Sample Exam Questions -

advertisement

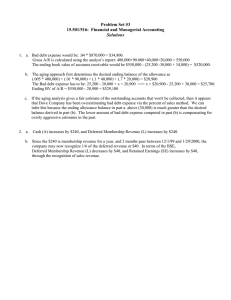

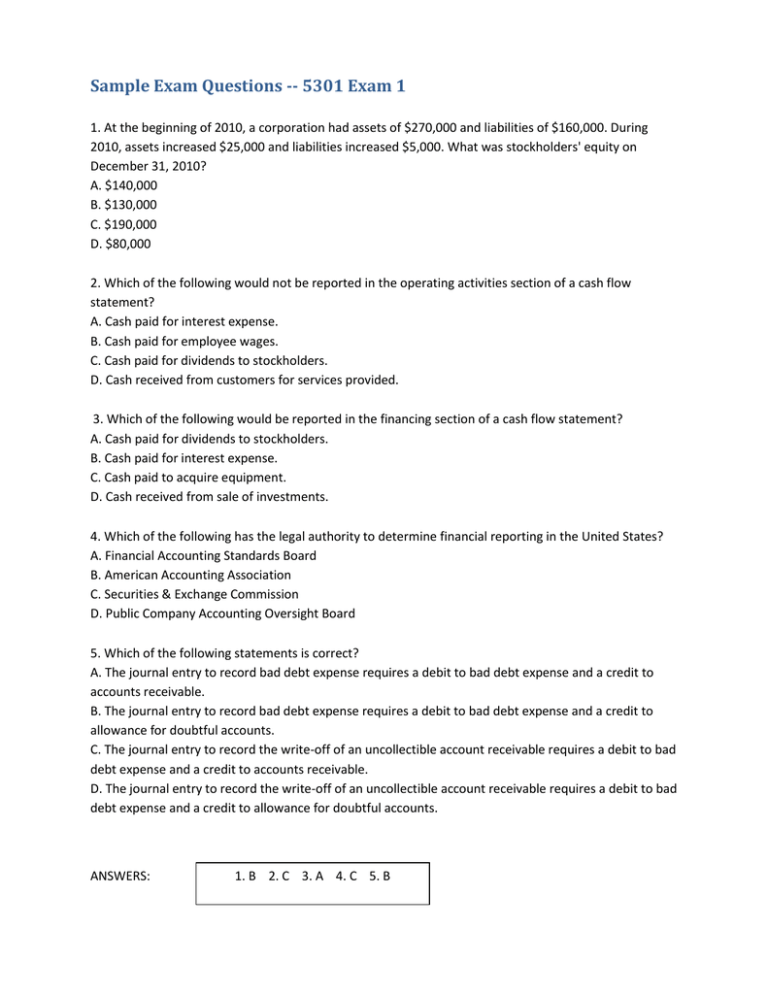

Sample Exam Questions -- 5301 Exam 1 1. At the beginning of 2010, a corporation had assets of $270,000 and liabilities of $160,000. During 2010, assets increased $25,000 and liabilities increased $5,000. What was stockholders' equity on December 31, 2010? A. $140,000 B. $130,000 C. $190,000 D. $80,000 2. Which of the following would not be reported in the operating activities section of a cash flow statement? A. Cash paid for interest expense. B. Cash paid for employee wages. C. Cash paid for dividends to stockholders. D. Cash received from customers for services provided. 3. Which of the following would be reported in the financing section of a cash flow statement? A. Cash paid for dividends to stockholders. B. Cash paid for interest expense. C. Cash paid to acquire equipment. D. Cash received from sale of investments. 4. Which of the following has the legal authority to determine financial reporting in the United States? A. Financial Accounting Standards Board B. American Accounting Association C. Securities & Exchange Commission D. Public Company Accounting Oversight Board 5. Which of the following statements is correct? A. The journal entry to record bad debt expense requires a debit to bad debt expense and a credit to accounts receivable. B. The journal entry to record bad debt expense requires a debit to bad debt expense and a credit to allowance for doubtful accounts. C. The journal entry to record the write-off of an uncollectible account receivable requires a debit to bad debt expense and a credit to accounts receivable. D. The journal entry to record the write-off of an uncollectible account receivable requires a debit to bad debt expense and a credit to allowance for doubtful accounts. ANSWERS: 1. B 2. C 3. A 4. C 5. B