CHAPTER 26

Savings, Investment Spending, and the

Financial System

PowerPoint® Slides

by Can Erbil

© 2005 Worth Publishers, all rights reserved

What you will learn in this chapter:

The relationship between savings and investment spending

About the loanable funds market, which shows how savers

are matched with borrowers

The purpose of the four principal types of assets: stocks,

bonds, loans, and bank deposits

How financial intermediaries help investors achieve

diversification

Some competing views of what determines stock prices and

why stock market fluctuations can be a source of

macroeconomic instability

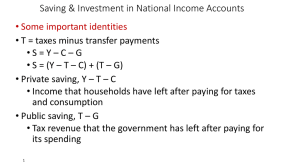

The Savings–Investment Spending Identity in a

Closed Economy

In a closed economy: GDP = C + I + G

SPrivate = GDP + TR − T − C

SGovernment = T − TR − G

NS = SPrivate + SGovernment = (GDP + TR − T − C) + (T − TR − G)

= GDP − C − G

Hence, I = NS

Investment spending = National savings in a closed

economy

Budget Surplus and Budget Deficit

The Savings–Investment Spending Identity

in an Open Economy

I = SPrivate + SGovernment + (IM – X) = NS + KI (10)

Investment spending = National savings + Capital inflow

in an open economy

The Savings-Investment Spending Identity in

Open Economies: the United States and Japan

2003

The Meaning of Saving and Investment

Private saving is the income remaining after

households pay their taxes and pay for consumption.

Examples of what households do with saving:

buy corporate bonds or equities

purchase a certificate of deposit at the bank

buy shares of a mutual fund

let accumulate in saving or checking accounts

The Meaning of Saving and Investment

Investment is the purchase of new capital.

Examples of investment:

General Motors spends $250 million to build

a new factory in Flint, Michigan.

You buy $5000 worth of computer equipment for your

business.

Your parents spend $300,000 to have a new house

built.

Remember: In economics, investment is NOT

the purchase of stocks and bonds!

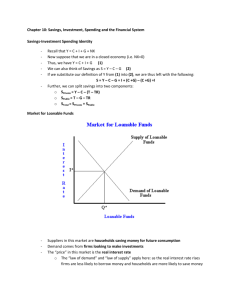

The Market for Loanable Funds

A supply-demand model of the financial system.

Helps us understand

how the financial system coordinates

saving & investment

how government policies and other factors affect

saving, investment, the interest rate

The Market for Loanable Funds

Assume: only one financial market.

All savers deposit their saving in this market.

All borrowers take out loans from this market.

There is one interest rate, which is both the return to

saving and the cost of borrowing.

The Market for Loanable Funds

The supply of loanable funds comes from saving:

Households with extra income can loan it out and earn

interest.

SHIFTS in the Supply Curve:

Changes

in private savings behavior

Changes

in capital flows

The Slope of the Supply Curve

Interest

Rate

Supply

6%

3%

60

80

An increase in

the interest rate

makes saving

more attractive,

which increases

the quantity of

loanable funds

supplied.

Loanable Funds

($billions)

The Market for Loanable Funds

The demand for loanable funds comes from investment:

• Firms borrow the funds they need to pay for new

equipment, factories, etc.

• Households borrow the funds they need to

purchase new houses.

•

SHIFTS in the Demand Curve

• Changes in perceived business opportunities

• Changes in government’s borrowing

The Slope of the Demand Curve

A fall in the interest

rate reduces the cost

of borrowing, which

increases the quantity

of loanable funds

demanded.

Interest

Rate

7%

4%

Demand

50

80 Loanable Funds

($billions)

Equilibrium

Interest

Rate

Supply

The interest rate

adjusts to equate

supply and demand.

The eq’m quantity

of L.F. equals

eq’m investment

and eq’m saving.

5%

Demand

60

Loanable Funds

($billions)

Policy 1: Saving Incentives

Interest

Rate

S1

S2

5%

4%

D1

60 70

Tax incentives for

saving increase

the supply of L.F.

…which reduces the

eq’m interest rate

and increases the

eq’m quantity of L.F.

Loanable Funds

($billions)

Policy 2: Investment Incentives

Interest

Rate

An investment tax

credit increases the

demand for L.F.

S1

6%

5%

D2

…which raises the

eq’m interest rate

and increases the

eq’m quantity of L.F.

D1

60 70

Loanable Funds

($billions)

A C T I V E L E A R N I N G 2:

Exercise A.

Use the loanable funds model to analyze

the effects of a government budget deficit:

Draw the diagram showing the initial equilibrium.

Determine which curve shifts when the government

runs a budget deficit.

Draw the new curve on your diagram.

What happens to the equilibrium values of the

interest rate and investment?

18

A C T I V E L E A R N I N G 2:

Exercise B.

Use the loanable funds model to analyze the effects

of tax decrease on the interest earned on savings.

How does the tax decrease on interest on savings

affect the market?

Draw the diagram showing the initial equilibrium.

Determine which curve shifts when the government runs a

budget deficit.

Draw the new curve on your diagram.

What happens to the equilibrium values of the interest rate and

investment?

19

Policy 3. Government Budgets

Budget Deficits, Crowding Out,

and Long-Run Growth

Our analysis: increase in budget deficit causes fall in

investment.

The govt borrows to finance its deficit,

leaving less funds available for investment.

This is called crowding out.

Recall from the preceding chapter: Investment is

important for long-run economic growth.

Hence, budget deficits reduce the economy’s growth rate

and future standard of living.

The U.S. Government Debt

The government finances deficits by borrowing (selling

government bonds).

Persistent deficits lead to a rising govt debt.

The ratio of govt debt to GDP is a useful measure of the

government’s indebtedness relative to its ability to raise

tax revenue.

Historically, the debt-GDP ratio usually rises during

wartime and falls during peacetime – until the early

1980s.

U.S. Government Debt

as a Percentage of GDP, 1970-2007

120%

WW2

100%

80%

60%

40%

Revolutionary

War

Civil

War

WW1

20%

0%

1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010

The Financial System - Definitions

Wealth

Financial asset

Physical asset

Liability

Transaction costs

Financial risk

Risk-Averse Attitudes Toward Gain and Loss

Three Tasks of a Financial System

Reducing transaction costs

Reducing financial risk

Providing liquid assets

Financial Intermediaries

Mutual funds

Pension funds

Life insurance companies

Banks

Financial Fluctuations

Financial market fluctuations can be a source of

macroeconomic instability.

Are markets irrational?

Policy makers assume neither that markets always

behave rationally nor that they can outsmart them.

The End of Chapter 26

coming attraction:

Chapter 27:

Aggregate Supply and

Aggregate Demand