TAXCH12

advertisement

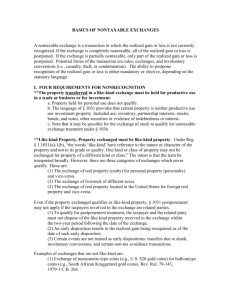

Income Tax Chapter 12 Property Transactions--Nontaxable Exchanges I) Like kind exchanges A) Property involved must be held for productive use in a trade or business or held for investment. 1. Property held for personal use -- does not qualify. 2. Section 1031 specifically excludes the following: notes, stocks, bonds, inventory B) Like kind refers to nature or character of property -- not its grade or quality 1. Real estate for real estate is ok a. Even if unimproved land is exchanged for improved property 2. Equipment for equipment is ok, provided: a. Business property must be within the same "general business asset class" (see page 12-3) or within same product class if not within a general asset class. 3. Real estate for equipment is not ok. C) Transaction must be an exchange -- reciprocal transfer of property 1. Boot does not disqualify exchange a. Boot is property which is not like-kind (generally cash) used to equalize value of items exchanged. b. Any liabilities assumed by taxpayer is treated as boot given, any taxpayer liability assumed by other party is treated as boot received. 2. Nonsimultaneous exchanges may qualify if structured properly. D) The nontaxability of gain and <loss> is mandatory if provisions of Section 1031 are met. 1. So if you have a loss, you may want to sell!! 2. Special rules for exchanges between related parties E) Calculation of realized gain or <loss> on exchange. 1. Compare: FMV of Property received to Adjusted Basis of property given up. F) Analysis of exchange scenarios 1. Pure exchange (no boot) a. No gain or loss is recognized b. Substituted basis (carryover basis) 2. Exchange with boot given a. Boot given is cash i. No gain or <loss> is recognized b. Boot given is non-like kind property other than cash i. Recognize gain or <loss> associated with boot. i.e. gain or loss is recognized to extent of difference between FMV of boot and basis of boot. c. Basis of new property -- see paragraph G below. 3. Exchange with boot received. a. If there is a realized gain then receipt of boot automatically triggers recognition of at least a portion of the gain!!! i. Recognized gain is lesser of: Boot received or Realized gain. G) Calculation of basis of new property: 1. Alternative formulae: FMV of (like-kind) property OR Adjusted basis of property given received + Boot given + Any losses postponed + Gain recognized - Any gains postponed - Boot received - Loss recognized a. Note -- gain and <losses> are not eliminated, just deferred (affect basis of new asset) II) Involuntary Conversions A) Occurs when your property is converted into other property or cash as a result of its being destroyed (partially or fully) by casualty, theft, or condemnation. B) Section 1033 applies only to gains not <losses>. 1. Allows you to defer recognition of gain if you plan to replace property. C) General rules for recognition of gains: 1. If amount realized is less than or equal cost of replacement property -no gain is recognized. 2. If amount realized is greater than cost of replacement property -- gain will be recognized. 3. Note: Time limits for replacement exists. Replacement must be with "qualified" property. Taxpayer must elect to defer gain!! D) Definitions 1. Amount realized -- amount received as compensation for the property converted, less any expenses incurred to obtain proceeds. a. Severance damages--compensation for decline in value of retained property. 2. Qualified replacement property a. More restrictive than "like-kind" rules I. For owner/user the property must be similar or related in use (functional use test) ii. Rental property has a taxpayer use test (owner/investor test) a) Exercise great care in applying this test -- research prior cases. b. Special rule for real property (non personal use) which is condemned -- like-kind rules apply. 3. Time for replacement. a. General rule is two years after close of first tax year in which any part of gain is realized. b. Special rule for non--personal use real property which is condemned -- substitute three for two above. E) No gain or <loss> is ever recognized on direct conversions. (carryover basis) F) Examples: 1. Factory destroyed by fire. Adjust. Basis 30,000 Insurance 25,000 New Factory 33,000 2. Garage condemned by state. Adjust. Basis 14,000 Award 20,000 New garage 18,000 G) Basis of replacement property. 1. Always is: Cost of replacement property - Any postponed gain H) If property was not timely replaced -- must file an amended return for year in which gain elected to be postponed. III) Sale of Principal Residence--pre May 7, 1997 rules A) Gain postponement (Section 1034) vs. gain excluded (Section 121) B) Provisions only apply to principal residence. C) Analysis of Section 1034 1. Replacement period -- two years before and after date of sale a. Must occupy new residence within time frame b. Special rules apply when more than one residence bought within time frame. I. Can not use Section 1034 on sales within two years of the last use of the rules!!! a) Exception if move is job related and expenses are deductible as moving expense. 2. To use Section 1034 to postpone gain taxpayer must reinvest the amount of the adjusted sales price in time period allowed. 3. Important relationships a. Selling price -Selling expense = Amount realized. b. Amount realized - Adjusted basis = Realized gain or <loss> c. Amount realized - Fixing up expenses = Adjusted sales price i. Fixing up expenses -- For work performed during 90 day period before sales contract was made. -- Be paid within 30 days after sales date -- Be otherwise N/D -- Not be a capital improvement d) Basis of new residence = Cost - Postponed gain 4. Example -Home sold for $52,000. Used as principal residence for 10 years. Adjusted basis = $27,000. Brokers fee = $4,000 and fixing up expense = $4,000. Two months later bought new residence for $30,000 D) Analysis of Section 121 1. Can elect to exclude up to $125,000 of gain 2. Once-in-a-lifetime election 3. For a married taxpayer -- spouse must join in election. (ie. Both spouses use election at same time.) 4. Must be at least 55 before date of sale. 5. Must have used residence for at least 3 years during the 5 year period ending on date of sale. E) Sales of personal residences are shown on Form 2119. IV) Sale of Principal Residence--post May 6, 1997 A) Former provisions of Section 1034 and Section121 are effectively repealed 1. Elective provisions exist to have Aold@ rules apply to pre August 5, 1997 sales or exchanges. a) Definition of Aprincipal residence@ as under Section 1034. B) Generally, a taxpayer may exclude gains up to $250,000 ($500,000 under certain circumstances if MFJ) 1. Property must have been owned and used as the taxpayer=s principal residence for at least two years during the five year period ending on the date of the sale or exchange. 2. Provision is applicable to one sale or exchange every two years. a) Sale due to changes in employment, health or other Aunforseen@ circumstances within two years of prior use may qualify for a reduced exclusion. I) Shorter of: Aggregate period of ownership and use as principal residence during five year period ending on date of sale, or period since last used exclusion (date of most recent prior sale or exchange) ----------------------------------------------------- X Exclusion Amt 2 years C) The exclusion does not apply to the extent of any depreciation allowed or allowable with respect to the rental or business use of the principal residence after May 6, 1997. D) Taxpayer may elect not to have the exclusion apply. E) Involuntary conversion of principal residence may be treated as a sale for purposes of determining gain exclusion. 1. If gain exceeds exclusion amount, excess gain may be deferred through timely replacement with qualified residence.