Document 10895202

advertisement

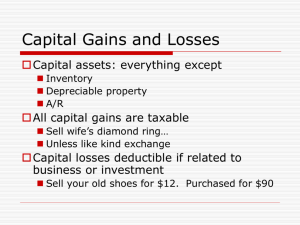

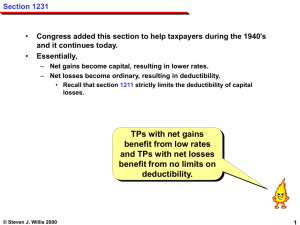

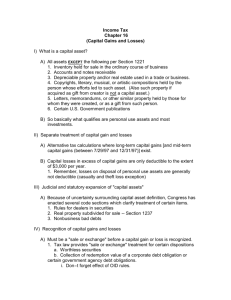

Presentation: Federal Income Taxation Chapter 19 Capital Gains Professor Wells November 11, 2015 1 Chapter 8 Capital Gains p.1103 Issues: 1) Meshing capital gains and losses 2) Capital gains policy issues 3) “Capital Asset” definition 4) Depreciation recapture 5) Code § 1231 property defined 2 Mechanics of the Treatment of Capital Gains & Losses p.1104 §1001(a) – determine the amount of the gain realized; how determine tax basis? See §6045(g) re brokers to report basis re securities transactions. §1001(c) - gain to be “recognized” - unless otherwise provided 3 Tax Benefits and Planning Objectives Capital Gains p.1106 1. Beneficial rate treatment - §1(h) provides for a capped 20% tax rate for long term capital gains, subject to certain exceptions (e.g., collectibles). 2. Capital losses cannot be used to offset ordinary income (except for individuals to the extent of $3,000 per year). How maximize the use of capital losses? 3. Definitional consideration: what is a capital asset? $ $ $ $ $ $ $$$ $ $ 4 When Capital Gains Exceed Capital Losses p.1106 Capital gains - §1(h) - lower tax rates. 1. Note that qualifying dividends (see p. 1112) are entitled to capital gains rate preference. 2. Note the multiple rates in §1(h) are designed to ensure a capital gains rate preference for lower brackets. Code §1222(11) - the excess of net long-term capital gain over net short-term capital loss is “net capital gain”. Meshing of (i) long term capital gains and losses and (ii) short term capital gains and losses is required to preclude arbitraging the tax rate structure. 5 Capital Losses Exceed Capital Gains p.1107 1) Deductible losses are available only to the extent of aggregate capital gains, but each year individuals can deduct $3,000 excess capital losses against ordinary income. Code §1211(b). The limited $3,000 deduction for individuals does permit low level “cherry picking” for loss utilization. See §1211(b) re $3,000 capital loss allowance. 2) Code §1212(b) allows an indefinite carryover of capital losses for individuals. Code §1212(a) provides a five year carryover limit for corporations, but a carryback is available for three years. 6 Example #1 Example 1: The taxpayer has taxable income of $300,000 for the year excluding capital gains and losses from stocks. Her capital gains and losses are as follows: Long-term capital gain $5,000 §1222(3) Long-term capital loss <$1,000> §1222(4) Net long-term capital gain $4,000 §1222(7) Short-term capital gain $2,000 §1222(1) Short-term capital loss <$3,500> §1222(2) Net short-term capital loss <$1,500> §1222(6) Net capital gain $2,500 §1222(11) The taxable income of $300,000 (excluding the capital gains) is taxed at the ordinary income rates. The net capital gain of $2,500 is taxed at a 20 percent rate per §1(h)(1)(D). 7 Example #2 Example 2: The taxpayer has taxable income of $300,000 for the taxable year excluding capital gains and losses from stocks. Her capital gains and losses are as follows: Long-term capital gain $5,000 §1222(3) Long-term capital loss <$1,000> §1222(4) Net long-term capital gain $4,000 §1222(7) Short-term capital gain $2,000 §1222(1) Short-term capital loss <$ 500> §1222(2) Net short-term capital gain $1,500 §1222(5) The taxpayer’s taxable income of $300,000 plus the net short-term capital gain of $1,500 is taxed at the ordinary income rates. The net long-term capital gain of $4,000 is taxed at a 20 percent rate per §1(h)(1)(D).! 8 Example #3 Example 3: The taxpayer has taxable income for the taxable year of $300,000 excluding capital gains and losses from stocks. Her capital gains and losses are as follows: Long-term capital gain $1,000 §1222(3) Long-term capital loss <$5,000> §1222(4) Net long-term capital loss <$4,000> §1222(8) Short-term capital gain $2,000 §1222(1) Short-term capital loss <$ 500> §1222(2) Net short-term capital gain $1,500 §1222(5) Net capital loss <$2,500> §1222(10) The taxpayer is permitted to net the $2,500 capital loss against up to $3,000 of ordinary income. Thus, the taxpayer has $297,500 taxable income taxed at ordinary income rates. 9 Example #4 Example 4: The taxpayer has taxable income for the taxable year of $300,000 excluding capital gains and losses from stocks. Her capital gains and losses are as follows: Long-term capital gain $1,000 §1222(3) Long-term capital loss <$5,000> §1222(4) Net long-term capital loss <$4,000> §1222(8) Short-term capital gain $1,000 §1222(1) Short-term capital loss <$3,000> §1222(2) Net short-term capital loss <$2,000> §1222(6) Net capital loss <$6,000> §1222(10) The taxpayer is permitted to use $3,000 of the $7,000 capital loss against up to $3,000 of ordinary income. Thus, the taxpayer has $297,000 of taxable income taxed at ordinary income rates. In addition, she will carry over to the following year $3,000 of long-term capital loss. For purposes of determining the character of the losses carried over to a subsequent year, any short-term losses are deemed to offset ordinary income before longterm losses. §1212(b)(2).! 10 Planning considerations – “Harvesting losses” Sell gain and loss assets in the same year? No (except for those individuals regularly having significant capital gains and losses); stagger gains and losses so as to (a) first use capital losses against $3,000 of ordinary income, and (b) then have long term gains taxed at the preferable 20% tax rate per §1(h)(1)(D) (or in reverse chronological order). 11 Defining the Term “Capital Asset” – Code § 1221 p.1109 Code §1221 provides a definition of “capital asset” as not including: (i) inventory and property held primarily for sale to customers (ii) Real property or depreciable property used in a trade or business, but see §1231. (iii) Copyrights and similar property (iv) Accounts receivable (v) US government publications §1231 property– Losses ordinary. Gains capital. 12 Code §1231 (see Chapter 14D) Trade or Business Assets 1231 Asset §1231 is an amphibian regime. 1. Aggregate Code §1231 gains are treated as long term capital gain. Aggregate Code §1231 losses are treated as ordinary losses. A five year meshing rule applies to preclude staggering of these gains and losses to enable arbitraging the tax rate differential - Code §1231(c). 2. But, remember §1245 recapture rules Hypo: asset tax basis is reduced (below FMV?) by tax depreciation. Code §1016(a)(2). §1245 steps in to treat all disposition gain equal to prior tax depreciations deductions is ordinary. 3. Interplay of statute: §1221 è §1221(a)(2) è§1231 è §1245 13 Planning considerations – “Harvesting losses” p.1114 Question: client has 100x of net long-term losses from sale of securities this year. He is expecting to realize 100x of collectibles gains and 100x of securities gains next year. He could accelerate the securities gains into the current year and asks your advice about whether that would be a good idea from a tax standpoint. Answer: Sell gain and loss assets in the same year? No (except for those individuals regularly having significant capital gains and losses); stagger gains and losses so as to (a) first use capital losses against $3,000 of ordinary income, (b) collectible gain will be offset next year (providing 28% tax benefit) and (c) then have long term gains taxed at the preferable 20% tax rate per §1(h)(1) (D) (or in reverse chronological order). 14 Fragmentation versus Unification of Assets Williams v. McGowan p.1116 Facts: Williams sold hardware $70,000 business to Corning Building Williams Corning Company for $63,926.28 plus $7,000 for favorable closing balance Hardware sheet for working capital (cash= Business $8,100; receivables=$7,000; fixtures=$800; inventory=$49,000 minus accounts payable=$1,000). Total purchase price was $70,000. Held: The sale must be treated as a sale of the separate assets; it must be comminuted. Regardless that a partner.’s interest in a partnership may be a capital asset, when Williams bought out his partner he became a sole owner and must be thought of as owning directly each asset of the business. 15 Temporary Taking p.1121 Commissioner v. Gillette Motor Transport Facts: Taxpayer received a sum received by respondent from the United States as compensation for the temporary taking by the Government of its business facilities during World War II. Issue: Was this payment ordinary income or a capital gain? Held: Payment was ordinary income. The relinquishment of the property right of use of the facilities was not a capital asset. In short, the right to use is not a capital asset, but is simply an incident of the underlying physical property, the recompense for which is commonly regarded as rent. That is precisely the situation here, and the fact that the transaction was involuntary on respondent’s part does not change the nature of the case. 16 Discounted Notes & Bonds p.1125 United States v. Midland-Ross Corp Facts: Taxpayer bought non-interest bearing promissory notes at less than face and sold them shortly before maturity at a gain. The gain that arose from the sale of the financial instrument was the economic equivalent of interest (representing the time value of money of holding the debt instrument). Held: Even though a debt instrument can be a capital asset in the hands of the taxpayer, the gain arising from the sale of that capital asset that represents earned original issue discount is not entitled to capital gain treatment. It is not gain but a substitute for ordinary income. 17 Jones v. Commissioner Purchased Remainder Interest p.1131 Taxpayer purchased remainderman interests in trusts and sells them after the death of the holder of the life interest but before the trust pays out. Taxpayer claims capital gain treatment on the sale of this investment. Court remanded for trial to determine whether gain was related to time value of money. 18 Curtis Co. v. Commissioner Sale to “Customers” p.1136 Housing Sales: Taxpayer built 1,098 rental housing properties that initially were intended to be held and rented. When price controls were removed after WWII, the taxpayer sold all these houses. A 45-acre parcel acquired and was intended to be developed into an apartment complex. Due to zoning problems, taxpayer sold out their interest in the property. Held: Capital gain even though these were sold with professional staff and as individual sales. Unimproved land: Taxpayer bought and sold unimproved real estate for resale. Held: Case remanded for factual determination. 19 Malat v. Riddell p.1136 Facts: A 45-acre parcel acquired and was intended to be developed into an apartment complex. Due to zoning problems, taxpayer sold out their interest in the property. Issue: Was the gain capital gain or ordinary income? Supreme Court: the determination is whether the property was or was not held primarily for sale to customers. “Primarily” means “of first importance” or “principally.” Case remanded to determine what is of first importance. Factors considered in other cases: 1) Frequency and substantiality of sales 2) Development and improvement activities for the land 3) Seller’s solicitation and advertising efforts in sales 4) Relative earnings – property sales vs. earned income 5) Bulk sales 6) Liquidation of investments? 20 Bramblett v. Commissioner Supp. pp. 89-93 FACTS: Baker Bramblett Walker Sexton Lot Lot Town East Baker Bramblett Walker Sexton Large Tracts $9.8 million Mesquite East Ranch 21