CHAPTER 16

advertisement

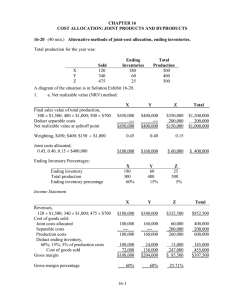

CHAPTER 16 COST ALLOCATION: JOINT PRODUCTS AND BYPRODUCTS 16-16 (20-30 min.) Joint-cost allocation, insurance settlement. 1. (a) Breasts Wings Thighs Bones Feathers Sales value at splitoff method: Pounds of Product 100 20 40 80 10 250 Wholesale Selling Price per Pound $0.55 0.20 0.35 0.10 0.05 Sales Value at Splitoff $55.00 4.00 14.00 8.00 0.50 $81.50 Weighting: Sales Value at Splitoff 0.675 0.049 0.172 0.098 0.006 1.000 Joint Costs Allocated $33.75 2.45 8.60 4.90 0.30 $50.00 Allocated Costs per Pound 0.3375 0.1225 0.2150 0.0613 0.0300 Costs of Destroyed Product Breasts: $0.3375 per pound 40 pounds = $13.50 Wings: $0.1225 per pound 15 pounds = 1.84 $15.34 b. Physical measure method: Breasts Wings Thighs Bones Feathers Pounds of Product 100 20 40 80 10 250 Weighting: Physical Measures 0.400 0.080 0.160 0.320 0.040 1.000 Costs of Destroyed Product Breast: $0.20 per pound 40 pounds Wings: $0.20 per pound 15 pounds Joint Costs Allocated $20.00 4.00 8.00 16.00 2.00 $50.00 = = Allocated Costs per Pound $0.200 0.200 0.200 0.200 0.200 $ 8 3 $11 Note: Although not required, it is useful to highlight the individual product profitability figures: Product Breasts Wings Thighs Bones Feathers Sales Value $55.00 4.00 14.00 8.00 0.50 Sales Value at Splitoff Method Joint Costs Gross Allocated Income $33.75 $21.25 2.45 1.55 8.60 5.40 4.90 3.10 0.30 0.20 16-1 Physical Measures Method Joint Costs Gross Allocated Income $20.00 $35.00 4.00 0.00 8.00 6.00 16.00 (8.00) 2.00 (1.50) 2. The sales-value at splitoff method captures the benefits-received criterion of cost allocation and is the preferred method. The costs of processing a chicken are allocated to products in proportion to the ability to contribute revenue. Quality Chicken’s decision to process chicken is heavily influenced by the revenues from breasts and thighs. The bones provide relatively few benefits to Quality Chicken despite their high physical volume. The physical measures method shows profits on breasts and thighs and losses on bones and feathers. Given that Quality Chicken has to jointly process all the chicken products, it is nonintuitive to single out individual products that are being processed simultaneously as making losses while the overall operations make a profit. Quality Chicken is processing chicken mainly for breasts and thighs and not for wings, bones, and feathers, while the physical measure method allocates a disproportionate amount of costs to wings, bones and feathers. 16-17 (10 min.) Joint products and byproducts (continuation of 16-16). 1. Ending inventory: Breasts 15 Wings 4 Thighs 6 Bones 5 Feathers 2 $0.3375 = 0.1225 = 0.2150 = 0.0613 = 0.0300 = $5.06 0.49 1.29 0.31 0.06 $7.21 2. Joint products Breasts Thighs Net Realizable Values of byproducts: Wings $ 4.00 Bones 8.00 Feathers 0.50 $12.50 Byproducts Wings Bones Feathers Joint costs to be allocated: Joint costs – Net Realizable Values of byproducts = $50 – $12.50 = $37.50 Breast Thighs Pounds of Product Wholesale Selling Price per Pound Sales Value at Splitoff Weighting: Sales Value at Splitoff Joint Costs Allocated Allocated Costs Per Pound 100 40 $0.55 0.35 $55 14 $69 55 ÷ 69 14 ÷ 69 $29.89 7.61 $37.50 $0.2989 0.1903 Ending inventory: Breasts 15 $0.2989 Thighs 6 0.1903 $4.48 1.14 $5.62 3. Treating all products as joint products does not require judgments as to whether a product is a joint product or a byproduct. Joint costs are allocated in a consistent manner to all products for the purpose of costing and inventory valuation. In contrast, the approach in requirement 2 lowers the joint cost by the amount of byproduct net realizable values and results in inventory values being shown for only two of the five products, the ones (perhaps arbitrarily) designated as being joint products. 16-2 16-18 (10 min.) Net realizable value method. A diagram of the situation is in Solution Exhibit 16-18. Corn Syrup Corn Starch $625,000 375,000 $250,000 0.8 $260,000 $156,250 93,750 $ 62,500 0.2 $ 65,000 Final sales value of total production, 12,500 $50; 6,250 $25 Deduct separable costs Net realizable value at splitoff point Weighting, $250,000; $62,500 $312,500 Joint costs allocated, 0.8; 0.2 $325,000 Total $781,250 468,750 $312,500 $325,000 SOLUTION EXHIBIT 16-18 (all numbers are in thousands) Joint Costs Separable Costs Processing $375,000 Corn Syrup: 12,500 cases at $50 per case Processing $93,750 Corn Starch: 6,250 cases at $25 per case Processing $325000 Splitoff Point 16-20 (40 min.) Alternative methods of joint-cost allocation, ending inventories. Total production for the year was: Ending Inventories 175 75 70 Sold X Y Z 75 225 280 Total Production 250 300 350 A diagram of the situation is in Solution Exhibit 16-20. 1. a. Net realizable value (NRV) method: X Final sales value of total production, 250 $1,800; 300 $1,300; 350 $800 Deduct separable costs Net realizable value at splitoff point 16-3 $450,000 –– $450,000 Y Z Total $390,000 –– $390,000 $280,000 120,000 $160,000 $1,120,000 120,000 $1,000,000 Weighting, $450; $390; $160 $1,000 Joint costs allocated, 0.45, 0.39, 0.16 $328,000 0.45 0.39 0.16 $147,600 $127,920 $ 52,480 X 175 250 70% Y 75 300 25% $ 328,000 Ending Inventory Percentages: Ending inventory Total production Ending inventory percentage Income Statement X Z 70 350 20% Y Z Total $135,000 $292,500 $224,000 $651,500 147,600 –– 147,600 127,920 –– 127,920 52,480 120,000 172,480 328,000 120,000 448,000 103,320 44,280 $ 90,720 31,980 95,940 $196,560 34,496 137,984 $ 86,016 169,796 278,204 $373,296 Gross-margin percentage 67.2% b. Constant gross-margin percentage NRV method: 67.2% 38.4% Revenues, 75 $1,800; 225 $1,300; 280 $800 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 70%; 25%; 20% of production costs Cost of goods sold Gross margin Step 1: Final sales value of prodn., (250 $1,800) + (300 $1,300) + (350 $800) $1,120,000 Deduct joint and separable costs, $328,000 + $120,000 448,000 Gross margin $ 672,000 Gross-margin percentage, $672,000 ÷ $1,120,000 60% Step 2: X Y Z Total Final sales value of total production, 250 $1,800; 300 $1,300; 350 $800 $450,000 $390,000 $280,000 $1,120,000 Deduct gross margin, using overall Gross-margin percentage of sales, 60% 270,000 234,000 168,000 672,000 Total production costs 180,000 156,000 112,000 448,000 Step 3: Deduct separable costs — — 120,000 120,000 Joint costs allocated $180,000 $156,000 $ (8,000) $ 328,000 The negative joint-cost allocation to Product Z illustrates one “unusual” feature of the constant gross-margin percentage NRV method: some products may receive negative cost allocations so that all individual products have the same grossmargin percentage. 16-4 Income Statement X Y Z Total $135,000 $292,500 $224,000 $651,500 180,000 180,000 156,000 156,000 (8,000) 120,000 112,000 328,000 120,000 448,000 126,000 54,000 $ 81,000 60% 39,000 117,000 $175,500 60% 22,400 89,600 $134,400 60% 187,400 260,600 $390,900 60% X Y Z Total $103,320 44,280 $ 31,980 95,940 $ 34,496 137,984 $169,796 278,204 $448,000 b. Constant gross-margin percentage NRV method Inventories on balance sheet $126,000 Cost of goods sold on income statement 54,000 $ 39,000 117,000 Revenues, 75 $1,800; 225 $1,300; 280 $800 Cost of goods sold: Joint costs allocated Separable costs Production costs Deduct ending inventory, 70%; 25%; 20% of production costs Cost of goods sold Gross margin Gross-margin percentage Summary a. NRV method: Inventories on balance sheet Cost of goods sold on income statement 2. $ 22,400 89,600 $187,400 260,600 $448,000 Gross-margin percentages: X 67.2% 60.0% NRV method Constant gross-margin percentage NRV SOLUTION EXHIBIT 16-20 Joint Costs Y 67.2% 60.0% Z 38.4% 60.0% Separable Costs Product X: 250 tons at $1,800 per ton Joint Processing Costs $328,000 Product Y: 300 tons at $1,300 per ton Processing $120000 Splitoff Point 16-5 Product Z: 350 tons at $800 per ton 16-22 (30 min.) Joint-cost allocation, sales value, physical measure, NRV methods. 1a. PANEL A: Allocation of Joint Costs using Sales Value at Splitoff Method Sales value of total production at splitoff point (10,000 tons $10 per ton; 20,000 $15 per ton) Weighting ($100,000; $300,000 ÷ $400,000) Joint costs allocated (0.25; 0.75 $240,000) PANEL B: Product-Line Income Statement for June 2012 Revenues (12,000 tons $18 per ton; 24,000 $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage Special B/ Beef Ramen Special S/ Shrimp Ramen $100,000 0.25 $60,000 $300,000 0.75 $180,000 Special B Special S $216,000 60,000 48,000 $108,000 50% $600,000 180,000 168,000 $252,000 42% $816,000 240,000 216,000 $360,000 44% Special B/ Beef Ramen 10,000 33% $80,000 Special S/ Shrimp Ramen 20,000 67% $160,000 Total 30,000 $240,000 Special B Special S Total Total $400,000 $240,000 Total 1b. PANEL A: Allocation of Joint Costs using Physical-Measure Method Physical measure of total production (tons) Weighting (10,000 tons; 20,000 tons ÷ 30,000 tons) Joint costs allocated (0.33; 0.67 $240,000) PANEL B: Product-Line Income Statement for June 2012 Revenues (12,000 tons $18 per ton; 24,000 $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage $216,000 80,000 48,000 $ 88,000 41% $600,000 160,000 168,000 $272,000 45% $816,000 240,000 216,000 $360,000 44% Special B Special S Total 1c. PANEL A: Allocation of Joint Costs using Net Realizable Value Method Final sales value of total production during accounting period (12,000 tons $18 per ton; 24,000 tons $25 per ton) Deduct separable costs Net realizable value at splitoff point Weighting ($168,000; $432,000 ÷ $600,000) Joint costs allocated (0.28; 0.72 $240,000) PANEL B: Product-Line Income Statement for June 2012 Revenues (12,000 tons $18 per ton; 24,000 tons $25 per ton) Deduct joint costs allocated (from Panel A) Deduct separable costs Gross margin Gross margin percentage 16-6 $216,000 48,000 $168,000 28% $67,200 $600,000 168,000 $432,000 72% $172,800 $816,000 216,000 $600,000 Special B $216,000 67,200 48,000 $100,800 46.7% Special S $600,000 172,800 168,000 $259,200 43.2% Total $816,000 240,000 216,000 $360,000 44.1% $240,000 2. Sherrie Dong probably performed the analysis shown below to arrive at the net loss of $2,228 from marketing the stock: PANEL A: Allocation of Joint Costs using Sales Value at Splitoff Sales value of total production at splitoff point (10,000 tons $10 per ton; 20,000 $15 per ton; 4,000 $5 per ton) Weighting ($100,000; $300,000; $20,000 ÷ $420,000) Joint costs allocated (0.238095; 0.714286; 0.047619 $240,000) PANEL B: Product-Line Income Statement for June 2012 Revenues (12,000 tons $18 per ton; 24,000 $25 per ton; 4,000 $5 per ton) Separable processing costs Joint costs allocated (from Panel A) Gross margin Deduct marketing costs Operating income Special B/ Beef Ramen Special S/ Shrimp Ramen Stock $100,000 $300,000 $20,000 $420,000 23.8095% 71.4286% 4.7619% 100% $57,143 $171,429 $11,428 $240,000 Special S Stock $600,000 168,000 171,429 $260,571 $20,000 0 11,428 8,572 10,800 $ (2,228) Special B $216,000 48,000 57,143 $110,857 Total Total $836,000 216,000 240,000 380,000 10,800 $369,200 In this (misleading) analysis, the $240,000 of joint costs are re-allocated between Special B, Special S, and the stock. Irrespective of the method of allocation, this analysis is wrong. Joint costs are always irrelevant in a process-further decision. Only incremental costs and revenues past the splitoff point are relevant. In this case, the correct analysis is much simpler: the incremental revenues from selling the stock are $20,000, and the incremental costs are the marketing costs of $10,800. So, Instant Foods should sell the stock—this will increase its operating income by $9,200 ($20,000 – $10,800). 16-25 (35-45 min.) Joint costs and byproducts. 1. A B Computing byproduct deduction to joint costs: Revenues from C, 16,000 $6 $ 96,000 Deduct: Gross margin, 10% of revenues 9,600 Marketing costs, 20% of revenues 19,200 Peanut Butter Department separable costs 12,000 Net realizable value (less gross margin) of C $ 55,200 Joint costs $180,000 Deduct byproduct contribution 55,200 Net joint costs to be allocated $124,800 Deduct Net Unit Final Separable Realizable Allocation of Sales Sales Processing Value at $124,800 Quantity Price Value Cost Splitoff Weighting Joint Costs 12,000 $12 $144,000 $27,000 $117,000 37.5% $ 46,800 65,000 3 195,000 –– 195,000 62.5% 78,000 16-7 Totals Joint Costs Allocation $ 46,800 78,000 $124,800 A B Totals $339,000 $27,000 $312,000 Add Separable Processing Costs Total Costs $27,000 $ 73,800 –– 78,000 $27,000 $151,800 $124,800 Units 12,000 65,000 77,000 Unit Cost $6.15 1.20 Unit cost for C: $3.45 ($55,200 ÷ 16,000) + $0.75 ($12,000 ÷ 16,000) = $4.20, $6.00 – $0.60 (10% $6) – $1.20 (20% $6) = or $4.20. 2. If all three products are treated as joint products: A B C Totals Quantity 12,000 65,000 16,000 A B C Totals Unit Sales Price $12 3 6 Joint Costs Allocation $ 55,892 93,153 30,955 $180,000 Final Sales Value $144,000 195,000 96,000 $435,000 Deduct Separable Processing Cost $27,000 ─ 31,200 $58,200 Add Separable Processing Costs $27,000 –– 12,000 $39,000 Net Realizable Value at Splitoff $117,000 195,000 64,800 $376,800 Total Costs $ 82,892 93,153 42,955 $219,000 Weighting 117 ÷ 376.8 195 ÷ 376.8 64.8 ÷ 376.8 Allocation of $180,000 Joint Costs $ 55,892 93,153 30,955 $180,000 Units 12,000 65,000 16,000 93,000 Unit Cost $6.91 1.43 2.68 Call the attention of students to the different unit “costs” resulting from the two assumptions about the relative importance of Product C. The point is that costs of individual products depend heavily on which assumptions are made and which accounting methods and techniques are used. 16-32 (20 min.) Joint-cost allocation with a byproduct. 1. Sales value at splitoff method: Byproduct recognized at time of production method Floor Mats Car Mats Products manufactured 31,250a 93,750b Products sold 25,000 85,000 Ending inventory 6,250 8,750 a 25 floor mats/100 tires = .25 floor mats per tire 125,000 tires = 31,250 floor mats 16-8 Rubber Shreds (lbs) 50,000c 43,000 7,000 75 car mats/100 tires = .75 car mats per tire 125,000 tires = 93,750 car mats (125,000 tires/100) 40 lbs = 50,000 lbs rubber shreds Joint cost to be charged to joint products = Joint Cost – NRV of Byproduct = $600,000 – (50,000 lbs 0.70 per lb) = $600,000 – $35,000 = $565,000 b c Floor Mats Sales value of mats at splitoff, 31,250 × $12; 93,750 × $6 Weighting, $375,000; $562,500 $937,500 Joint costs allocated, 0.40; 0.60 × $565,000 Revenues, 25,000 × $12; 85,000 × $6 Cost of goods sold Joint costs allocated, 0.40; 0.60 × $565,000 Less: Ending inventory Cost of goods sold Gross margin b c $375,000 0.40 $226,000 Floor Mats $300,000 226,000 (45,200)b 180,800 $119,200 Car Mats Total $562,500 0.60 $339,000 $937,500 Car Mats $510,000 Total $810,000 339,000 (31,640)c 307,360 $202,640 565,000 (76,840) 488,160 $321,840 $565,000 6,250 × $226,000/31,250 = $45,200 8,750 × $339,000/93,750 = $31,640 2. Sales value at splitoff method: Byproduct recognized at time of sale method Joint cost to be charged to joint products = Joint Cost = $600,000 Sales value of mats at splitoff, 31,250 × $12; 93,750 × $6 Weighting, $375,000; $562,500 $937,500 Joint costs allocated, 0.40; 0.60 × $600,000 Revenues, 25,000 × $12; 85,000 × $6 Cost of goods sold Joint costs allocated, 0.40; 0.60 × $600,000 Less: Ending inventory Cost of goods sold Gross margin Floor Mats Car Mats Total $375,000 0.40 $240,000 $562,500 0.60 $360,000 $937,500 Floor Mats $300,000 Car Mats $510,000 240,000 (48,000)e 192,000 $108,000 360,000 (33,600)f 326,400 $183,600 Rubber Shreds $30,100d Total $840,100 $30,100 600,000 (81,600) 518,400 $321,700 d 43,000 lbs × $0.70 per lb. = $30,100 6,250 × $240,000/31,250 = $48,000 f 8,750 × $360,000/93,750 = $33,600 e 3. The production method of accounting for the byproduct is only appropriate if The Mat Place is positive they can sell the byproduct at the expected selling price. Moreover, The Mat Place should view the byproduct’s contribution to the firm as material enough to find it worthwhile to record and track any inventory that may 16-9 $600,000 arise. The sales method is appropriate if either the disposition of the byproduct is unsure or the selling price is unknown, or if the amounts involved are so negligible as to make it economically infeasible for The Mat Place to keep track of byproduct inventories. 16-33 (15 min.) Byproduct journal entries (continuation of 16-32). 1. Byproduct – production method journal entries i) At time of production: Work-in-process Inventory Accounts Payable, etc. 600,000 600,000 For byproduct: Finished Goods Inv – Shreds Work-in-process Inventory 35,000 For Joint Products Finished Goods Inv – Floor Finished Goods Inv – Car Work-in-process Inventory 226,000 339,000 ii) At time of sale: For byproduct Cash or A/R Finished Goods Inv – Shreds For Joint Products Cash or A/R Sales Revenue – Floor Sales Revenue – Car 35,000 565,000 30,100 30,100 810,000 300,000 510,000 Cost of goods sold - Floor Cost of goods sold – Car Finished Goods Inv – Floor Finished Goods Inv – Car 2. Byproduct – sales method journal entries i) At time of production: Work-in-process Inventory Accounts Payable, etc. 180,800 307,360 180,800 307,360 600,000 600,000 For byproduct: No entry For Joint Products Finished Goods Inv – Floor Finished Goods Inv – Car Work-in-process Inventory 16-10 240,000 360,000 600,000 ii) At time of sale For byproduct Cash or A/R Sales Revenue – Shreds For Joint Products Cash or A/R Sales Revenue – Floor Sales Revenue – Car Cost of goods sold - Floor Cost of goods sold - Car Finished Goods Inv – Floor Finished Goods Inv – Car 16-11 30,100 30,100 810,000 300,000 510,000 192,000 326,400 192,000 326,400