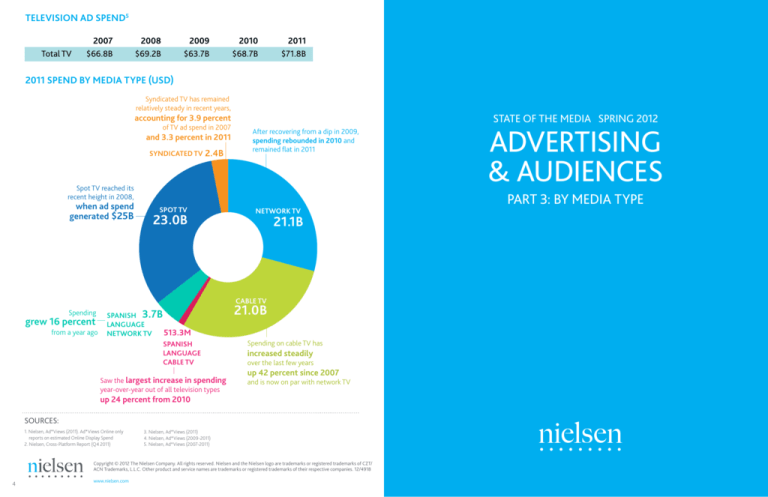

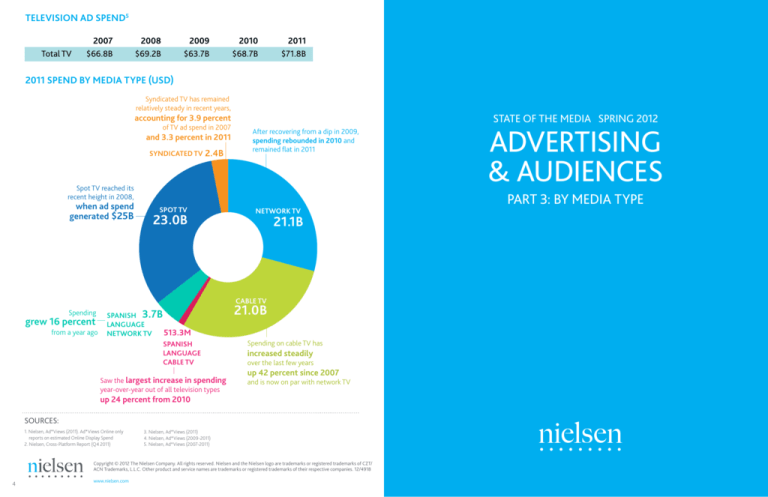

Television Ad Spend5

Total TV

2007

$66.8B

2008

$69.2B

2009

$63.7B

2010

$68.7B

2011

$71.8B

2011 Spend by Media Type (USD)

Syndicated TV has remained

relatively steady in recent years,

STATE OF THE MEDIA Spring 2012

accounting for 3.9 percent

of TV ad spend in 2007

and 3.3 percent in 2011

SYNDICATED TV 2.4B

After recovering from a dip in 2009,

spending rebounded in 2010 and

remained flat in 2011

Spot TV reached its

recent height in 2008,

when ad spend

generated $25B

SPOT TV

23.0B

NETWORK TV

Advertising

& Audiences

Part 3: BY MEDIA TYPE

21.1B

CABLE TV

Spending

grew 16 percent

from a year ago

SPANISH 3.7B

LANGUAGE

513.3M

NETWORK TV

SPANISH

LANGUAGE

CABLE TV

Saw the largest increase in spending

year-over-year out of all television types

21.0B

Spending on cable TV has

increased steadily

over the last few years

up 42 percent since 2007

and is now on par with network TV

up 24 percent from 2010

SOURCES:

1. Nielsen, Ad*Views (2011). Ad*Views Online only

reports on estimated Online Display Spend

2. Nielsen, Cross-Platform Report (Q4 2011)

3. Nielsen, Ad*Views (2011)

4. Nielsen, Ad*Views (2009-2011)

5. Nielsen, Ad*Views (2007-2011)

Copyright © 2012 The Nielsen Company. All rights reserved. Nielsen and the Nielsen logo are trademarks or registered trademarks of CZT/

ACN Trademarks, L.L.C. Other product and service names are trademarks or registered trademarks of their respective companies. 12/4918

4

www.nielsen.com

1

AN IN-DEPTH LOOK AT AUDIENCES

AND ADVERTISING

Overall, the amount of national TV ad units

rose 14% from 2010 to 2011

BY MEDIA TYPE

2011 AD SPEND BY MEDIA TYPE (USD)1

Monthly Time Spent in Hours: Minutes

0:00 YOY

4:20

+35.7% YOY

Mobile Subscribers Watching

Video on a Mobile Phone

33.5M

+0:11 YOY

4:34

+4.2% YOY

Watching Video on Internet

147.4M

+0:18 YOY

26:10

+7.1% YOY

113.5M

12B

Internet

Newspapers

Watching Timeshifted TV

6B

(only in homes with DVRs)

Television

Magazines

-0:46 YOY

Radio

153:19

72B

-0.5%

NETWORK TV

Monthly time spent Q4 11

16B

7B

In the U.S., ad spending increased 2 percent from 2010.

TOP CATEGORIES BY SPEND3

All Media

Direct Response

Restaurant

All English and Spanish Language TV

TV COMMERCIAL LENGTH4

Share of All Commercial Units

Dish Network

$10.2B

$1.9B

TOP BRANDS*

Allstate

$1.9B $1.7B

Automotive

Department Store $3.4B

2009

$265.9M $239.5M

$1.1B

$278.1M

Home Depot

2011

:15

:15

33%

33%

34%

:30

46%

48%

47%

:60

10%

9%

9%

AT&T

$283.2M

2010

Comcast

Motion Picture $3.5B

The average length of a TV

commercial in 2011

CABLE TV

Overall usage Q4 11

Auto Insurance

28.4s

Monthly Audience Reach (P2+)

-1.7% YOY

Television ad spend in 2011 was

up 4.5 percent from 2010, with

spending on Spanish-language cable

and network TV seeing double

digit growth (up 24% and 16%,

respectively). Though print makes

up a significant share of annual ad

spend--accounting for 25 percent-more is spent on TV than all other

platforms combined.

+5.4%

CROSS-PLATFORM VIDEO VIEWING2

On Traditional TV

284.4M

American advertisers and

consumers’ appetite for television

is apparent, as TV holds the lion’s

share of ad dollars and consumers’

media time. The third and final part

of Nielsen’s look at audiences and

advertising offers an in-depth look

at media by platform.

YOY % CHANGE

IN AD SPEND

$4.2B

Quick Service

Restaurants

Automotive Dealership $3.5B

$3.9B

Pharmaceutical

$3.6B

Telephone Services / Wireless

$315.6M

$702.2M

Walmart

Verizon Wireless

$326.3M

DIRECTV

$335.7M

State Farm

$414.8M

Geico

Read as: In 2011, $10.2 billion was spent on Automotive advertising

* AT&T Wireless Web Access, Verizon Wireless Web Access, Geico Auto Insurance, State Farm Auto Insurance, DIRECTV Satellite Services, Wal-Mart Dept Store,

Comcast Xfinity, Home Depot Home Improvement, Dish Network Satellite Services, Allstate Auto Insurance

Source: Nielsen

2

Copyright © 2012 The Nielsen Company.

3