CAPM Capital Asset Pricing Model

advertisement

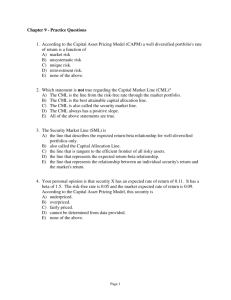

CAPM Capital Asset Pricing Model By Martin Swoboda and Sharon Lu Introduction Modern Portfolio Theory and diversification Beta vs. standard deviation Unsystematic vs. systematic risk Security Market Line (SML) The CAPM equation Asset pricing Assumptions behind using CAPM Modern Portfolio Theory and diversification Rational investors use diversification to optimize their portfolios Diversification reduces portfolio risk (assets that are not perfectly correlated) Efficient Portfolio Beta vs. standard deviation Standard deviation includes systematic and unsystematic risk; not used because unsystematic risk diversified away Beta: A standardized measure of the risk of an individual asset, one that captures only the systematic component of its volatility; measures how sensitive an individual security is to market movements; measure of market risk Unsystematic vs. systematic risk Unsystematic risk: risk that can be eliminated through diversification a.k.a. Unique risk, residual risk, specific risk, or diversifiable risk Systematic risk: risk that cannot be eliminated through diversification a.k.a, market risk or undiversifiable risk Security Market Line Line representing the relationship between expected return and market risk; shows expected return of an overall market as a function of systematic risk Graphical representation of CAPM Compare a single asset to the SML (and see if it falls below, above, or on the line) Security Market Line Capital Asset Pricing Model (CAPM) The expected return on a specific asset equals the risk-free rate plus a premium that depends on the asset’s beta and the expected risk premium on the market portfolio. Expected return of specific asset: E(Ri) Risk-free rate: Rf Expected risk premium: E(Rm) - Rf Practice Problem #1 If the risk-free rate equals 4% and a stock with a beta of 0.8 has an expected return of 10%, what is the expected return on the market portfolio? Practice Problem #1: answer If the risk-free rate equals 4% and a stock with a beta of 0.75 has an expected return of 10%, what is the expected return on the market portfolio? 10% = 4% + 0.75(market portfolio – 4%) 8% = market portfolio – 4% 12% = market portfolio Practice Problem #2 A particular asset has a beta of 1.2 and an expected return of 10%. Given that the expected return on the market portfolio is 13% and the risk-free rate is 5%, the stock is: A. appropriately priced B. underpriced C. overpriced Practice Problem #2: answer A particular asset has a beta of 1.2 and an expected return of 10%. Given that the expected return on the market portfolio is 13% and the risk-free rate is 5%, the stock is: A. appropriately priced B. underpriced C. overpriced; expected return should be 14.6% (5+1.2(13-5)) Asset pricing Future cash flows of the asset can be discounted using the expected return calculated from CAPM to establish the price of the asset If observed price > CAPM valuation overvalued (paying too much for that amount of risk) If observed price < CAPM valuation undervalued Assumptions behind the CAPM U.S. treasuries are risk-free Uncertainty about inflation Assumed that investors can borrow money at same interest rate at which they lend, but generally borrowing rates are higher than lending rates WHY we still use CAPM: benchmark portfolios used Treausry bills and market portfolio Practice Problem #3 Last year… Firm A: return: 10%, beta: 0.8 Firm B: return: 11%, beta: 1.0 Firm C: return: 12%, beta: 1.2 Given that the risk-free rate was 3% and market return was 11%, which firm had the best performance? Practice Problem #3: answer Firm A: 3% + 0.8(11%-3%) = 9.4% (over) Firm B: 3% + 1.0(8%) = 11% (same) Firm C: 3% + 1.2(8%) = 12.6% (under) Firm A performed the best because it exceeded the expected return