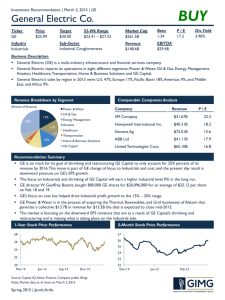

INDUSTRIALS SECTOR The Ohio State University: SIM Program

advertisement

INDUSTRIALS SECTOR GARRETT GANDEE, SHI TING GU, STEVEN ROEHLIG FIN 824 - Industrials Sector Overview The Ohio State University: SIM Program AGENDA O verview B usiness Analysis E conomic Analysis F inancial Analysis Valuation Analysis R ecommendation FIN 824 - Industrials Sector Overview SIM PORTFOLIO WEIGHT December, 2011 FIN 824 - Industrials Sector Overview INDUSTRIALS OVERVIEW Sector Size Market Cap = 1.2 Trillion Industries S&P Sectors Air Freight & Logistics Airlines Industrials Building Products Commercial Printing Construction / Engineering Electrical Components Industrial Conglomerates Railroads Industrial & Construction Machinery Data Processing, Environmental Services Farm Machinery FIN 824 - Industrials Sector Overview SEVEN LARGEST COMPANIES FIN 824 - Industrials Sector Overview RECENT PERFORMANCE Last Year Last Quarter Earnings Per Share Up 21% Revenues (% Change) Up 10% Earnings Per Share Up 20% Revenues (% Change) Up 11% FIN 824 - Industrials Sector Overview PAST PERFORMANCE VS. S&P 500 • Very Highly Correlated - r = .98 FIN 824 - Industrials Sector Overview INDUSTRIALS LIFE CYCLE PHASE Industrials Sector is in the “Maturity Phase” • Performance tied to market • Selling in large volumes • Maximizing Profit • Stable # of Competitors FIN 824 - Industrials Sector Overview FIVE FORCES ANALYSIS FIN 824 - Industrials Sector Overview KEY DRIVERS Gross Domestic Product New Product Orders Government Spending Business Capital Spending Manufacturing Capacity Utilization Oil Prices FIN 824 - Industrials Sector Overview New Orders • Machinery orders appear to have peaked. FIN 824 - Industrials Sector Overview Capacity Utilization • Utilization peaking; still some slack. FIN 824 - Industrials Sector Overview Business Capital Expenditures • Businesses continue to invest as economy recovers. FIN 824 - Industrials Sector Overview Business Capital Expenditures • Industrial spending strong as output recovers. FIN 824 - Industrials Sector Overview Economy • Recovery still gradual; expected to pick up pace. FIN 824 - Industrials Sector Overview Real-GDP 10-Year • Pace of recovery softens as consumption moderates. FIN 824 - Industrials Sector Overview Oil Prices • Prices slightly higher on Middle-East instability. FIN 824 - Industrials Sector Overview New Orders • Supported by higher oil prices FIN 824 - Industrials Sector Overview Nominal-GDP 10-Year • Consumer spending and inventory support growth. FIN 824 - Industrials Sector Overview HOUSING BOTTOM? FIN 824 - Industrials Sector Overview Valuation Analysis Absolute (Sector) P/Trailing E P/Forward E P/B P/S P/CF Median Rela+ve Current Current Median Current 18.1 15.3 1.1 1.2 16.7 13.4 16.5 13.7 1.1 1.1 15.6 13.3 3.1 2.7 1.1 1.3 2.8 2.2 1.4 1.2 1 1 1.4 1.2 11.1 10.3 1.1 1.1 10.4 9.3 Aero/Defense Industry Median S&P Median Conglomerates Current Median Machinery Current Median Current P/Trailing E 18.1 15.3 17.5 14.5 18.1 15.6 P/Forward E 16.5 13.7 16.6 13.4 16.5 14.0 P/B 3.1 2.7 3.1 1.8 3.1 2.7 P/S 1.4 1.2 2.0 1.4 1.4 1.2 11.1 10.3 11.6 9.3 11.1 10.4 P/CF FIN 824 - Industrials Sector Overview FINANCIAL ANALYSIS The estimated growth rate of the sector in the next few years is roughly 6%-9%. Cash flow to Earnings ratio is around 1.3. ROE for the sector is higher than the market. FIN 824 - Industrials Sector Overview SALES OF UTX COMPARED TO INDUSTRY The revenue of UTX is constantly growing during the past 5years, with a slightly back during the financial crisis FIN 824 - Industrials Sector Overview SALES OF DHR COMPARED TO INDUSTRY The revenue growth rate of DHR is much better than the performance of the industry. FIN 824 - Industrials Sector Overview SALES OF FLS COMPARED TO INDUSTRY With a slightly back during the financial crisis, it seems Machinery industry will gain a huge growth in revenue during the next few years. FIN 824 - Industrials Sector Overview Financial Analysis FIN 824 - Industrials Sector Overview RECOMMENDATIONS Currently -1.18% Underweight Our recommendation is to move to even weight, or slightly overweight Took into account Gina Martin Adams’ recommendation to increase weight in this sector Pros Future Indicators (Capacity Utilization, Oil, Employment) look good Cons General economic volatility FIN 824 - Industrials Sector Overview RECOMMENDATIONS WITHIN SECTOR Industry Diversified Machinery Aerospace and Defense Products and Services Industrial Electrical Equipment Farm & ConstrucKon Machinery Industrial Equipment & Components Waste Management General Building Materials Metal FabricaKon Aerospace & Defense – Major Diversified Heavy ConstrucKon ResidenKal ConstrucKon Machine Tools & Accessories Small Tools & Accessories Cement General Contractors TexKle Industrial PolluKon & Treatment Controls Lumber, Wood ProducKon Manufactured Housing FIN 824 - Industrials Sector Overview QUESTIONS? FIN 824 - Industrials Sector Overview