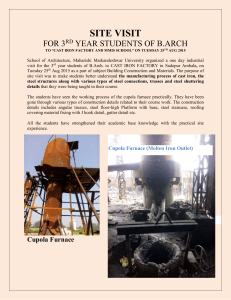

LJBRAR\ ! £~7 6

advertisement