Valuing our Accounts

advertisement

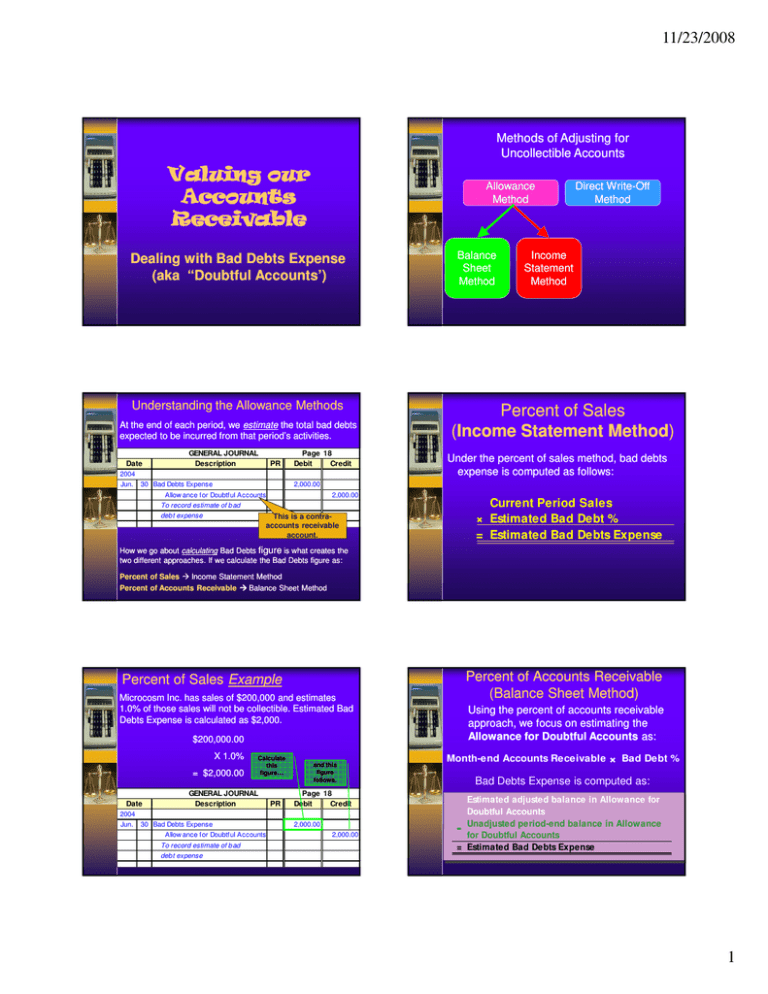

11/23/2008 Methods of Adjusting for Uncollectible Accounts Valuing our Accounts Receivable Allowance Method Dealing with Bad Debts Expense (aka “Doubtful Accounts’) Understanding the Allowance Methods At the end of each period, we estimate the total bad debts expected to be incurred from that period’s activities. Date GENERAL JOURNAL Description PR Page 18 Debit Credit 2004 Jun. 30 Bad Debts Expense Balance Sheet Method Direct WriteWrite-Off Method Income Statement Method Percent of Sales (Income Statement Method) Method) Under the percent of sales method, bad debts expense is computed as follows: 2,000.00 Allow ance for Doubtful Accounts 2,000.00 Current Period Sales × Estimated Bad Debt % = Estimated Bad Debts Expense To record estimate of b ad This is a contraaccounts receivable account. debt expense How we go about calculating Bad Debts figure is what creates the two different approaches. If we calculate the Bad Debts figure as: Percent of Sales Income Statement Method Percent of Accounts Receivable Balance Sheet Method Percent of Accounts Receivable (Balance Sheet Method) Percent of Sales Example Microcosm Inc. has sales of $200,000 and estimates 1.0% of those sales will not be collectible. Estimated Bad Debts Expense is calculated as $2,000. Using the percent of accounts receivable approach, we focus on estimating the Allowance for Doubtful Accounts as: $200,000.00 X 1.0% = $2,000.00 Date Calculate this figure… GENERAL JOURNAL Description PR and this figure follows. Page 18 Debit Credit 2004 Jun. 30 Bad Debts Expense Allow ance for Doubtful Accounts To record estimate of b ad 2,000.00 2,000.00 Month-end Accounts Receivable × Bad Debt % Bad Debts Expense is computed as: Estimated adjusted balance in Allowance for Doubtful Accounts Unadjusted period-end balance in Allowance for Doubtful Accounts = Estimated Bad Debts Expense - debt expense 1 11/23/2008 Percent of Accounts Receivable Example Our aim is to create a desired balance in Allowance for Doubtful Accounts. $ × = $ Date 50,000 5.00% 2,500 Jun. Allowance for Doubtful Accounts 500 What do we need in order to get this balance? 30 Bad Debts Expense 2,000 2,500 GENERAL JOURNAL Description 2004 Reviewing Methods to Estimate Bad Debts We already had a balance forward! PR and this figure follows. % of Receivables Emphasis on Matching Emphasis on Realizable Value Sales Page 18 Debit Credit Bad Debts Exp. Accts. Rec. (total) Allowance for Doubtful Accts. 2,000.00 Allow ance for Doubtful Accounts Income Statement Focus 2,000.00 Calculate this figure… To record estimate of b ad debt expense Writing Off a Bad Debt account is determined to be uncollectible, Allowance for Doubtful Accounts will be debited… ♦ and the customer’s account receivable will be credited. GENERAL JOURNAL Description ♦ Subsequent collections require that the original writewrite-off entry be reversed before the cash collection is recorded. GENERAL JOURNAL Page 18 Date PR Debit Credit Page 18 Description PR Debit Credit 2001 Mar. 11 Accounts Receivable - Kent Allowance for doubtful accounts 2001 Jan. 23 Allowance for Doubtful Accounts Accounts Receivable - Kent Balance Sheet Focus Recovery of a Bad Debt ♦ Within either allowance method, when an Date % of Sales 520 520 520 To re-instate a ccount previ ousl y written off 520 To record write-off of Jack Kent's uncollectible account 11 Cash Accounts Receivable - Kent 520 520 To record payment of account i n full Direct WriteWrite-Off Method Example Direct WriteWrite-Off Method ♦ On January 23, TechCom determines it ♦ If Jack Kent later pays the $520, the cannot collect $520 from Jack Kent, a credit customer. ♦ The account is expensed at time of write--off. write previous entry is simply reversed and the cash collection is recorded. GENERAL JOURNAL Date Description PR Page 18 Debit Credit 2001 GENERAL JOURNAL Date Description Page 18 PR Debit Credit 2001 Jan. 23 Bad Debts Expense Accounts Receivable - Kent To wri te off uncoll ecti lbe account 520 520 Mar. 11 Accounts receivable Bad Debt Expense 520 520 to reverse previous write-off 11 Cash Account receivable 520 520 to record receipt of payment 2 11/23/2008 Aging of Accounts Receivable Method Aging of Accounts Receivable Example At December 31, 2001, the receivables for DeCor were categorized as follows: Year-end Accounts Receivable is broken down into age classifications. DeCor Schedule of Accounts Receivable by Age 31-Dec-01 Each age grouping has a different likelihood of being uncollectible. Days Past Due Current 1 - 30 31 - 60 61 - 90 Over 90 Compute a separate allowance for each age grouping. DeCor Schedule of Accounts Receivable by Age 31-Dec-01 Accounts Estimated Estimated Receivable Bad Debts Uncollectible Days Past Due Balance Percent Amount $ 37,000 6,500 3,500 1,900 1,000 49,900 2% $ 5% 10% 25% 40% $ x = 37,000 6,500 3,500 1,900 1,000 49,900 Aging of Accounts Receivable Example Using estimated bad debt percentages, DeCor would calculate the estimated uncollectible amount as follows: $ $ $ Aging of Accounts Receivable Example Current 1 - 30 31 - 60 61 - 90 Over 90 Accounts Receivable Balance 740 325 350 475 400 2,290 DeCor’s unadjusted balance in the allowance account is a debit of $200. The previous computation shows the desired balance is $2,290. Therefore, the adjusting entry is for $2,290 + 200 = $2,490. Date GENERAL JOURNAL Description Allowance for Doubtful Accounts 200 2,490 2,290 PR Page 18 Debit Credit 2004 Jun. 30 Bad Debts Expense Allow ance for Doubtful Accounts 2,490.00 2,490.00 To record estimate of b ad debt expense 3