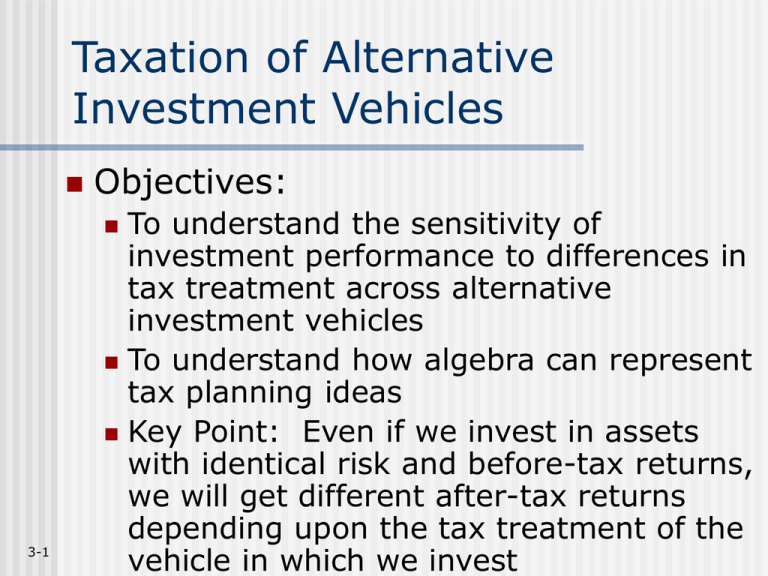

Taxation of Alternative Investment Vehicles

advertisement

Taxation of Alternative

Investment Vehicles

Objectives:

To understand the sensitivity of

investment performance to differences in

tax treatment across alternative

investment vehicles

To understand how algebra can represent

tax planning ideas

Key Point: Even if we invest in assets

with identical risk and before-tax returns,

we will get different after-tax returns

depending upon the tax treatment of the

vehicle in which we invest

3-1

Taxation of Alternative

Investment Vehicles continued

We will start with a simplified

environment, in order to illustrate

how three tax-related forces impact

after-tax accumulations and after-tax

rates of return:

deductibility of investment

deferral of taxation of earnings

exclusion of earnings from taxation

3-2

• taxation at lower rates is equivalent to

partial exclusion

Notation

R = before-tax rate of return

r = after-tax rate of return

t = tax rate on ordinary income

tcg = tax rate on capital gains

n = number of periods

F = future value of the investment

(after-tax accumulation at the end of

n periods)

$I = amount of initial investment

3-3

Computing the ‘After-Tax Rate

of Return’

$I invested for n periods yields F

after-tax dollars in the future

F =$I(1+r)n where r is the after-tax

rate of return

Solving for r:

r = (F/$I)(1/n) - 1

3-4

Investment

Vehicle

I. MMA

II. SPDA

III.

Mutual

Fund

IV.

Foreign

Corp.

V. Tax

exempt

VI.

3-5

Pension

Is the

Frequency

Rate at

Investthat

which

ment tax earnings

earnings

deductare taxed are taxed

ible?

No

Annually

Ordinary

After-tax

accumulation

per after-tax

dollar invested

n

$I[1+R(1-t)]

n

$I(1+R) (1-t) + t$I

No

Deferred

Ordinary

No

Annually

Capital

Gains

$I[1+R(1-tcg)]

No

Deferred (no

dividends)

Capital

Gains

n

$I(1+R) (1 -

No

Never

Exempt

tcg) + tcg$I

n

$I(1+R)

Yes

Deferred

Ordinary

n

$I(1+R)

n

Investment Vehicle (IV) 5 - Tax

Exempt Earnings

3-6

$I invested in IV5 at rate R accumulates,

after 1 period, to:

F = $I(1 + R)

If F is reinvested at the same rate R, after

2 years the total accumulation is:

$I[(1+R) + (1+R)(R)]

= $I[1 + 2 R + R2]= $I(1 + R)2

What if a dollar is invested in IV5 for

n periods?

What is the after-tax rate of return for

IV5?

IV1 - Money Market Account

What is the after-tax accumulation of IV1?

3-7

Invest $1 for one year at a before-tax return of

R, say 10%. The before-tax accumulation is:

$1(1 + R) = $1(1 +.10) = $1.10

But, the earnings of 10 cents are taxed.

Let t represent the ordinary tax rate, say 30%.

So the after-tax accumulation is:

$1(1+R) - R t = 1 + R - R t = 1 + R(1 - t)

= $1.10 - .10(30%) = 1 + .10(1-30%) = $1.07

What is the after-tax accumulation of

IV1 if we invest for n years?

IV1 continued

What is the after-tax rate of return for IV1?

After-tax rate of return: r = (F/$I)(1/n) - 1 <1>

For IV1,

F = $I [1 + R(1 - t)]n

Substituting this value of F into <1> yields:

r = {[1 + R(1 - t)]n}(1/n) - 1

r = 1 + R(1 - t) - 1

r = R(1 - t)

3-8

What factors influence the after-tax rate

of return for IV1?

IV2 -SPDA

What is the after-tax accumulation if

we invest in IV2 for:

1 year: $I(1 + R) - R t = $I[1 + R(1 - t)]

Same as IV1!

2 years:

$I(1+R)(1+R) - $I[(1 + R)(1 + R) - 1] t

= $I(1 + R)2 - $I[(1 + R)2 - 1] t

= $I(1 + R)2 - $I(1 + R)2 t - $I t

= $I(1 + R)2 (1 - t) + $I t

n years: $I(1 + R)n (1 - t) + $I t

3-9

Compare the After-Tax

Accumulations of IV1 and IV2

3-10

Assume R = 10%, t = 30%, $I = 1, n = 40

IV1: $I[1 + R(1 - t)]n

= [1 + .10(1-.30)]40

= $14.97

IV2: $I (1 + R)n (1 - t) + t

= $1 (1 + .10)40 (1-.30) + .30

= $31.98

Result: SPDA accumulates to more

than twice as much as the MMA over

a 40 year period. Why?

Comparison of IV1 and IV2

continued

What is the key difference in the

algebraic expressions for the aftertax accumulations of IV1 and IV2?

Compare the after-tax rate of return

of IV1 and IV2:

IV1: r = (F/$I)(1/n) - 1

= $14.97 (1/40) - 1 = 7.00%

IV2: r = (F/$I)(1/n) - 1 = $31.98 (1/40) - 1

= 9.05%

What happens to this difference in the

after-tax rates of return as n increases?

3-11

IV3 – Mutual Fund

The after-tax accumulation from IV3

is similar to that of IV1, except that

taxation occurs annually at the

capital gains rate rather than the

ordinary income rate

3-12

As long as t >tcg, IV3 will dominate IV1

Comparison of IV2 and IV3

Assume R = 10%, t = 30%, tcg =

20%, $I = 1, n = 40

IV2: $I (1 + R)n (1 - t) + $I t

= $1 (1 + .10)40 (1-.30) + .30

= $31.98

IV3: $I[1 + R(1 - tcg)]n

= [1 + .10(1-.20)]40

= $21.72

What happens to this difference in

accumulations if n decreases?

3-13

Comparison of IV2 and IV3

continued

What if n = 10?

IV2: $I (1 + R)n (1 - t) + $I t

= $1 (1 + .10)10 (1-.30) + .30

= $2.12

IV3: $I[1 + r(1 - tcg)]n

= [1 + .10(1-.20)]10

= $2.16

For shorter time horizons, IV3 can

dominate IV2

3-14

IV4 – Foreign Stock

Investment

Our analysis here assumes no

periodic dividend payments. Such

payments would be taxed to the

recipient when received as ordinary

income.

After-tax accumulation of IV4:

$I(1 + R)n (1 - tcg) + $I tcg

How does IV4 compare to IV2?

3-15

IV6 - Pensions

Contributions to pension vehicles are

deductible in computing current taxable

income. Thus, each dollar invested in the

pension fund costs (1 - t) dollars after tax.

Distributions from the pension fund are

taxed (in total) when distributed.

3-16

Net distribution: $I (1+R)n (1 - t)

Cost of contribution: $I (1 - t)

Return on pension investment =

Distribution/Contribution

=$I (1+R)n (1 - t)/$I (1 - t) = (1+R)n

IV6 continued

Key Point: When tax rates are constant

(i.e., the tax rate at the time of

contribution equals the tax rate at the time

of distribution), deductibility followed by

taxation at time of distribution is

equivalent to tax exemption. In this case,

IV6 is equivalent to IV5.

3-17

What if tax rates are not constant?

Let t0 = tax rate at time of contribution

tn = tax rate at time of distribution

Return becomes: $I (1+R)n (1 - tn)/$I (1 - t0)

which may be more or less than (1+R)n

IV6 continued

Key Points:

Increasing tax rates:

Pension Return < Exemption

IV6 < IV5

Decreasing tax rates:

Pension Return > Exemption

IV6 > IV5

3-18

Summary of Tax Forces in

Basic Investment Vehicles

Deferral

Exclusion

IV2 (SPDA)

IV5 (tax exempt)

Deductibility

IV4 (Foreign IV4 (Foreign Stock Stock)

partial exclusion)

IV6

(Pension)

3-19

IV3 (mutual fund –

partial exclusion)

IV6 (Pension)

IV1 is affected by none of these tax forces, but

could be preferred when tax rates are increasing

Some General Conclusions

Compared to an environment of

constant tax rates:

Deferral is less attractive when tax rates

are increasing

Deferral is more attractive when tax

rates are decreasing

3-20

So the dominance relations that exist

in an environment of constant tax

rates do not hold true when tax rates

are changing

Some General Conclusions

continued

3-21

If we further relax the assumptions of

no risk and constant before-tax

returns, then we see why all of these

investment vehicles are used even

though our simplified analysis

indicates that some are strictly

preferred to others

Taxation of Alternative IRAs

Recall the three tax-related forces

that impact after-tax accumulations

and after-tax rates of return:

deductibility of investment

deferral of taxation of earnings

exclusion of earnings from taxation

3-22

3 Types of IRAs

Frequency Rate at

InvestInvestthat

which

ment

ment tax earnings earnings

Vehicle deductible are taxed are taxed

No

Never

Exempt

Roth IRA –

IV5

Yes

Deferred

Ordinary

Traditional

IRA – IV 6

Nondeductible

IRA – IV2

3-23

No

Deferred

Ordinary

After-tax

accumulation

$I(1+R)n

$I(1+R)n (1-tn)

(1-t0)

n

$I[(1+R) (1-tn) + tn]

Computing the ‘After-Tax Rate

of Return’

$I invested for n periods yields F

after-tax dollars in the future

F =$I(1+r)n where r is the after-tax

rate of return

Solving for r:

r = (F/$I)(1/n) - 1

3-24

After-tax Rate of Return for

3 Types of IRAs

3-25

IV5: r = R

IV6: r = (1+R)[(1-tn)/(1-t0)](1/n) – 1

IV2: r = [(1+R)n(1-tn) + tn](1/n) – 1

Factors Influencing r

Note that:

For IV5, r does not depend on the tax

rates or the investment horizon, but

depends only on R

For IV6, r depends on R, n, tn, and t0

For IV2, r depends on R, n, and tn, but

does not depend on t0

3-26

Which IRA do Investors Prefer?

As noted last class

If tn > t0, IV6 < IV5 (Roth IRA preferred

to traditional IRA)

If tn < t0, IV6 > IV5 (traditional IRA

preferred to Roth IRA)

3-27

Preferences continued

Also note that

IV5 > IV2, for all n and tn (Roth IRA

preferred to nondeductible IRA)

• Implies that IV6 > IV2 if tn < t0 (traditional

IRA preferred to nondeductible IRA)

3-28

Can IV2 be > IV6? Yes, if tn is

substantially > t0 (nondeductible IRA

preferred to traditional IRA)

Restrictions on Choice

If the Roth IRA is always preferred to

the nondeductible IRA (and the

traditional IRA is preferred to the

nondeductible IRA if tax rates fall

after retirement) why would anyone

ever choose the nondeductible IRA?

3-29

Income limits for traditional IRA and

Roth IRA