Accounting Review Ex 10

advertisement

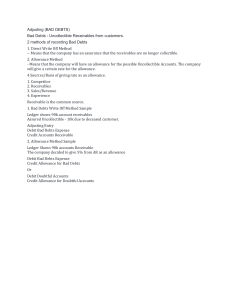

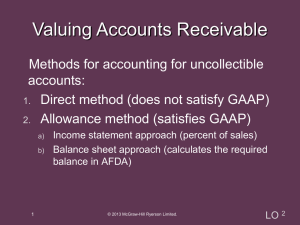

Accounting System Applications Accounting Review 10 Short Answer Exercise Instructions: Click the text box beside Name and enter your name. Press the tab key to move to the first answer box and enter the first answer for the question on the left. Continue to press tab to advance to each answer box. Most answers can be found in the Lesson Comments or in Chapter 12 of your QuickBooks text. When you have answered all questions, save your changes and upload this document to Lesson 1 Assignments in NS Online. This exercise is worth 10 points. Name 1. An outline of the projected incomes and expenses of a business is known as a(n) 1) 2. Company A uses the Allowance Method, percentage of receivables approach of estimating bad debts. The company has an ending balance in Accounts Receivable of $50,000, an ending balance in Allowance for Doubtful Accounts of $100, and an ending balance in the Sales account of $275,000. The company estimates that bad debts will be 5% of outstanding accounts receivable. What amount should be recorded as Bad Debt Expense? 1) 3. Company A uses the Allowance Method, percentage of sales approach of estimating bad debts. The company has an ending balance in Accounts Receivable of $50,000, an ending balance in Allowance for Doubtful Accounts of $100, and an ending balance in the Sales account of $275,000. The company estimates that bad debts will be 1% of outstanding sales. What amount should be recorded as Bad Debt Expense? 1) Continued on the next page. 4. Company B uses the Allowance Method to estimate and record bad debts. Bad debts are estimated to be $1,000. Draft the entry that you would record in the QB journal. Account Debit 5. Company C uses the Direct write-off Method to record bad debts. The account of Joy Martin in the amount of $850 has been determined to be uncollectible. Draft the entry that you would record in the QB journal. Account Debit