CHAPTER 26

Savings, Investment Spending, and the

Financial System

PowerPoint® Slides

by Can Erbil

© 2005 Worth Publishers, all rights reserved

What you will learn in this chapter:

The relationship between savings and investment spending

About the loanable funds market, which shows how savers

are matched with borrowers

The purpose of the four principal types of assets: stocks,

bonds, loans, and bank deposits

How financial intermediaries help investors achieve

diversification

Some competing views of what determines stock prices and

why stock market fluctuations can be a source of

macroeconomic instability

2

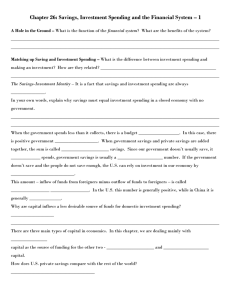

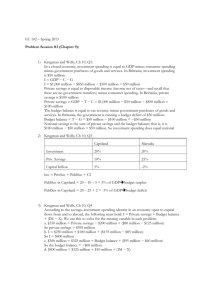

The Savings–Investment Spending Identity in a

Closed Economy

In a closed economy: GDP = C + I + G

SPrivate = GDP + TR − T − C

SGovernment = T − TR − G

NS = SPrivate + SGovernment = (GDP + TR − T − C) + (T − TR − G)

= GDP − C − G

Hence, I = NS

Investment spending = National savings in a closed

economy

3

Budget Surplus and Budget Deficit

4

The Savings–Investment Spending Identity

in an Open Economy

I = SPrivate + SGovernment + (IM – X) = NS + KI (10)

Investment spending = National savings + Capital inflow

in an open economy

5

The Savings-Investment Spending Identity in

Open Economies: the United States and Japan

2003

6

The Demand for Loanable Funds

7

The Supply for Loanable Funds

8

Equilibrium in the Loanable Funds Market

9

Savings, Investment Spending, and

Government Policy

10

Increasing Private Savings

11

The Financial System - Definitions

Wealth

Current Savings + Accumulated Savings

Financial asset

Paper claim that entitles the buyer to a future claim from the seller.

Physical asset

Claim on a tangible object (home, car, etc.)

Liability

A requirement to pay income in the future (Car loan, mortgage, etc.)

Transaction costs

Expenses of putting together and executing a deal

Financial risk

Uncertainty about future outcomes that involve financial loses and

gains.

12

Risk-Averse Attitudes Toward Gain and Loss

13

Three Tasks of a Financial System

Reducing transaction costs

Reducing financial risk

Providing liquid assets

Liquid assets can be quickly converted into cash,

while illiquid assets cannot.

14

Types of Financial Assets

Loans

Bank Deposits

Stocks

A share of ownership in a company

Bonds

A promise by the seller to pay interest each year and

to repay the principal to the owner of the bond on a

particular date.

15

Financial Intermediaries

Mutual funds

Pension funds

Life insurance companies

Banks

16

Financial Fluctuations

Financial market fluctuations can be a source of

macroeconomic instability.

Are markets irrational?

Policy makers assume neither that markets always

behave rationally nor that they can outsmart them.

17

The End of Chapter 9

coming attraction:

Chapter 10:

Aggregate Supply and

Aggregate Demand

18