Financial Accounting

John J. Wild

Seventh Edition

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Chapter 7

Reporting and Analyzing

Receivables

C1

Accounts Receivable

Amounts due from

customers for credit sales.

Credit sales require:

Maintaining a separate

account receivable for

each customer.

Accounting for bad

debts that result from

credit sales.

7-3

C1

Credit Card Sales

With some credit cards and nearly all debit

cards, the seller deposits the credit card

sales receipts in the bank just like it

deposits a customer’s check.

The bank increases the balance in the

company’s checking account.

The company usually pays a fee of 1%

to 5% of card sales, for the service.

7-4

P1/P2

Valuing Accounts Receivable

Some customers may not pay

their account. Uncollectible

amounts are referred to as bad

debts. There are two methods

of accounting for bad debts:

Direct Write-Off Method

Allowance Method

7-5

P1

Matching vs. Materiality

The matching

(expense recognition)

principle requires

expenses to be reported

in the same accounting

period as the sales they

help produce.

The materiality

constraint states

that an amount can

be ignored if its

effect on the

financial statements

is unimportant to

users’ business

decisions.

7-6

P2

Allowance Method

At the end of each period, estimate total bad debts

expected to be realized from that period’s sales.

There are two advantages to the allowance method:

1. It records estimated bad debts expense in the

period when the related sales are recorded.

2. It reports accounts receivable on the balance

sheet at the estimated amount of cash to be

collected.

7-7

P2

Estimating Bad Debts Expense

Two Methods

1. Percent of Sales Method (Income

Statement Method); and

2. Accounts Receivable Methods

(Balance Sheet Methods)

Percent of Accounts

Receivable Method

Aging of Accounts

Receivable Method.

7-8

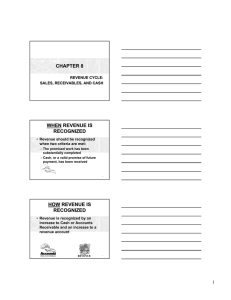

P2

Summary of Allowance Methods:

Estimate based

on % of Sales

Emphasis on

Matching

Sales

Bad

Debts

Exp.

Income

Statement

Focus

Estimate based on

% of Receivables

Estimate based on

an Aging of

Receivables

Emphasis on

Realizable Value

Emphasis on

Realizable Value

Accts.

Rec.

Accts.

Rec.

All. for

Doubtful

Accts.

Balance

Sheet Focus

All. for

Doubtful

Accts.

Balance

Sheet Focus

7-9

C2

Notes Receivable

Date of note

$1,000.00

Term

July 10, 2013

Payee

Ninety days

Principal

after

date I promise to pay to

the order of Barton Company, Los Angeles, CA

One thousand and no/100 --------------------------------- Dollars

Payable at

First National Bank of Los Angeles, CA

Interest Rate

Value received with interest at

No.

42

12%

Due Oct. 8, 2013

per annum

Maker

Julia Browne

Due Date

7-10

End of Chapter 7

7-11