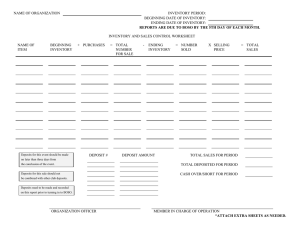

7-53 (15-25 min.) Under the FIFO cost

advertisement

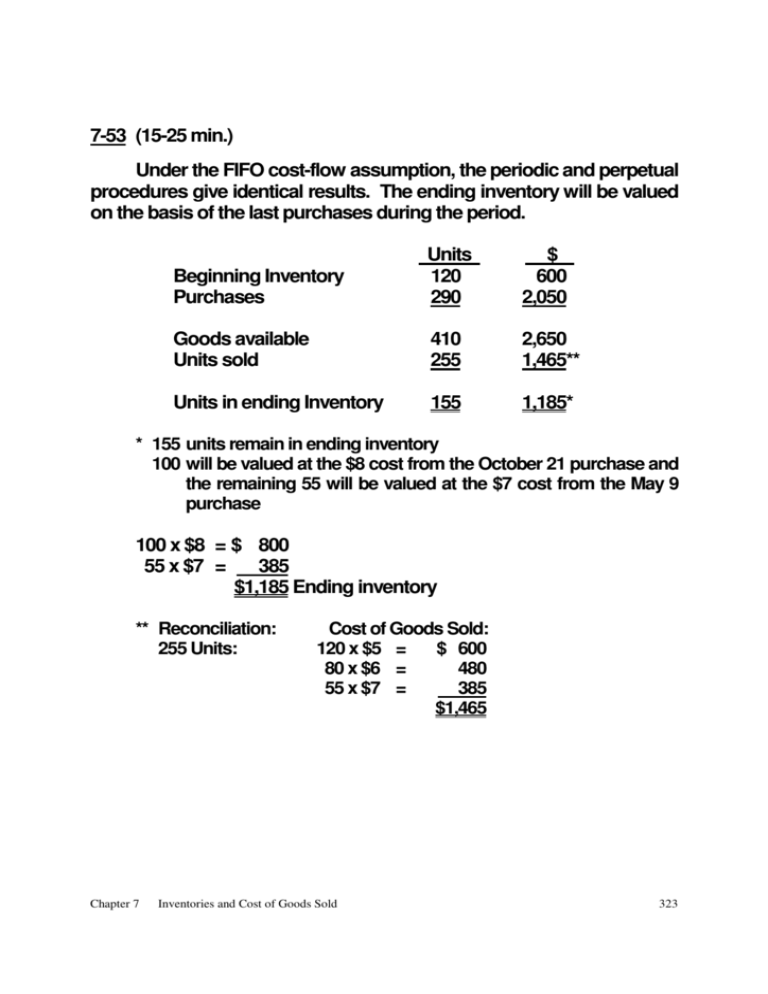

7-53 (15-25 min.) Under the FIFO cost-flow assumption, the periodic and perpetual procedures give identical results. The ending inventory will be valued on the basis of the last purchases during the period. Beginning Inventory Purchases Units 120 290 $ 600 2,050 Goods available Units sold 410 255 2,650 1,465** Units in ending Inventory 155 1,185* * 155 units remain in ending inventory 100 will be valued at the $8 cost from the October 21 purchase and the remaining 55 will be valued at the $7 cost from the May 9 purchase 100 x $8 = $ 800 55 x $7 = 385 $1,185 Ending inventory ** Reconciliation: 255 Units: Chapter 7 Cost of Goods Sold: 120 x $5 = $ 600 80 x $6 = 480 55 x $7 = 385 $1,465 Inventories and Cost of Goods Sold 323