57% vs. S&P 500 9.79%) Positives: During the recession most of industrial stocks are undervalued Most of the stocks should have an upside when economy turns around Increased government spending (i.e. OSK, GE, Shaw) Low interest rates Risks: Double-dip recession driving prices further down Lag between GDP growth and Industrial growth Companies have divested most of the assets due to the prolonged recession Excess capacity in the housing market and commercial real estate Q&A